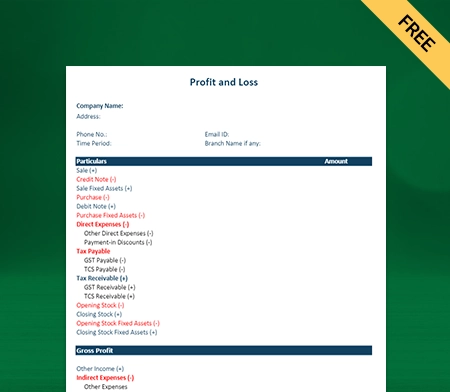

Profit and Loss Account Format – Excel, PDF & Word

Create professional Profit and Loss Account Formats in Excel, PDF, and Word – absolutely free. With Vyapar, you can download easy-to-edit P&L templates and manage your business finances in a structured way.

P & L Account Format vs Vyapar App

P&L Account Format

Billing Software

Price

Free

Free

200+ Professional Themes

Quick Billing

Unlimited Formats

Auto Calculation

Error-Free Transactions

Data Backup

UPI Payments

Payment Reminders

Business Status Reports

Download Profit and Loss Account Format in Excel, PDF, and Word

Get 100+ Premium Profit & Loss Account Formats to Customize. Try Vyapar for FREE!

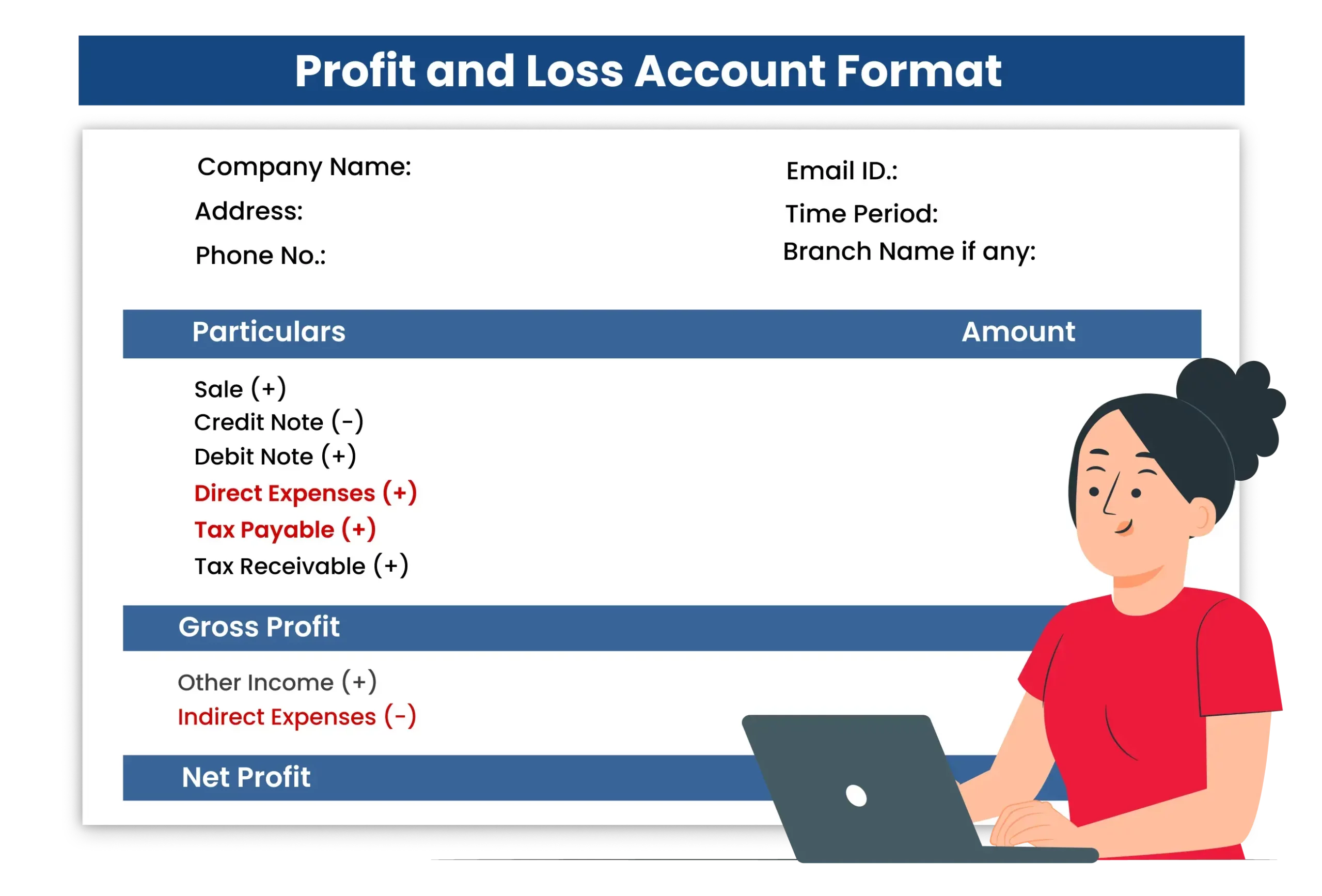

What is Profit and Loss Account Format?

A Profit and Loss Account Format is a structured layout used to summarize a business’s revenues, costs, and expenses over a specific period. It helps in calculating the net profit or loss of the business and provides valuable insights into financial performance.

Typically, the format includes key components such as:

- Revenue or Sales Income

- Cost of Goods Sold (COGS)

- Operating Expenses

Net Profit or Loss

Profit and Loss Statement vs Profit and Loss Account Format

Components of Profit and Loss Account Format

Revenue / Income

This includes all earnings during the period, such as revenue from sales or services and other income like interest, rent, or dividends received.

Cost of Goods Sold

COGS includes all direct costs like raw materials, production labor, and factory expenses. Deducting COGS from revenue gives the gross profit.

Operating Expenses

These are indirect costs for running the business, such as salaries, admin expenses, marketing, R&D, utilities, and depreciation.

Operating Profit

EBIT is the profit earned from business operations before taxes and interest, indicating how efficiently core activities generate profit.

Net Income

The final profit figure after deducting all expenses, interest, and taxes. It reflects the actual earnings and financial health of the business.

Periodic Analysis

Shows financial data from past periods to analyze trends, spot anomalies in income or expenses, and support long-term planning.

Benefits of Using the Profit and Loss Account Format

Using a Profit and Loss Account Format offers multiple benefits for businesses in terms of compliance, planning, and financial transparency. Here’s how:

📌 1. Compliance and Financial Reporting

The P&L account format ensures businesses comply with standard accounting practices and regulatory requirements. It helps maintain transparency by providing a structured way to report income, expenses, and net profit — making tax filings and financial audits smoother and more accurate.

📌 2. Identify Revenue Sources

By categorizing income, the format helps identify major revenue streams and highlights which products, services, or customers generate the most profit. This allows businesses to optimize their sales strategy and focus on the most profitable areas.

📌 3. Analyze Expense Patterns

The profit and loss statement format gives businesses a clear view of their expense structure. It helps identify cost-heavy areas, inefficiencies, or overspending trends, making it easier to reduce unnecessary expenses and improve cost control.

📌 4. Financial Planning & Budgeting

By offering a detailed summary of past financial performance, the format enables better forecasting and budgeting. Businesses can use this data to plan future investments, control costs, and strategize for sustainable growth.

📌 5. Effective Stakeholder Communication

The standardized P&L format provides a clear and concise way to communicate financial health to investors, partners, or lenders. It builds trust and supports decision-making by offering a summary of earnings, expenses, and profitability in a familiar structure.

📌 6. Informed Business Decisions

With a clear view of profits and losses, business owners can make smarter choices regarding pricing, product launches, cost reductions, or expansion. The format helps align financial decisions with long-term business goals.

📌 7. Supports Financial Analysis

The P&L format allows businesses to calculate key financial ratios like:

- Gross profit margin

- Operating profit margin

- Net profit margin

These metrics are essential for assessing financial efficiency, profitability, and performance over time.

📌 8. Tracks Overall Profitability

By comparing total revenue against expenses, businesses can accurately assess net income or net loss over a specific period. This insight is critical for evaluating success, setting future targets, and improving financial outcomes.

Features That Make Vyapar P&L Account Formats Best for Business

✅ Track Your Business Status

Vyapar’s intuitive business dashboard gives you real-time visibility into:

- Cash flow

- Inventory and stock

- Open sales and payments

With Vyapar, you can manage everything in one place — whether you’re on desktop or using the free GST billing and accounting app on mobile. All data is auto-synced, so you can create trial balances and profit and loss statements effortlessly, even on the go.

✅ Record Business Expenses Seamlessly

Keeping track of all expenses — GST and non-GST — is critical for accurate reporting. Vyapar’s free accounting software makes expense management easy:

- Record daily operational costs

- Auto-categorize GST-inclusive/exclusive entries

- Minimize tax-time stress

Accurate expense recording through Vyapar helps you cut unnecessary costs and improve profitability over time.

✅ Prepare Profit and Loss Statement Online & Offline

No internet? No problem. Vyapar works both online and offline, allowing you to:

- Create and manage P&L statements without delays

- Send invoices, quotations, and bills anytime

- Operate seamlessly even in remote areas with weak internet

Offline access makes Vyapar the most reliable solution for small businesses in tier-2 and tier-3 cities.

✅ Accept Multiple Modes of Payment

Give your customers more ways to pay — and get paid faster:

- Add QR codes directly on invoices for UPI payments

- Share bank details for NEFT, RTGS, IMPS transfers

- Accept cash, e-wallets, or cheques

Vyapar ensures faster collections and better cash flow by supporting all preferred payment methods.

✅ Maintain Business Cash Flow

Vyapar helps you automate financial processes and reduce accounting errors:

- View real-time daybook and ledger summaries

- Monitor income vs. expenses with built-in P&L and balance sheet tools

- Get accurate insights for better capital management

Everything you need to stay debt-free and financially sound is available in one app.

✅ Secure Data with Auto Backup

Data security is critical. Vyapar provides:

- Daily automatic cloud backups

- Encrypted data protection

- Reliable access to historical data anytime

With Vyapar’s free backup features, you never lose critical financial records — even if your device is lost or damaged.

✅ Set Up an Online Store for Free

Take your business online in just a few clicks:

- Create a digital catalogue of products and services

- Share store links with customers for online orders

- Save customer wait time by preparing orders in advance

All this — with zero extra charges. Sell more, serve faster, and grow locally with your Vyapar-powered web store.

✅ Build a Stronger Brand Image

Vyapar helps you present your business professionally:

- Generate branded P&L statements with your logo, font, and colors

- Share customized quotes, invoices, and financial reports

- Improve trust and credibility with investors and clients

A polished profit and loss account format builds brand authority and supports negotiations and investor pitches.

Frequently Asked Questions (FAQs’)

A Profit and Loss Statement (P&L) is a financial report that summarizes a company’s income, expenses, and net profit or loss over a specific time. It helps track business performance and is used by owners, investors, and stakeholders to make informed financial decisions.

The Profit and Loss Account Format is the structured layout used to prepare a P&L statement. It organizes the data into standard sections like income, cost of goods sold, expenses, and net profit — commonly available in Excel, PDF, or Word formats for easy reporting.

The purpose of the profit and loss account is to report a business’s earnings and expenditures during a financial period. It helps identify profitability, areas for improvement, and supports budgeting and compliance with tax regulations.

The format typically includes revenue from:

1. Product or service sales

2. Interest income

3. Rental earnings

4. Commission or royalty income

5. Any recurring business income

Net profit or loss is calculated as:

Total Revenue – Total Expenses

This figure reflects how much the business actually earned or lost during the reporting period after accounting for all costs.

It provides investors, creditors, and business owners a clear view of financial health, profitability, and risk. It supports better decisions around funding, partnerships, and strategic planning.