Free Invoice Formats & Bill Formats

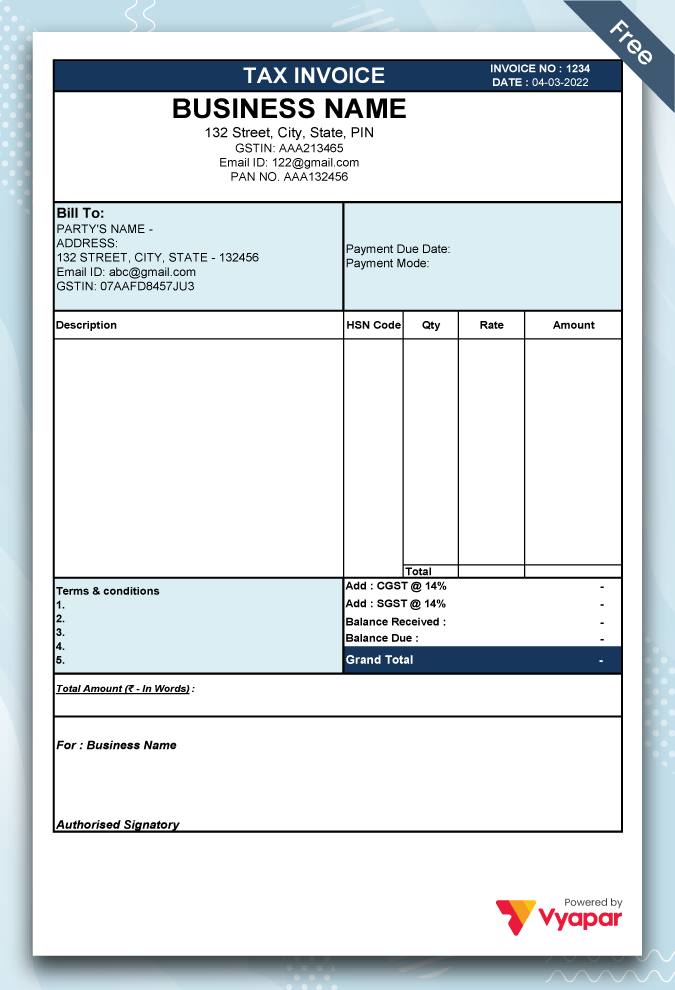

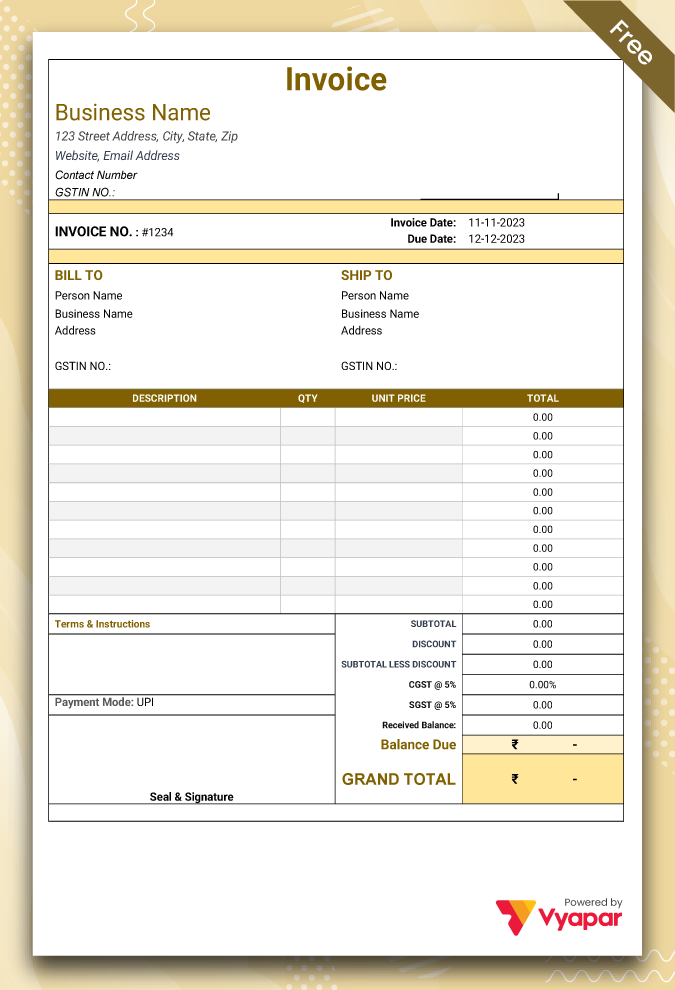

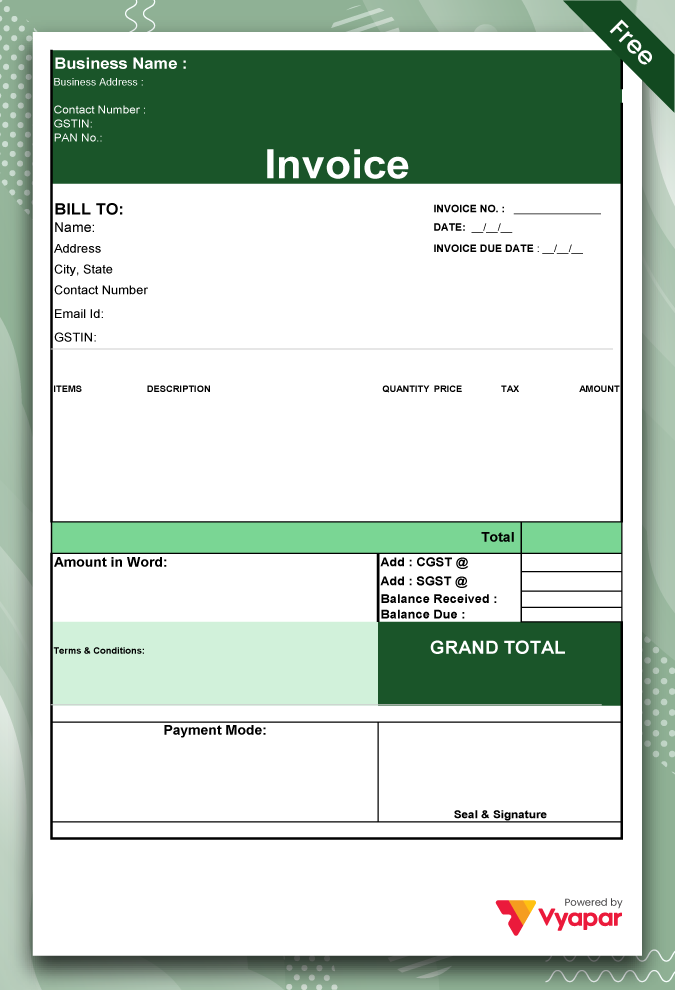

Create professional, GST-compliant & Non-GST invoices in minutes with our free templates for Excel, Word and PDF.

- ⚡️ Download and customise the perfect format for your business

- ⚡ Let pre-built formulas handle all calculations automatically

- ⚡️ Impress clients with a professional, print-ready invoice

What is an Invoice Format?

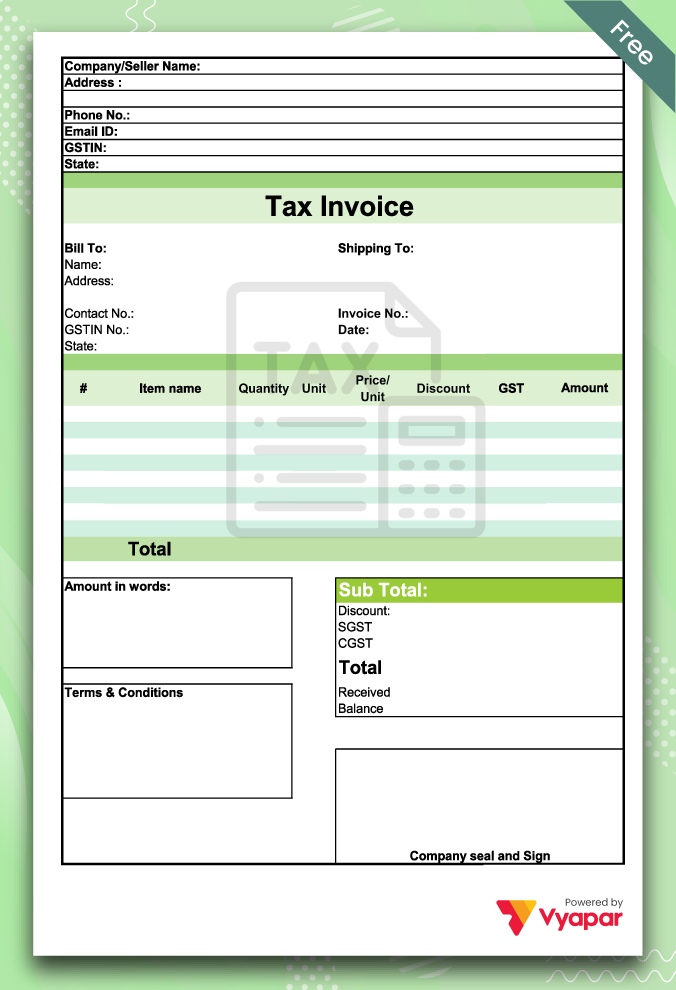

An invoice bill format is a pre-designed, professional layout for a bill that acts as a fill-in-the-blank guide for your business. It includes all the essential fields required for clear and compliant invoicing, such as your business details, client information, an itemised list of goods or services, and tax calculations.

These bill formats are available in various file types, including Excel, Word, and PDF, and often include built-in formulas to automate calculations, allowing you to create an accurate, professional, and trustworthy invoice in minutes.

Choose Your Preferred Invoice Format File Type

Select the format that best suits your needs. We offer professional, ready-to-use templates in Excel, Word, and PDF for every business need.

Choose Your Bill or Invoice Template by Transaction

Whether you need a professional invoice format for a client or a simple bill format for a quick sale, we have a ready-to-use template for any business situation.

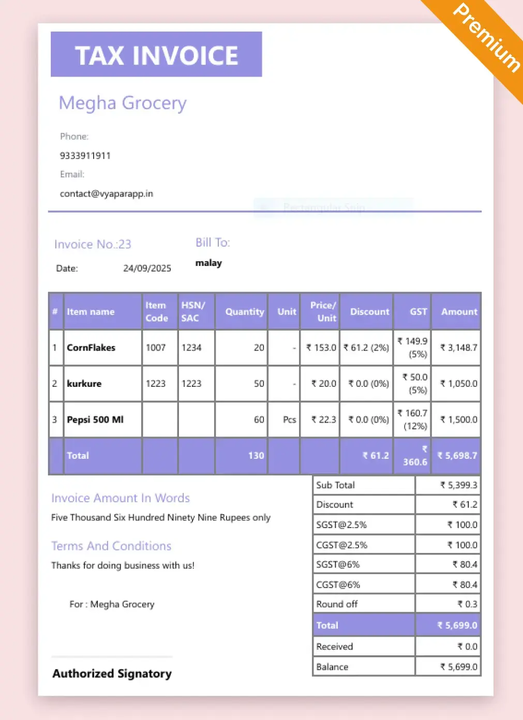

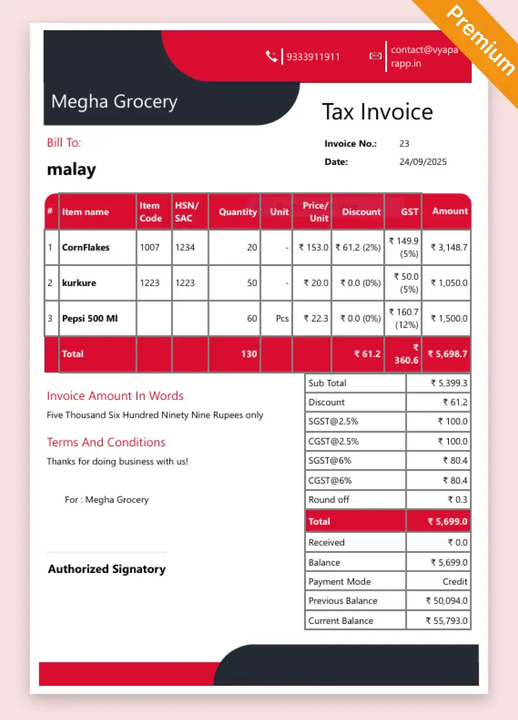

Ready for a Professional Upgrade? Explore Our Premium Invoice Themes

Ready to make your brand stand out? Our premium themes, available exclusively in the Vyapar App, offer a superior, professional look designed to make a lasting impression on your clients.

French Elite

Double Divine

Landscape

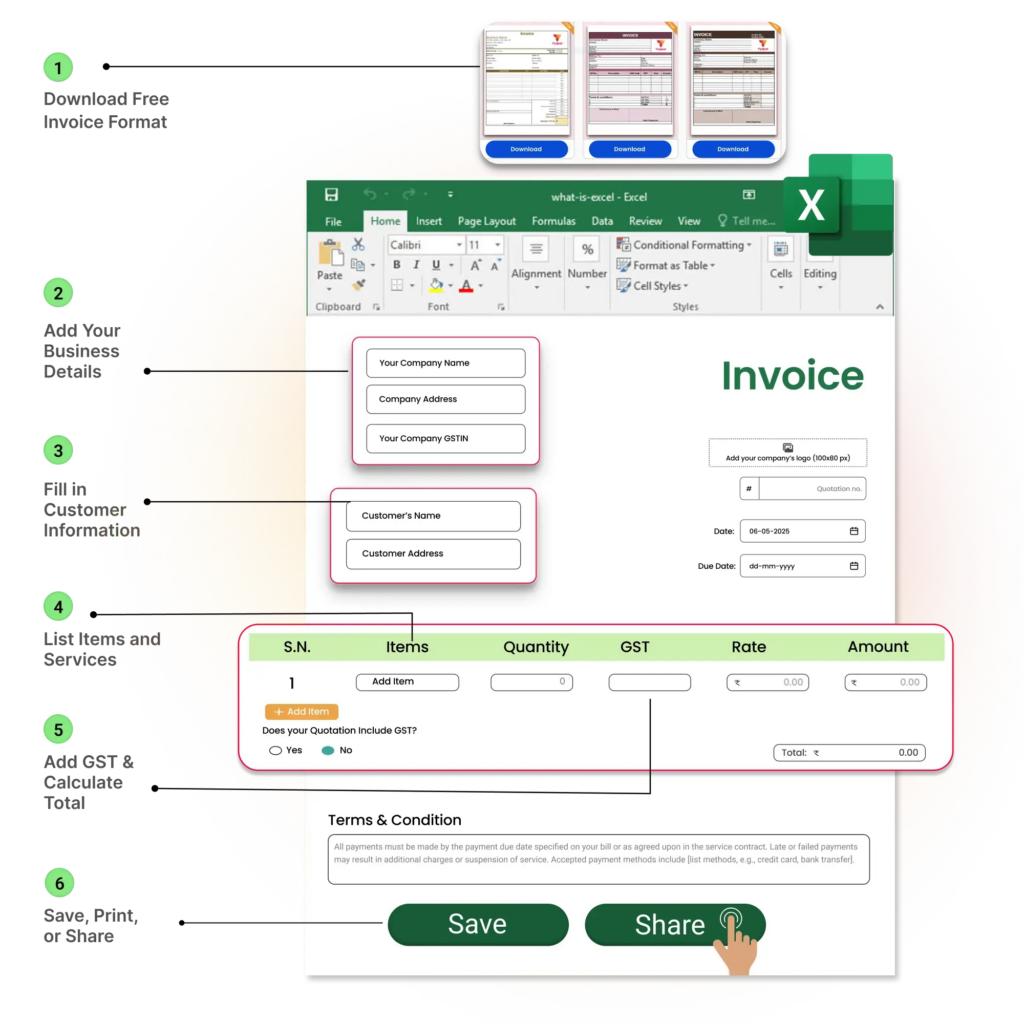

How to Use a Free Bill Format for Your Business

✅ Step 1: Download Your Free Format: Choose from Vyapar’s free invoice bill formats designed for Indian businesses. Our templates are GST-ready, customizable, and easy to use.

✅ Step 2: Add Your Business Details: Enter your company name, logo, address, contact info, and GSTIN. This personalises your invoice and ensures it looks professional.

✅ Step 3: Fill in Customer Information: Include the customer’s name, contact details, and GSTIN (if applicable) for proper documentation and billing accuracy.

✅ Step 4: List Your Products or Services: Add a detailed breakdown of each item or service, including the name, quantity, price per unit, and subtotal.

✅ Step 5: Add Taxes & Calculate the Total: Insert the applicable GST rates. If you’re using an Excel template, the formulas will automatically calculate the final total for you. For Word or PDF formats, you will need to calculate the total manually.

✅ Step 6: Save, Print, or Share: Save your completed invoice, print a hard copy for your records, or export it as a PDF to share with your customer via WhatsApp or email.

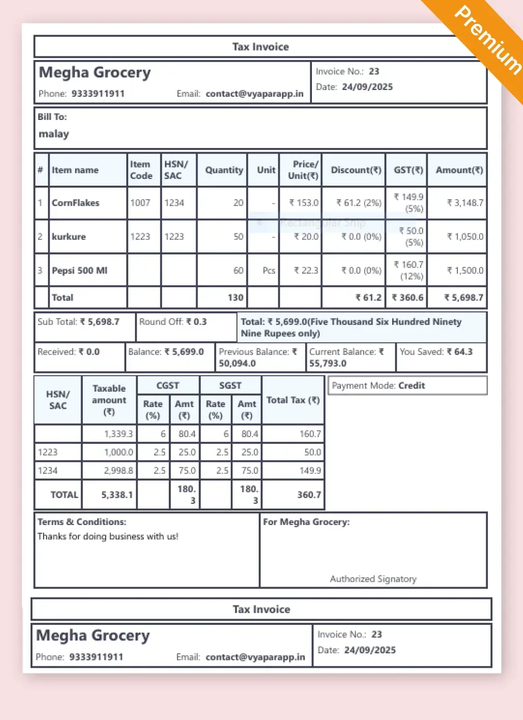

Key Components of an Invoice Format in India

1. Title and Business Information

Start with a clear title, such as “Invoice”, “Bill” or “Tax Invoice”. Add your business name, logo, address, phone number, email, and GSTIN (if applicable). This builds credibility and trust.

2. Customer Details

Include the customer’s full name, contact number, address, and GSTIN (for B2B invoices). Accurate information ensures transparency and proper record-keeping.

3. Invoice Number & Date

Assign a unique invoice number and mention the invoice issue date. This helps in tracking sales, audits, and maintaining organised financial records.

4. Itemised Product/Service Details

List each product or service separately with quantity, unit rate, HSN/SAC code, and item-wise total. This breakdown makes the bill easy to understand.

5. Tax Summary (GST)

Add applicable GST components like CGST, SGST, or IGST depending on the sale type. Clearly mention the tax percentage and amount to ensure compliance.

6. Total Amount & Payment Terms

Include subtotal, discounts (if any), tax amount, and the final amount payable. Also, specify the due date and accepted payment modes (cash, UPI, card, etc.) for smooth transactions.

What are the Different Types of Invoices?

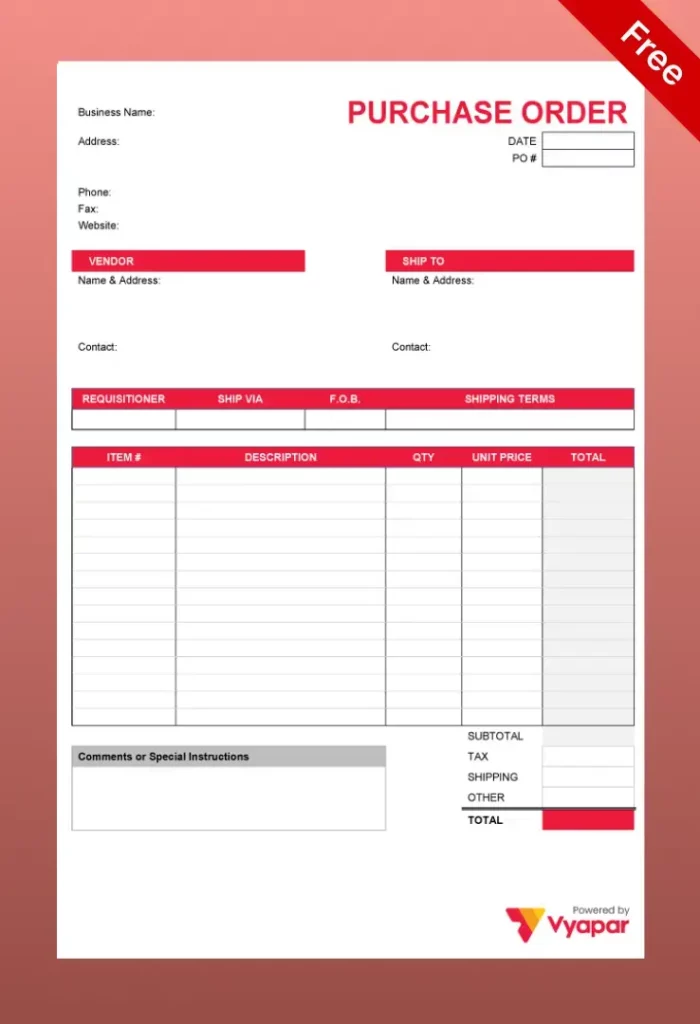

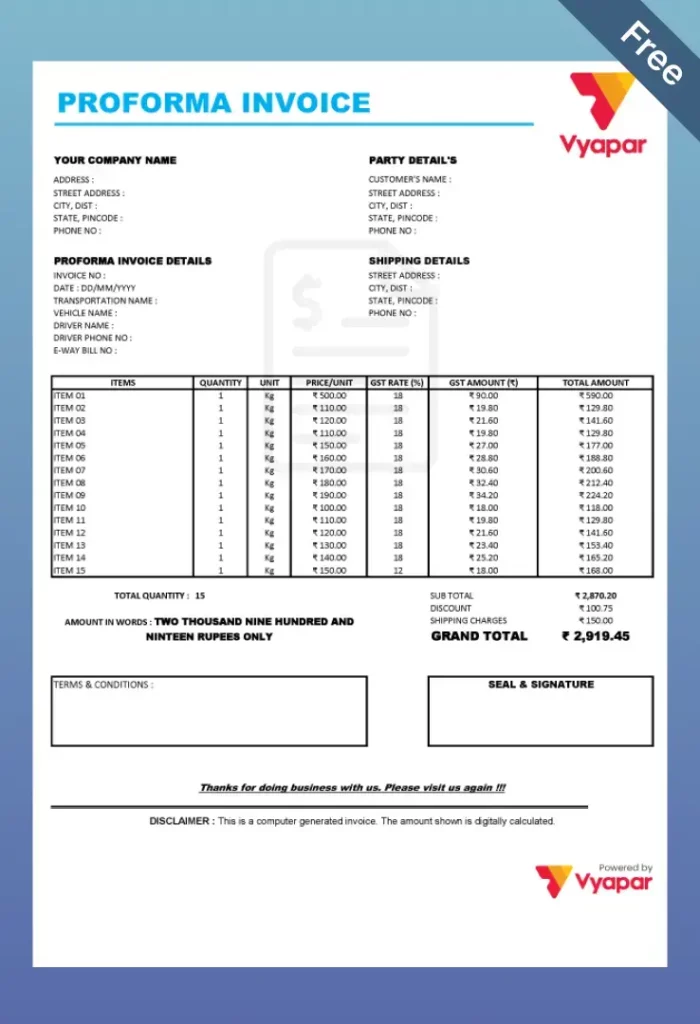

Businesses use different invoice formats depending on the nature of their transactions. Each type serves a specific role in ensuring accurate billing and smooth operations. Here are the most common types:

- Standard Invoice: A general-purpose invoice that lists the goods or services provided, quantities, prices, and the total amount payable.

- Proforma Invoice: A preliminary bill issued before delivery, giving an estimated cost to help the buyer approve or plan the purchase.

- E-Invoice: Digitally generated invoice that ensures GST compliance and simplifies the billing process through automation.

- Credit Invoice (Credit Note): Used to reduce the total amount owed, often due to product returns, discounts, or billing errors.

- Debit Invoice: Sent to a customer to increase the amount they owe, often to correct an under-billed original invoice.

- Return Invoice: Created when goods are returned by the buyer; it includes refund or credit information.

- Timesheet Invoice: Ideal for service-based businesses—especially freelancers and consultants—billing is based on hours worked.

- Recurring Invoice: Automatically generated at fixed intervals for ongoing services or subscriptions like software, rent, or memberships.

- Commercial Invoice: Used for international trade. Includes shipping details, country of origin, and customs-related information.

- Interim Invoice: Used for long-term projects. Allows partial billing as work progresses, making it easier to manage cash flow.

- Final Invoice: Sent after completing a project or delivery, summarising all charges and closing the billing cycle.

- Past Due Invoice: A follow-up invoice sent for overdue payments, often including late fees and new payment deadlines.

- Sales Invoice: A straightforward invoice given to a customer at the time of purchase, acting as direct proof of the sale.

- Purchase Invoice: Received from vendors or suppliers to record the purchase of goods or services, with pricing and terms.

- Utility Invoice: Used for billing utility services like electricity, water, internet, etc., based on monthly or periodic usage.

What to Include in an Invoice: An Essential Checklist

Here is a clear and detailed breakdown of what to include in your invoice:

Company Details:

Include your Business Logo, Business Name, Business Address, and Business Contact Information at the top. This makes it easy for your customer to identify the invoice and reach out to you with any questions.

Invoice Information:

– Invoice Number: [Unique Invoice Number]

– Invoice Date: [Date of Invoice]

– Due Date: [Payment Due Date]

Assign a unique invoice number to each bill for tracking and reference. Include the invoice issue date and payment due date to ensure timely payment.

Bill To:

– Customer Name

– Customer Address

– Customer Contact Information

Provide the name, address, and contact details of the customer you are billing. This helps both you and the customer keep accurate records.

Itemised List of Products/Services:

– Item Description

– Quantity

– Unit Price

– Total

List each product or service provided, along with its quantity, unit price, and total amount for each item. This gives the customer a clear breakdown of what they are being charged for.

Summary of Charges:

– Subtotal: [Subtotal Amount] (The total before taxes and discounts.)

– Tax (e.g., VAT, GST): [Tax Amount] (Calculate and list any applicable taxes here.)

– Discount: [Discount Amount] (If you’re offering a discount, deduct it here.)

– Total Amount Due: [Total Amount Due] (This is the final amount the customer has to pay.)

Payment Terms:

Include clear payment terms to avoid confusion. Mention the payment methods you accept (e.g., bank transfer, credit card) and state any late fees that might apply if payment is not received by the due date.

Additional Notes:

This optional section can be used to add a thank-you message or any other personal notes to the customer.

This invoice format not only organises the essential details but also provides clarification where necessary, ensuring that the customer understands every part of the invoice.

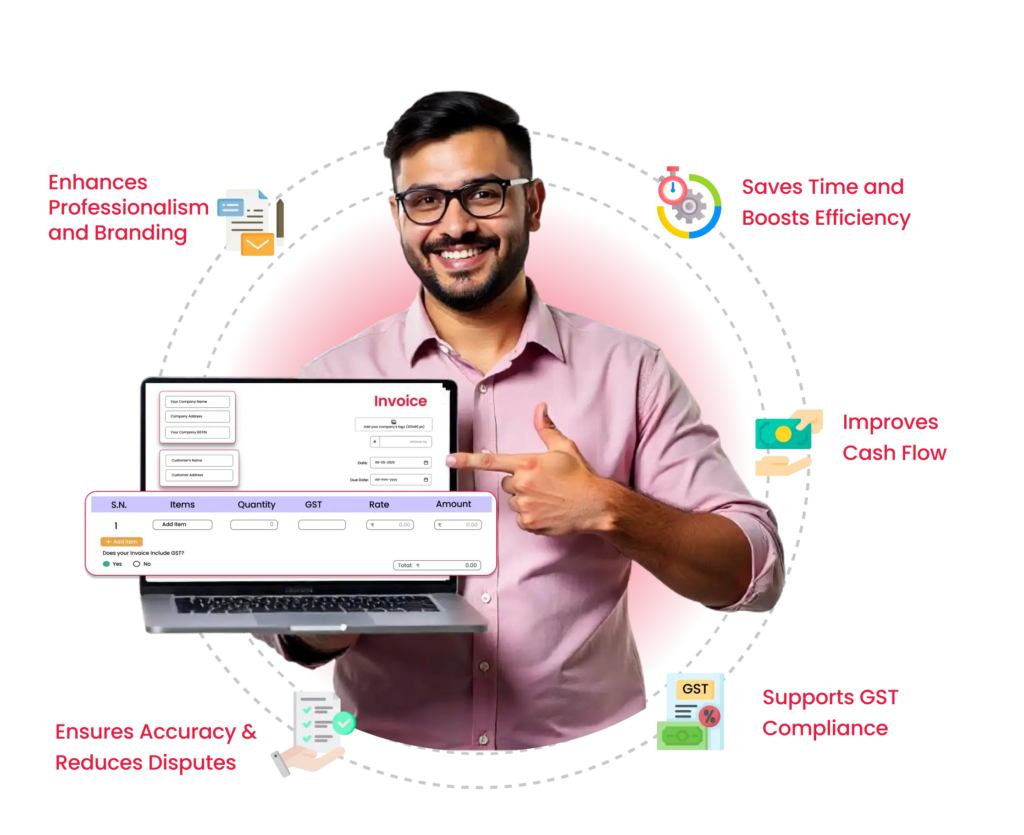

Why a Professional Invoice Template is Essential

- Ensures Professionalism and Accuracy: Invoice bill templates bring consistency to your billing. A well-structured format with predefined fields for totals and taxes reduces manual errors and presents a strong, trustworthy brand impression to every client.

- Saves Time and Boosts Efficiency: Reusable invoice designs eliminate repetitive work. With pre-filled and auto-calculating fields, you can generate and share accurate invoices in just a few clicks, leading to quicker payments.

- Simplifies GST Compliance: With built-in sections for GSTIN, HSN/SAC codes, and tax summaries, our invoice templates ensure you meet all of India’s regulatory requirements, making GST filing much less stressful.

- Improves Cash Flow with Clear Payment Terms: By clearly specifying due dates and accepted payment methods upfront, your invoices encourage timely payments and help you maintain a healthier cash flow.

- Enhances Branding and Client Experience: Customizable templates let you include brand elements like your logo and colour themes. This enhances brand recall and provides a smooth, professional experience for your clients.

- Supports Effortless Record-Keeping: Digital templates make invoice storage and retrieval simple. This is ideal for tracking payments, simplifying audits, and generating financial reports.

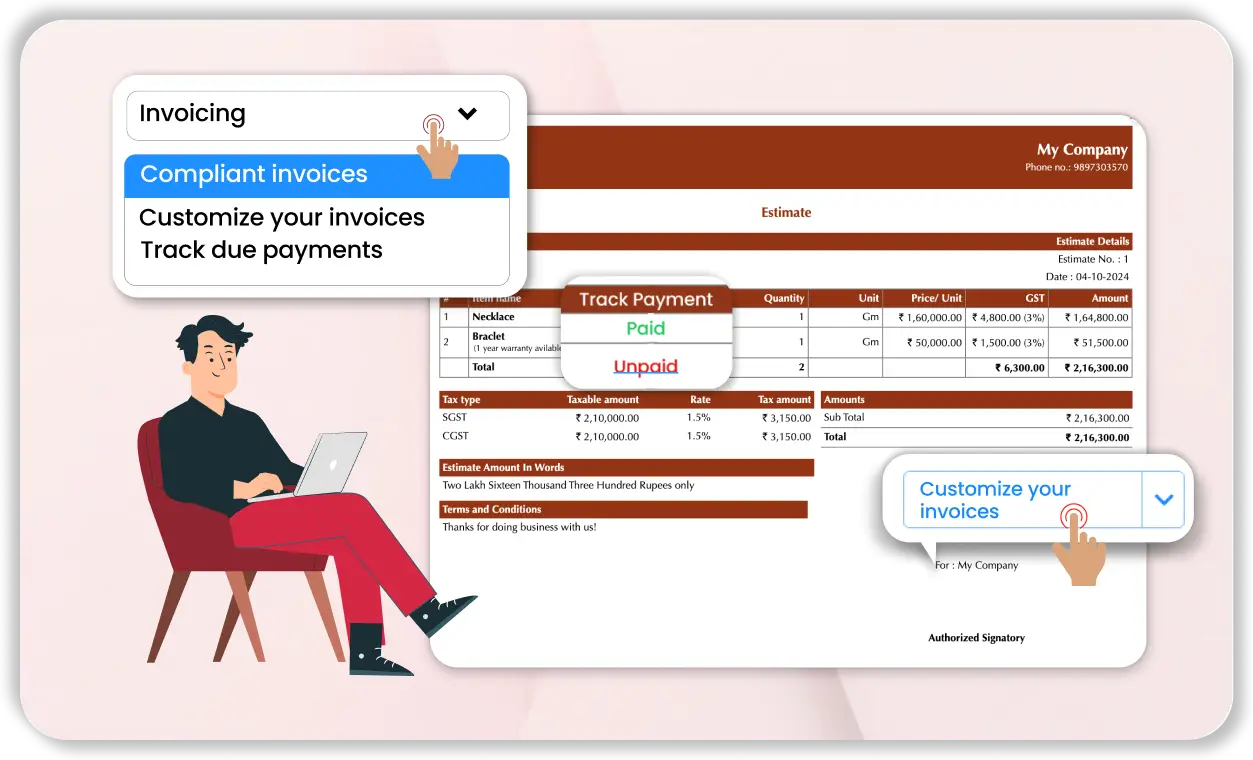

Ready for a Smarter Invoicing Solution?

Look More Professional

Look More Professional

Make your brand stand out with over a dozen professional, fully customizable invoice themes that go beyond a basic template.

Get Paid Faster

Get Paid Faster

Automatically send payment reminders to your customers via WhatsApp or SMS and easily track all outstanding balances from a single dashboard.

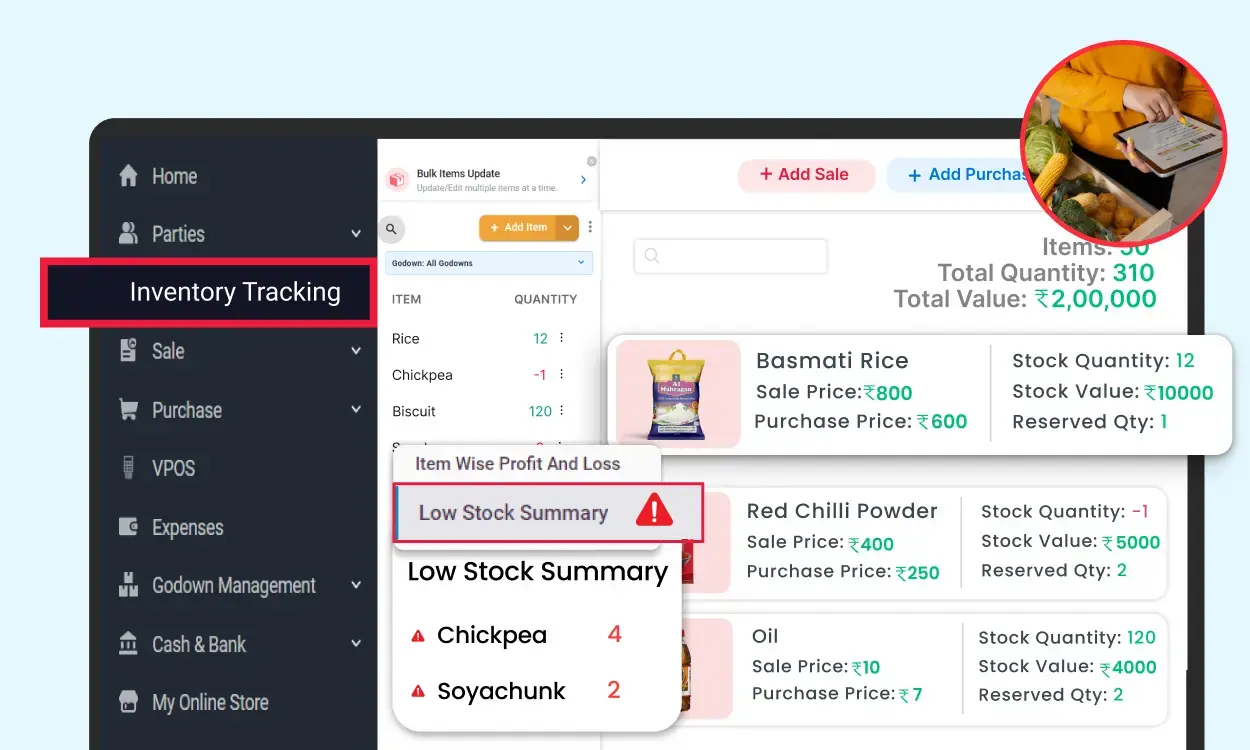

Manage Inventory in Real-Time

Manage Inventory in Real-Time

Your stock levels update automatically with every sale and purchase, and you get low-stock alerts so you never run out of items.

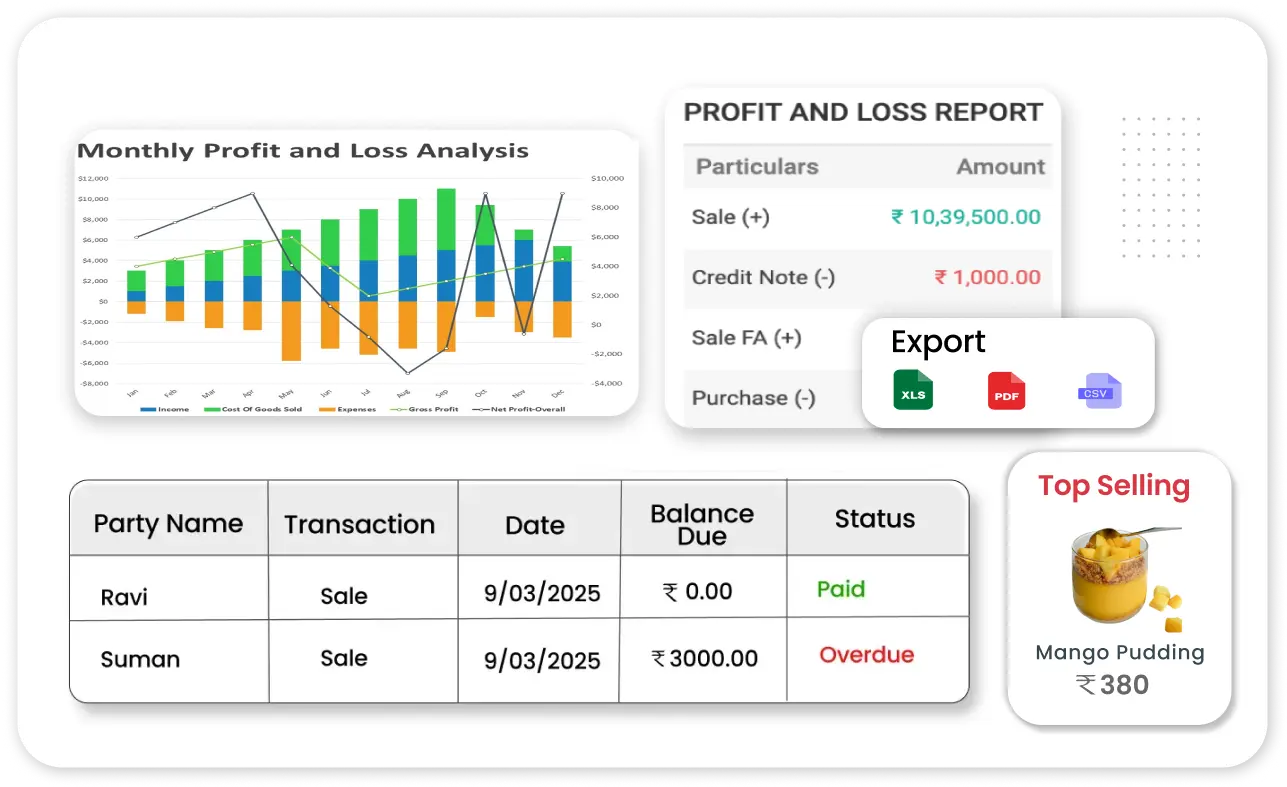

Get Instant Business Reports

Get Instant Business Reports

Generate over 40 types of detailed business reports, like Profit & Loss and GST Reports, with a single click.

Access Your Business Anywhere

Access Your Business Anywhere

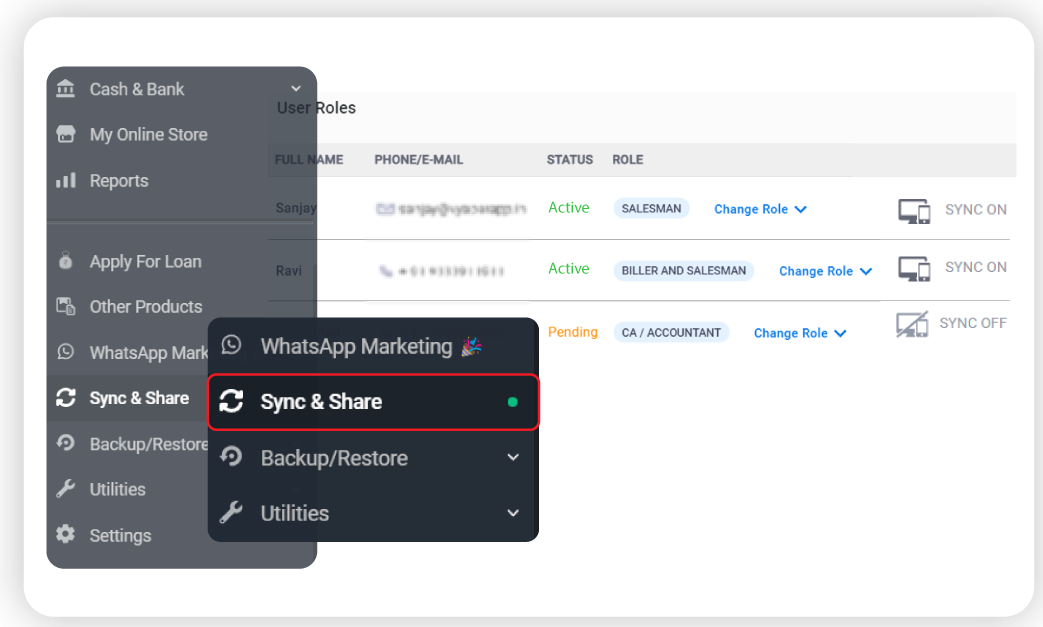

Unlike a static file, the Vyapar App securely syncs your data across your mobile and desktop devices, so you can manage your business from anywhere.

Get a Free Demo

Looking for More Business-Specific Formats

Select the specific invoice template that best suits your business needs. We have provided all kinds of business-specific templates.

Frequently Asked Questions (FAQs)

The choice of a bill format depends on your business type. Vyapar offers multiple sample bill formats tailored for retailers, service providers, wholesalers, and freelancers. Whether you need a normal invoice bill format, a GST bill, or a billing format for clients, Vyapar has you covered.

Yes! All Vyapar invoice formats are available for free. You can choose from a variety of editable formats in Word, Excel, and PDF. Simply select a bill format download that matches your business needs and start billing instantly.

A standard bill invoice format includes:

1. Business name, logo, and contact info

2. Customer details

3. Unique invoice number and issue date

4. Itemised product/service list with pricing

5. Applicable taxes and total payable

6. Payment terms and additional notes

To generate an invoice bill using Vyapar:

1. Install the Vyapar App and sign up

2. Choose a Vyapar app bill format

3. Add customer and product/service details

4. The app calculates taxes and totals automatically

5. Share via WhatsApp, email, or download the online bill format

Yes, Vyapar supports bill format download in Excel, PDF, and Word formats. This flexibility allows you to create and share bills with ease, using the format that works best for your workflow.

A billing format is often used for immediate retail transactions, while an invoice typically includes payment terms for B2B use. Vyapar supports both invoice bill templates and billing formats for client requirements, offering complete flexibility.

Absolutely! With Vyapar, you can:

1. Add your brand logo and footer

2. Customise fields and layouts

3. Choose colour schemes that reflect your identity

This makes the Vyapar invoice format ideal for businesses seeking a professional, on-brand billing solution.

Using Vyapar’s mobile app, you can create a sample bill format on the go:

1. Log in to the Vyapar App

2. Select a bill format template

3. Enter your business and customer info

4. Add items and prices

5. Send the invoice via WhatsApp or email

Yes, Vyapar offers billing formats for client types tailored to Indian businesses, including GST-compliant formats. You can choose from various styles that meet legal and business standards in India.

Yes. Every Vyapar invoice format allows you to add item-wise or bill-wise discounts, and supports CGST, SGST, and IGST calculations.

Definitely! Vyapar provides industry-specific formats—whether you need a sample bill format for retail, service, manufacturing, or even specialised sectors like textile or food delivery.

Yes. Before finalising any online bill format, Vyapar lets you preview, edit, and save it. You can then send it digitally or print it instantly.

Did not find what you were looking for?