Debit Note Format

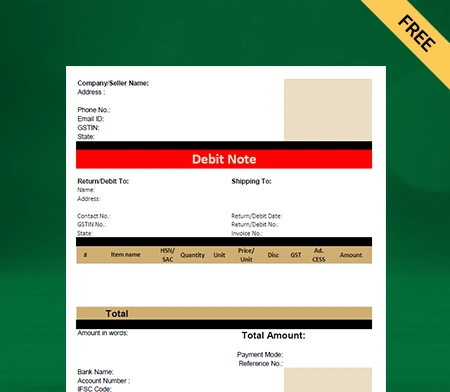

Struggling with Debit Note formats that are confusing, error-prone, or non-GST compliant? Download clean, professional and GST-ready Debit Note formats or let the Vyapar app handle it all in seconds, no errors, no stress.

Debit Note Format VS Vyapar App

Features

Debit Note Format

No Daily Template Edits

Invoice & Customer Tracking

Smart Inventory & Payment Sync

Attach Supporting Documents

Share Via WhatsApp/Email

Auto Sync Across Devices

Data Backup And Security

Works Offline

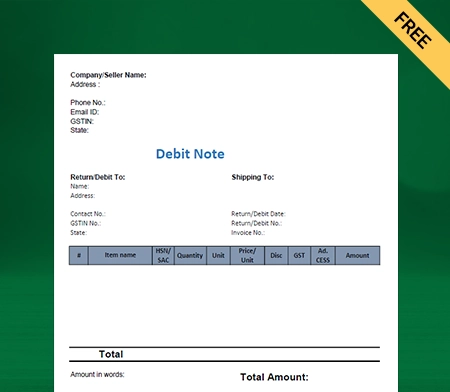

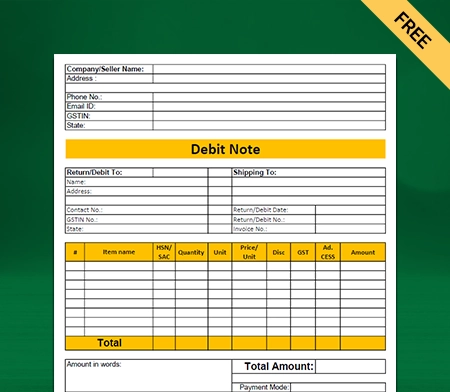

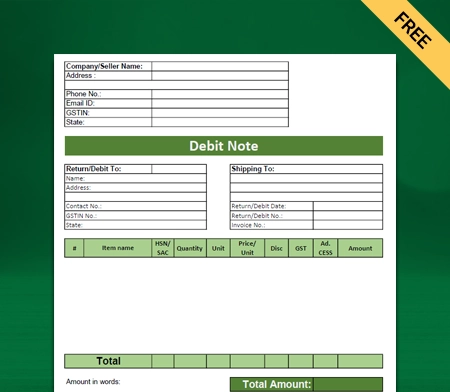

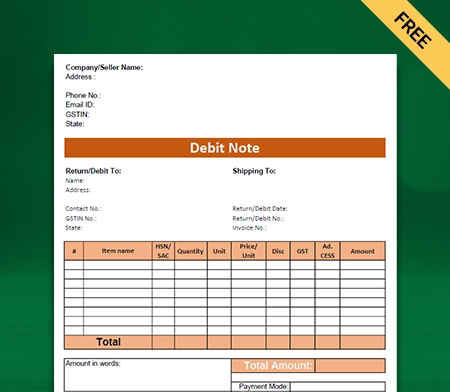

Download Free & Easy-to-Use Debit Note Format in Excel, Word, and PDF

Choose the format that suits your workflow best: Excel, Word, or PDF and handle your debit notes the right way.

Debit Note Format in Excel

Debit Note Format in Word

Debit Note Format in PDF

Debit Note Format in Docs

Debit Note Format in Sheet

GST Debit Note Format

Skip Manual Formats. Automate Debit Notes With Vyapar

What is a Debit Note

A debit note is an official document issued by a seller to notify the buyer of an additional amount payable. This typically happens when a billing error is discovered, extra goods or services are added, or price adjustments are required after the original invoice has been sent.

For example, if a business accidentally billed for 8 units instead of 10, a debit note is used to request payment for the remaining 2 units, clearly and professionally.

Using a well-structured debit note template ensures all key details are captured, such as the reason for the adjustment, invoice reference, and updated amount, helping both parties maintain transparency and accurate accounting records.

Key Components of a Debit Note

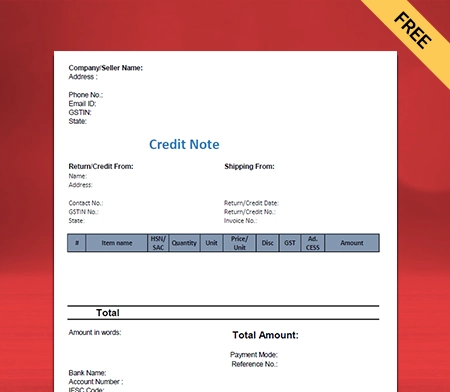

Credit Note VS Debit Note

Importance of Debit Note Format

In business, even small billing mistakes can lead to confusion, delayed payments, or strained relationships with customers. That’s why having a clear and structured format of debit note is more than just paperwork — it’s peace of mind.

A well-designed format ensures:

- Accuracy in your records — Every adjustment is properly documented.

- Clarity for your customers — No back-and-forth or miscommunication.

- Compliance with tax laws — Especially for GST-registered businesses.

- Professional presentation — Helping you build trust and credibility.

Whether you’re running a small business or managing large accounts, a proper debit note format helps you stay organised, look professional, and avoid costly errors.

From Format to Full Control — Explore Vyapar Now

How to Create a Debit Note in Vyapar

- Open the Vyapar App and go to the Purchase section.

- Tap on Purchase Return/Debit Return and click Create New.

- Select the Supplier (Party) from whom the items were purchased.

- Add the returned items, including quantity, rate, and applicable GST.

- Optionally, enter the reason for return in notes.

- Preview the debit note and then save it.

- Share or print the Debit Note via WhatsApp, Email, or Printer.

Why 1 Crore+ Users Choose Vyapar for Everything Beyond Debit Notes

Business Dashboard

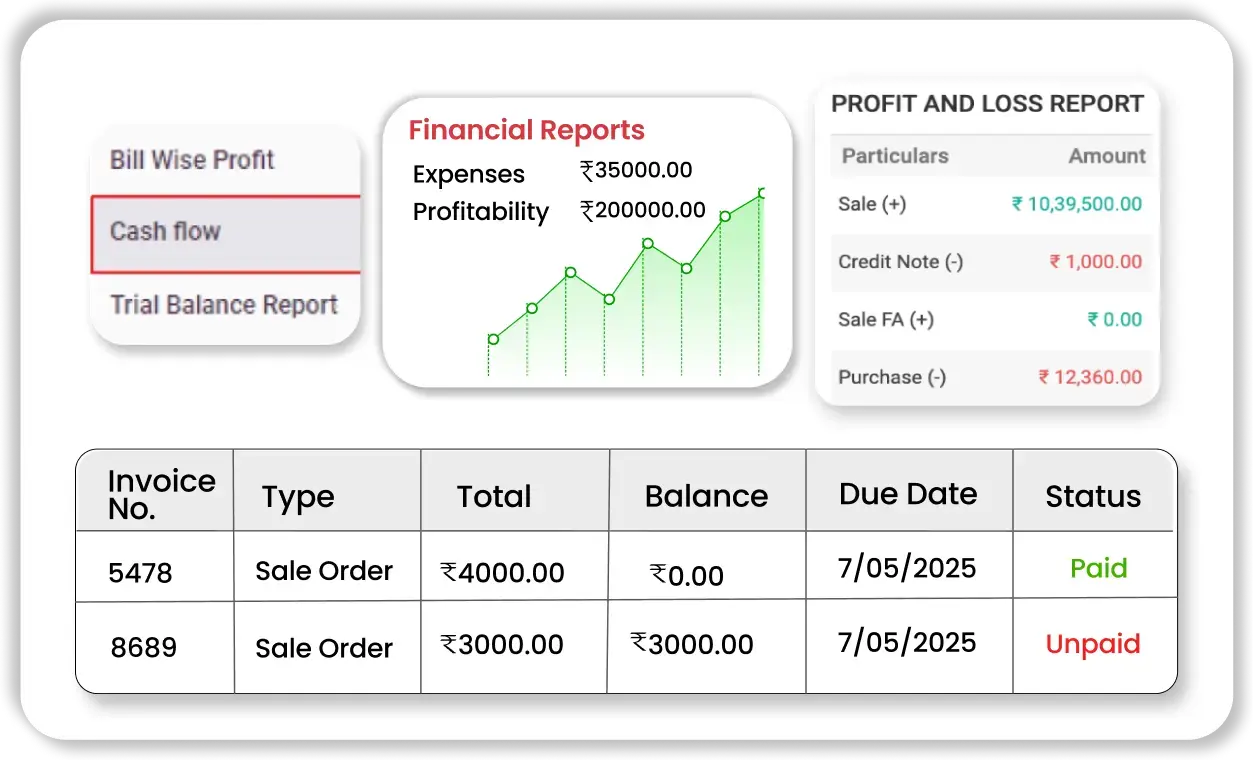

Empower your customers—and yourself—with a centralised portal that gives a complete view of your business. The Vyapar business dashboard brings everything together in one place, so you can stay on top of your business operations without switching between tools.

From generating invoices and tracking estimates to monitoring cash flow, inventory status, sales orders, and payment updates, everything is organised for quick access and better decision-making. Whether you’re a shop owner, trader, or service provider, this dashboard helps you save time, reduce errors, and run your business more efficiently.

Inventory Management

It is easy to track your business sales and manage inventory with accuracy when you have inventory management software. Vyapar offers smart business reports that help you evaluate how well your business is performing and where improvements can be made. By analysing these reports, you can identify slow-moving items and free up space by removing products that aren’t selling frequently.

The app also comes with an auto stock adjustment feature, ensuring your inventory stays updated in real-time and popular items are always available when needed.

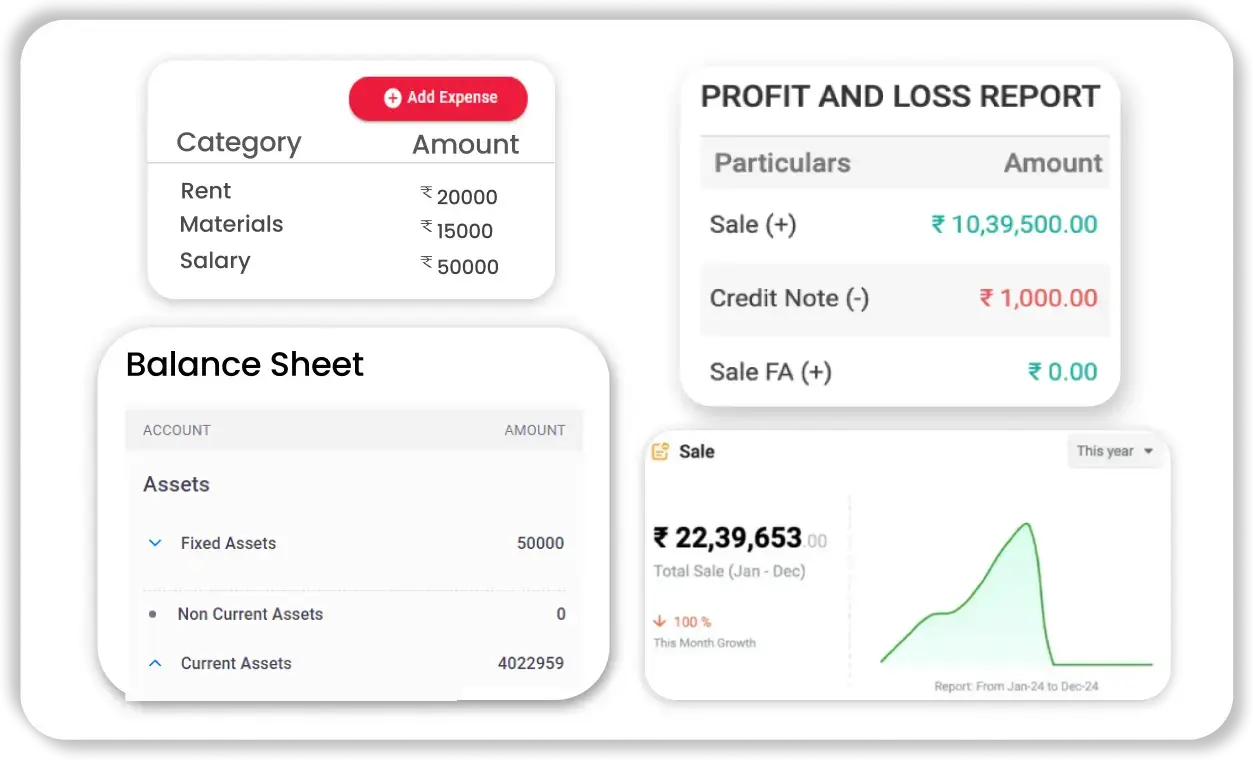

Accounting And Financial Reports

Vyapar simplifies your accounting and bookkeeping by automatically recording and organising all your business transactions. You can easily track your cash flow, view profit and loss statements, check your balance sheet, and access a variety of financial reports whenever you need them.

The app also lets you export and share these reports directly with your accountant, bank, or tax authorities, making tax filing and financial planning faster and more accurate.

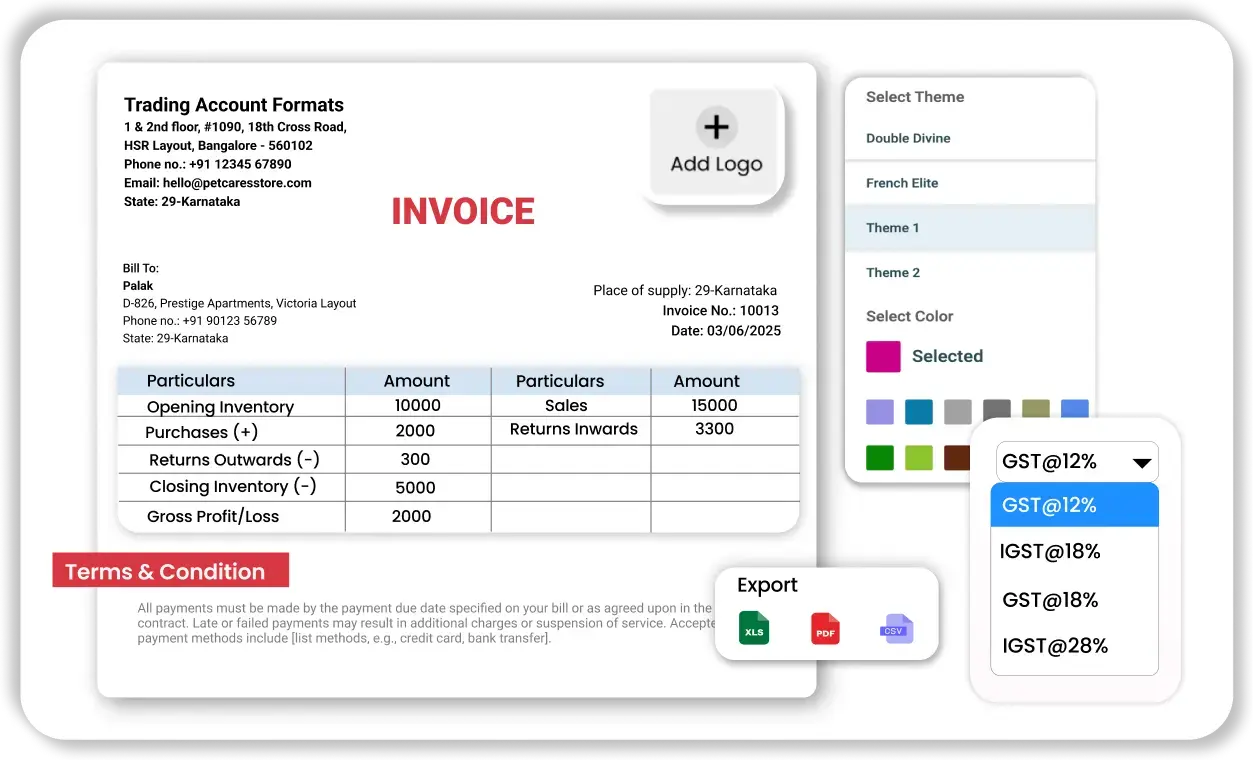

Invoicing & Billing

Vyapar makes invoicing simple and professional with fully customizable invoice formats for both sales and purchases. Whether you need GST-compliant invoices, recurring bills, or want to apply item-wise discounts, the software handles it all with ease.

You can create and share invoices in just a few taps, saving time and effort. Plus, Vyapar helps you stay on top of your payments by tracking outstanding invoices and sending automatic reminders, so you never miss a due payment again.

Easy Cash Flow Management

Vyapar helps small businesses in India keep track of their cash flow effortlessly by providing a clear, real-time view of money coming in and going out. It presents financial data in a simple, easy-to-understand format that’s perfect for business owners who want quick insights without digging through spreadsheets.

With features like the daily cash summary, users can instantly see how much cash has been received and spent each day, especially useful for shops, local traders, and anyone handling frequent transactions.

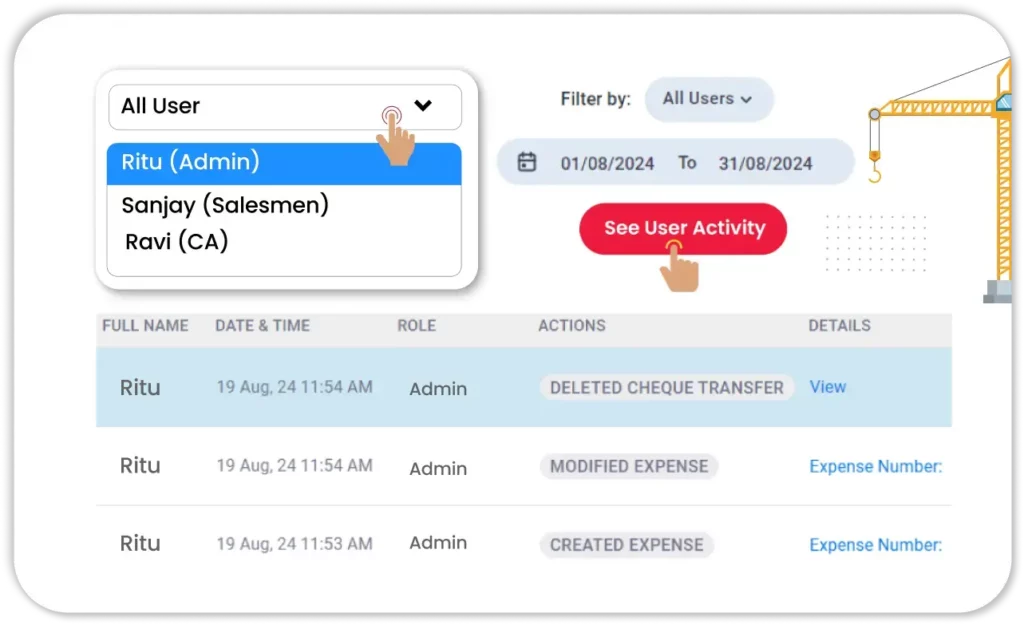

Multi-User Access with Role Control

Vyapar helps to manage their team efficiently by allowing them to add staff members and assign specific roles like billing, inventory, or viewer access. This ensures that sensitive financial data is only visible to the right people. All user activities, like adding, editing, or deleting entries, are tracked in real-time, promoting accountability and reducing the chances of internal errors or fraud.

Admin-level controls remain secure, with only authorised users able to access detailed reports, export data, or make large-scale changes, giving business owners full control over their operations.

Frequently Asked Questions (FAQ’s)

What is a debit note format?

When should I issue a debit note?

Is a debit note legally required under GST?

What’s the difference between a debit note and an invoice?

How to make debit note format that’s GST compliant?

What should be included in a debit note format?

Can a debit note be cancelled or modified later?

Can I use Excel or Word to create a debit note?

Is there a standard debit note format for small businesses?

Where can I download a professional debit note format?