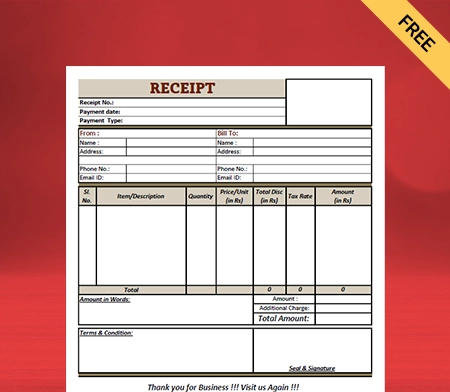

Receipt Format for Every Business

Explore ready-to-use receipt formats in Word, Excel, and PDF – perfect for retail, services, and freelancers. Easy to customize, print, and share with your customers. Make every transaction look professional and organized.

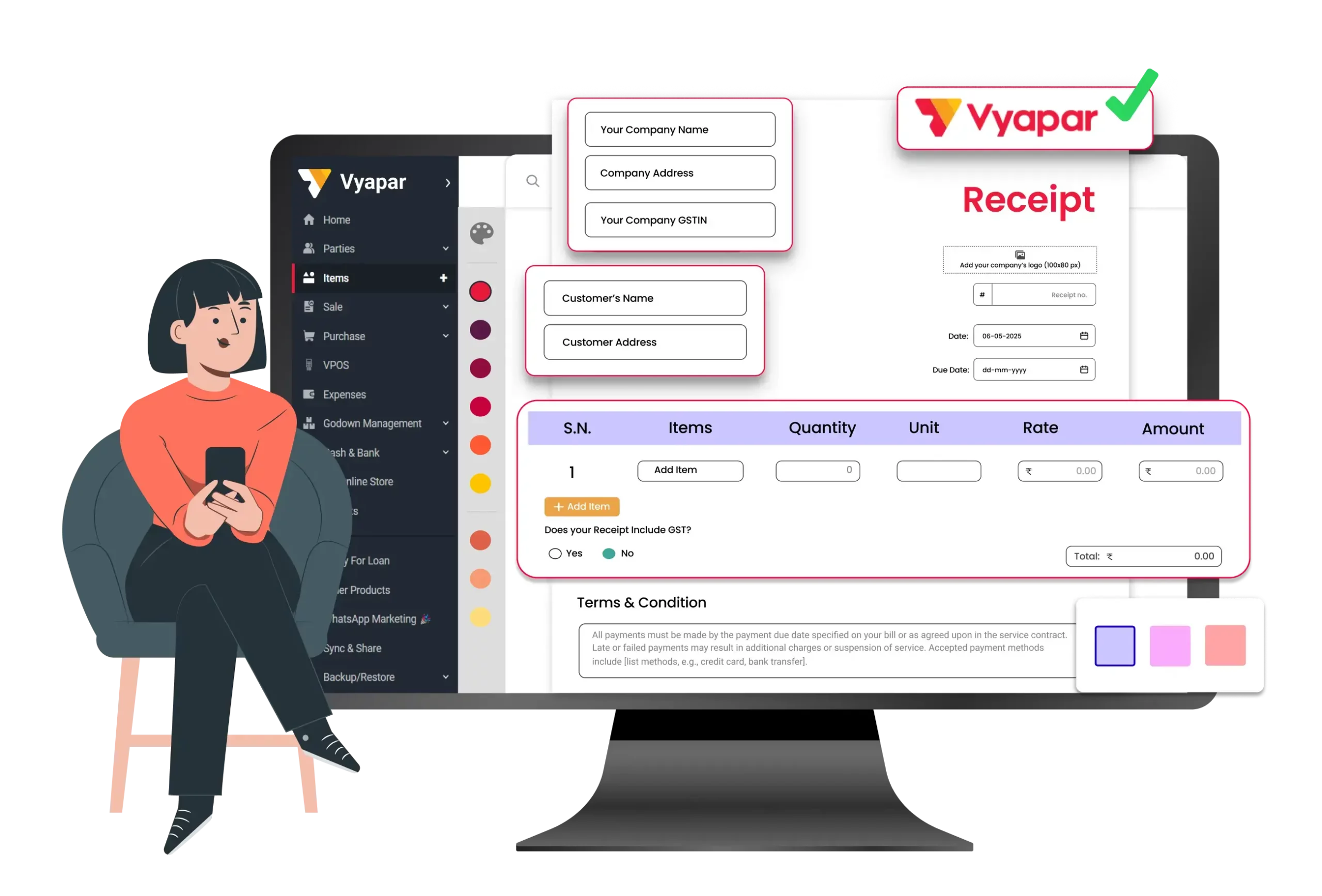

Free Receipt Format vs Vyapar App

Free Receipt

Receipt Format

Billing Software

Price

Free

Free

200+ Professional Themes

Quick Editing

Unlimited Receipts

Auto Calculation

Error-Free Transactions

Data Backup

UPI Payments

Payment Reminders

Business Status Reports

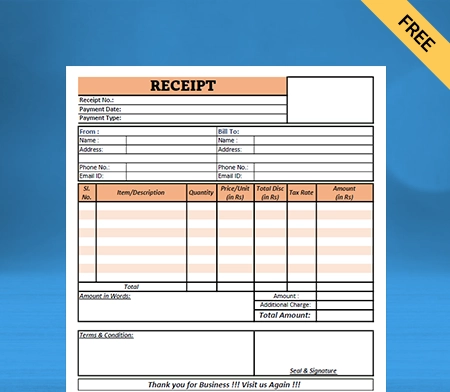

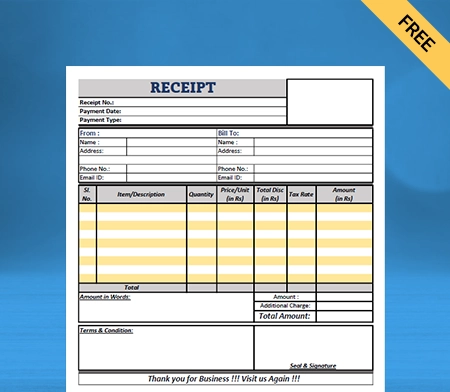

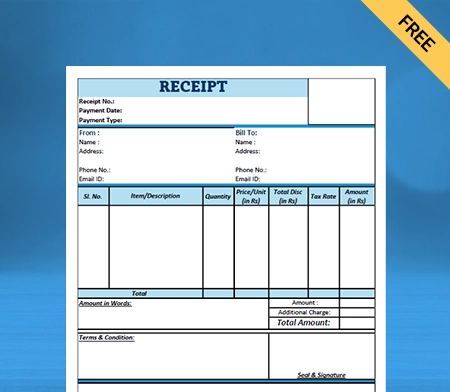

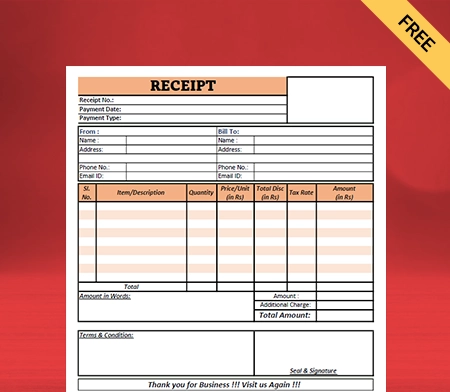

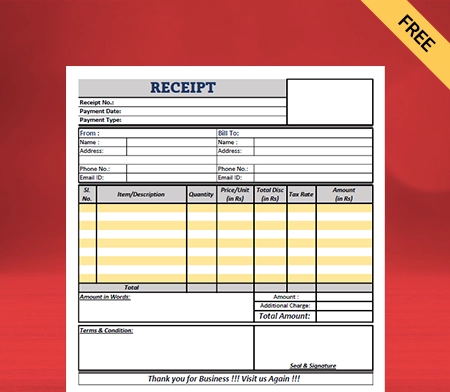

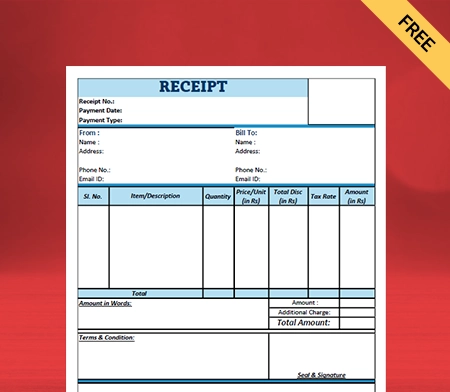

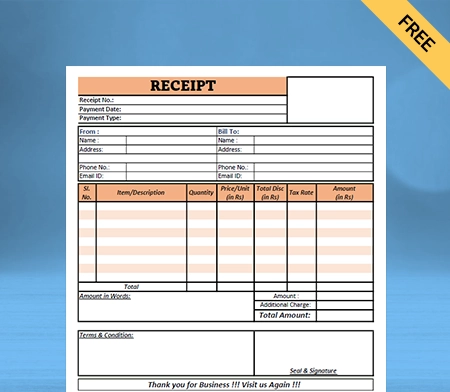

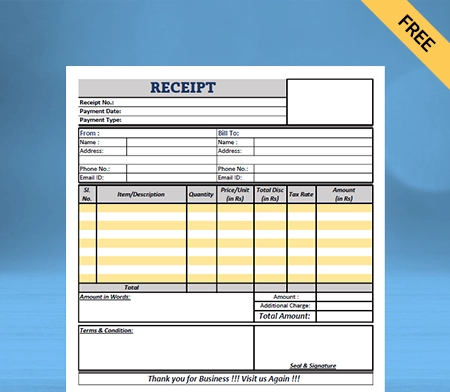

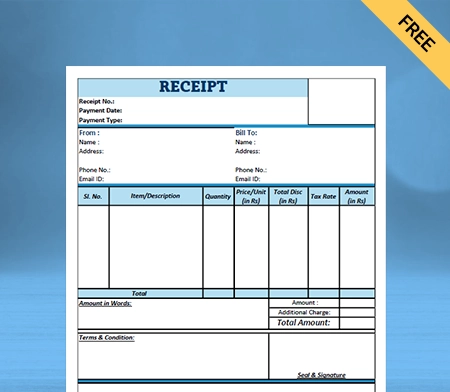

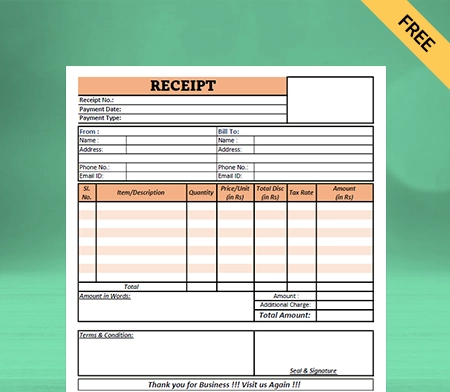

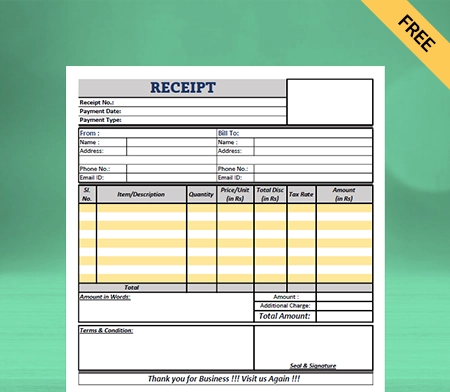

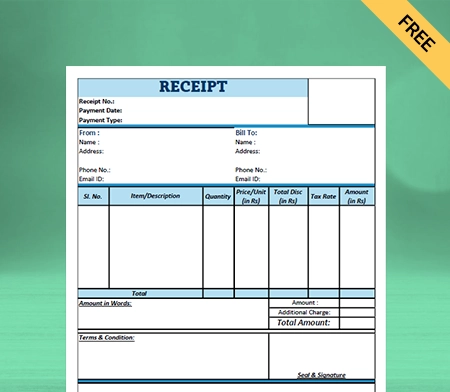

Download Free Receipt Format

Download the receipt format, and customize it according to your requirements at zero cost.

What is a Receipt Format?

A receipt format is a predefined layout used to create receipts that confirm a transaction between two parties—usually a seller and a buyer. It acts as written proof that payment has been made and the goods or services have been delivered. Receipts are important for maintaining accurate financial records, filing taxes, resolving disputes, and building trust in business transactions.

A typical receipt format includes the following details:

- Date of the transaction

- Description of goods or services provided

- Amount paid and applicable taxes

- Mode of payment (cash, UPI, bank transfer, cheque, etc.)

- Signature or stamp of the issuer

Key Components of a Receipt Format

Receipt Title and Number

Start with a clear title like “Tax Invoice” or “Bill”. Add your business name, logo, address, phone number, email, and GSTIN (if applicable). This builds trust and makes your receipt look professional.

Customer Details

Include the customer’s full name, contact number, address, and GSTIN (for B2B invoices). This ensures transparency and helps maintain accurate records.

Receipt Number and Date

Assign a unique receipt number and mention the issue date. This helps in tracking sales, auditing, and record-keeping for both the customer and business.

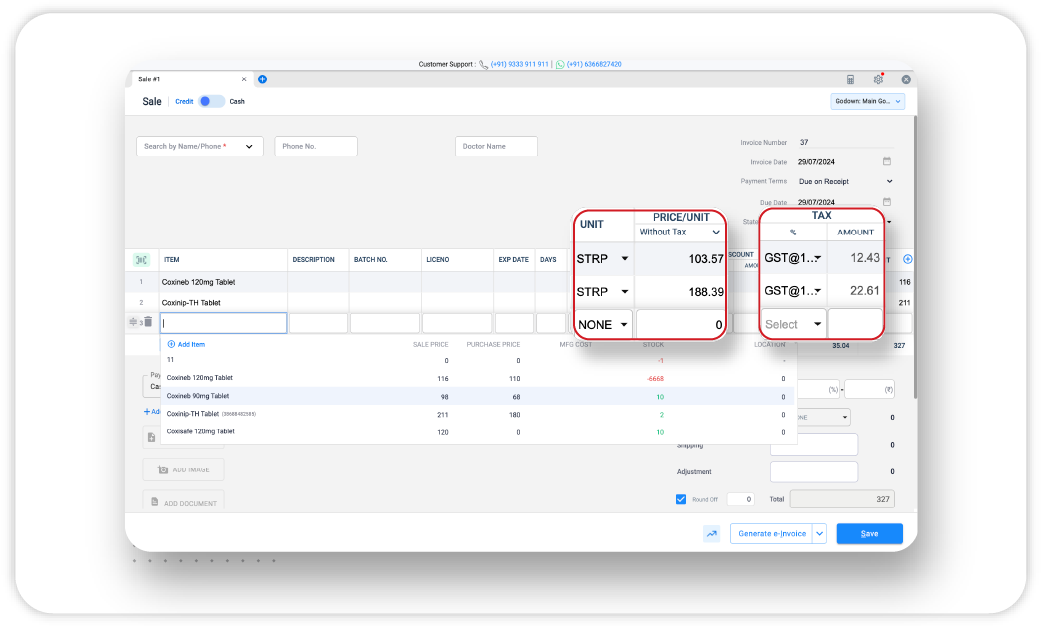

Itemized Product/Service Details

List each product/service separately with quantity, unit rate, HSN/SAC code, and item-wise totals. This detailed breakdown ensures clarity and avoids confusion.

Tax Summary (GST)

Add applicable GST components like CGST, SGST, or IGST, based on sale type. Clearly mention tax percentages and amounts to comply with government norms.

Total Amount and Payment Terms

Mention the subtotal, discounts (if any), tax, and final amount payable. Add payment mode (cash, UPI, card, etc.) and any due date for smooth payment processing.

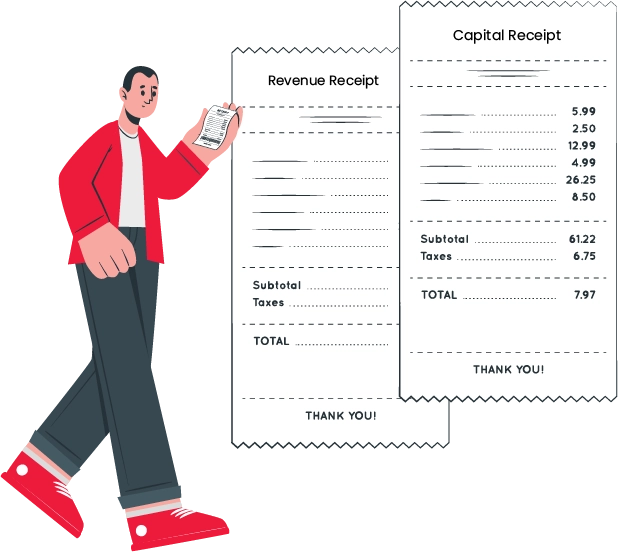

Difference Between Revenue Receipts and Capital Receipts

Benefits of Using a Great Receipt Format

- Professional Brand Image: A well-designed receipt format does more than just record a sale—it reflects your brand’s identity. Including your logo, brand colors, and proper formatting helps you appear trustworthy and organized in front of your customers.

- Accurate Record-Keeping: A structured receipt format makes it easier to maintain clean, organized records of every transaction. Whether you’re reconciling sales at the end of the day or preparing data for tax filing, a standardized format helps avoid errors, omissions, or confusion in your books.

- Faster Dispute Resolution : Clear receipts act as strong proof of transaction. In case of any product return, service complaint, or pricing disagreement, a well-documented receipt with itemized details helps both the seller and buyer resolve the issue quickly, professionally, and without unnecessary hassle.

- Legal and Tax Compliance: Receipts with properly listed GST, HSN/SAC codes, and tax breakdowns ensure your business stays compliant with statutory regulations. This minimizes the risk of penalties during audits and also simplifies filing monthly or annual tax returns with accurate sales data.

- Improved Customer Experience: A great receipt format enhances customer satisfaction by keeping everything transparent—prices, taxes, discounts, and payment modes. When customers receive receipts they can easily understand and refer back to, it builds trust and encourages repeat purchases.

- Better Business Insights: Receipts aren’t just paper—they’re data points. A consistent format lets you analyze sales trends, track your top-selling items, measure average order value, and monitor customer buying habits. This information can be used to make informed decisions and grow your business faster.

Why Must Sellers Issue Receipts?

Sellers generate receipts when delivering goods or services to the buyer for the following reasons:

- Proof of the buyer’s ownership transfer.

- The buyer has documentation of the amount paid as a safeguard.

- To serve as the foundation for an accounting entry that will document the underlying transaction.

- To prove ownership for insurance.

- The supplier should provide documentation if products are returned under warranty.

- Proof that a sales tax was paid during the transaction, so the buyer is exempt from paying a use tax.

Invoice Vs Receipt

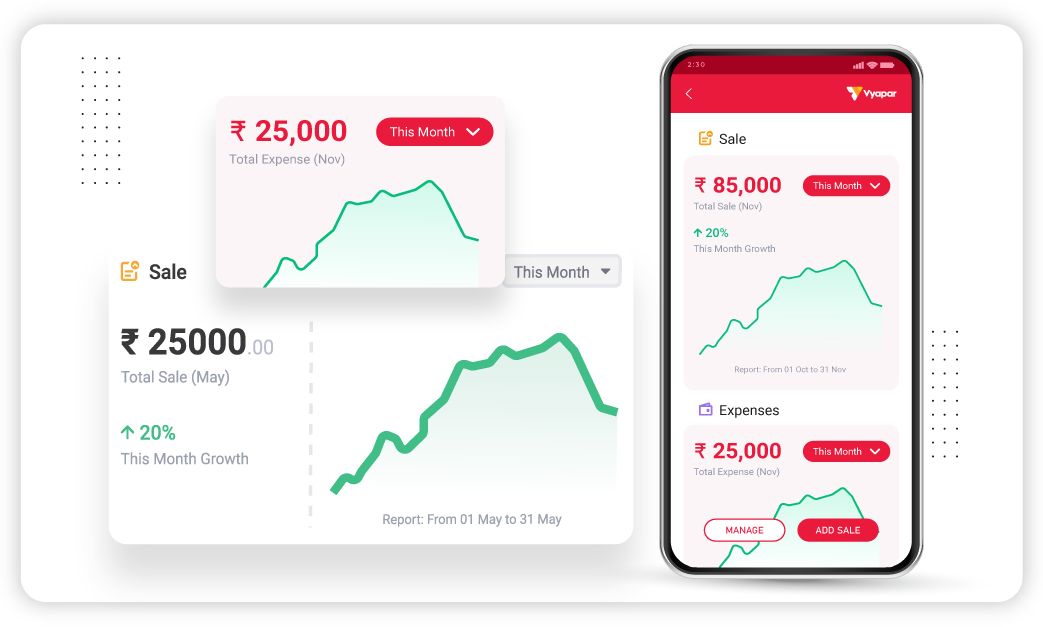

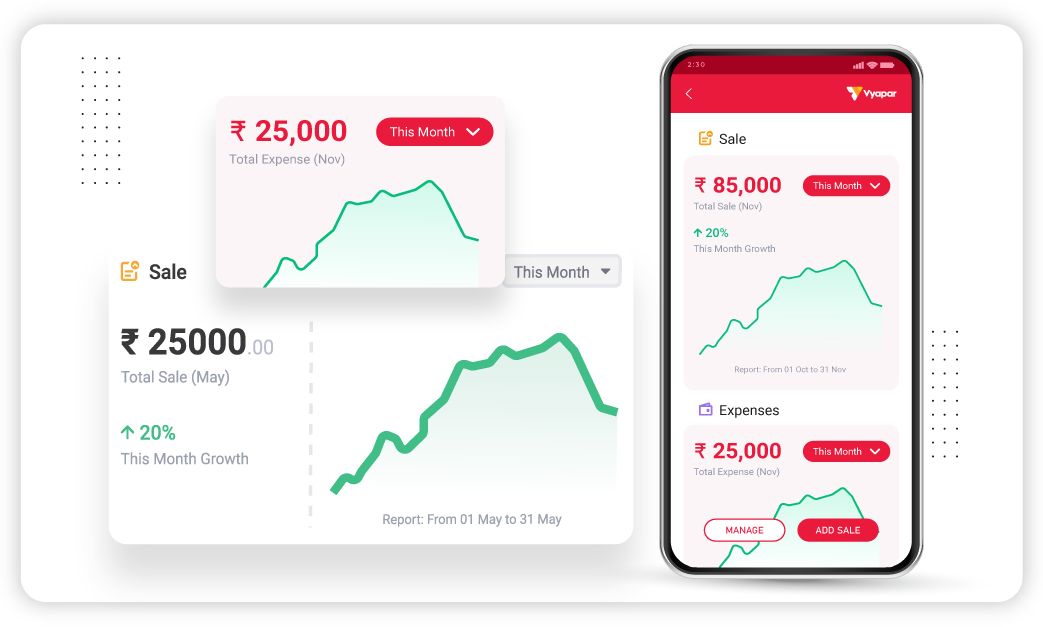

Why Vyapar is the Best Alternative to Receipt Format

Stop relying on outdated, manual receipt templates. Vyapar gives you everything a static format can’t—automated receipts, real-time tracking, digital sharing, and full business management in one easy-to-use app.

Complete Business Management in One App

Vyapar is not just a receipt tool—it’s your all-in-one business solution.

- Billing, Inventory, Accounting: Handle everything from a single dashboard.

- Bank & Cash Flow Tracking: Monitor every rupee across accounts.

- GST Filing & Reports: Built-in tools for compliant and effortless filing.

Auto-Generate Professional Receipts

Why spend time editing formats when Vyapar lets you generate GST-compliant receipts in seconds?

- Branded Output: Your logo, business name, and contact details included automatically.

- Consistent Design: Every receipt looks clean and professional.

- Faster Checkout: Save time by eliminating manual data entry.

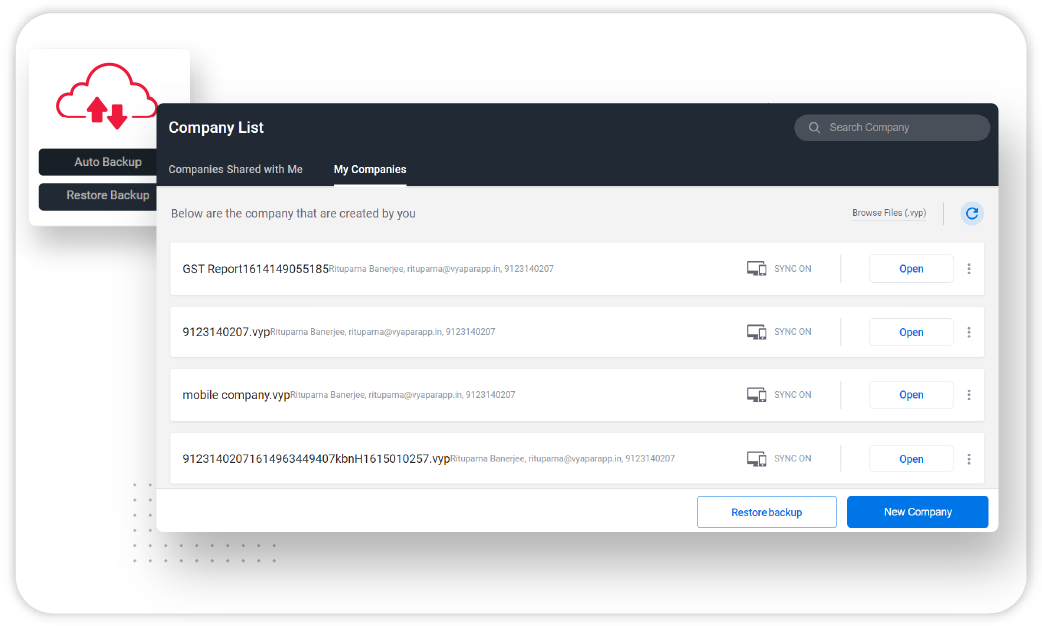

Integration and Synchronization

Vyapar connects seamlessly with your existing tools and syncs data across devices to make business operations smoother and smarter.

- Multi-Device Sync: Access the same updated data from both desktop and mobile apps.

- Auto Cloud Backup: No need to manually save or transfer files—your data stays safe and updated in real-time.

- WhatsApp & Printer Integration: Send receipts digitally or print them instantly using connected devices.

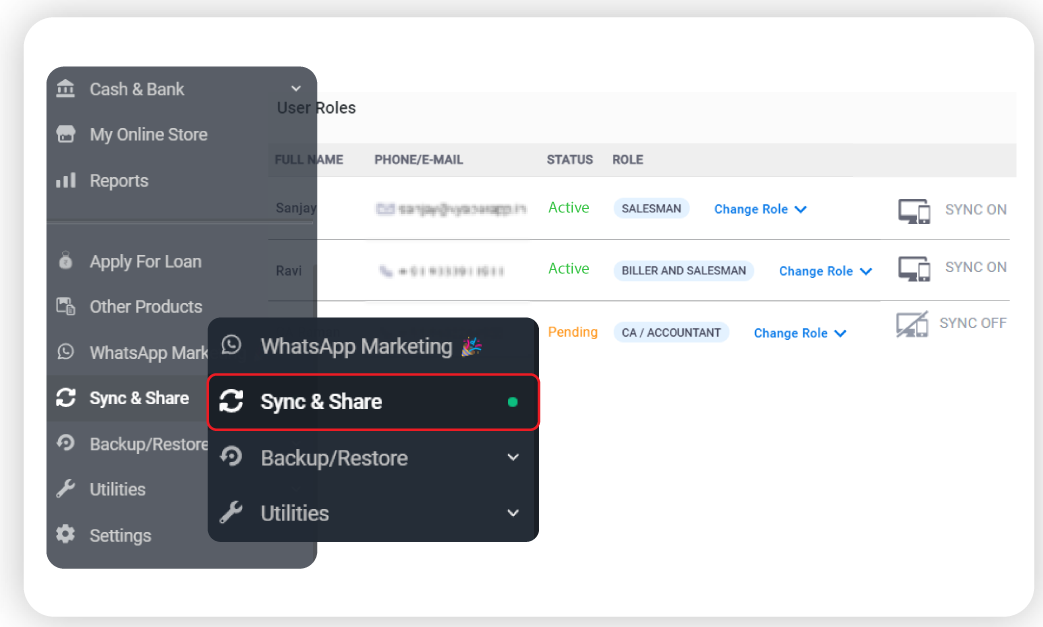

Data Safety and Secure Backups

Templates can be lost or overwritten—Vyapar keeps your business data protected.

- Local & Cloud Backups: Your data is stored safely and retrievable anytime.

- Multi-Device Access: Use the same data across desktop and mobile.

- Access Control: Set permissions for team members or staff access.

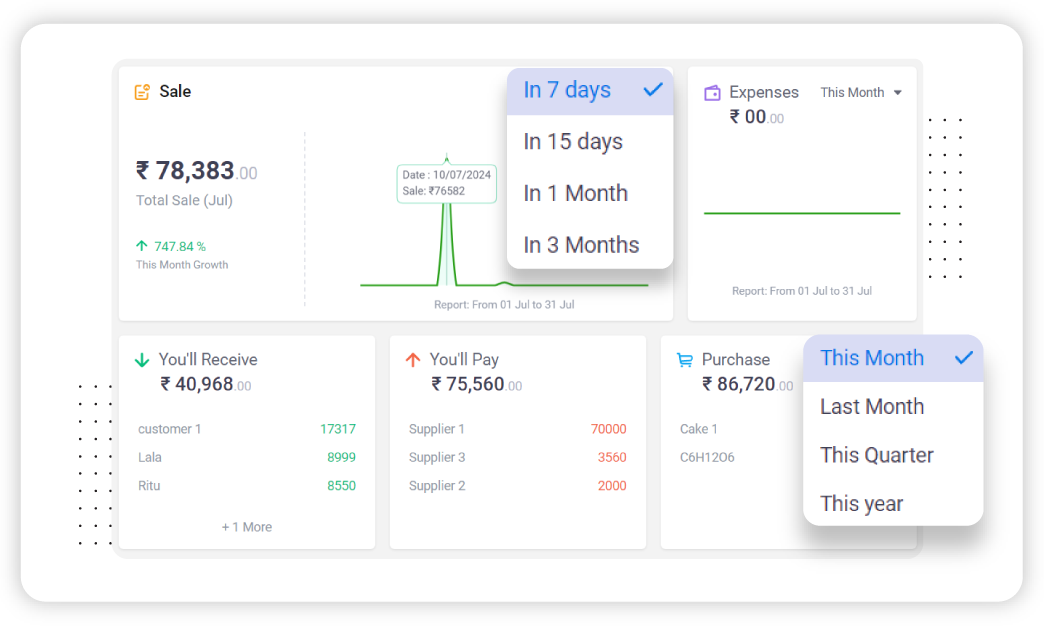

Real-Time Record Keeping

Forget manual logbooks or saving separate files. Vyapar updates everything in real-time.

- Auto Transaction Logging: Every bill, receipt, and expense is tracked instantly.

- Accurate Reports: Eliminate mismatch errors with real-time data syncing.

- Audit-Ready Data: Maintain complete transaction history without stress.

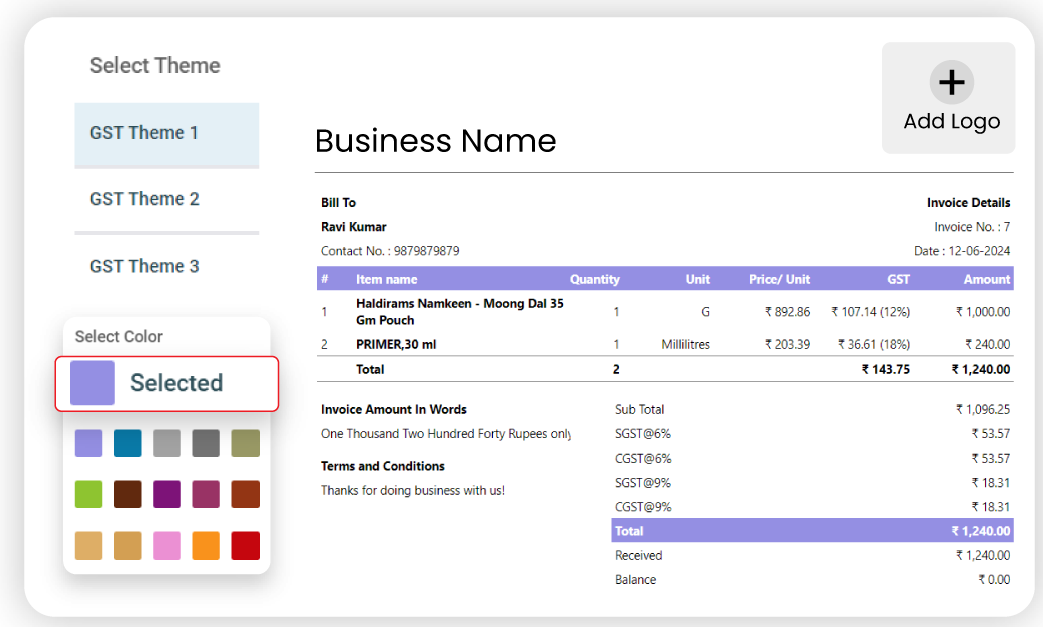

Receipt Customization & Branding

Vyapar lets you showcase your brand identity in every receipt, helping your business stand out and build customer trust.

- Add Logo and Colors: Personalize receipts with your brand logo, theme colors, and contact details.

- Custom Invoice Fields: Include fields like delivery notes, payment terms, or any custom message.

- Multiple Invoice Themes: Choose from a variety of sleek, professional templates tailored to your business style.

Mobile-Friendly & On-the-Go Billing

With Vyapar’s mobile app, you can manage your business anytime, anywhere—without needing a desktop or paperwork.

- Bill On-the-Go: Create and send invoices directly from your phone.

- Track Inventory & Sales: Stay updated with real-time stock and order status from your mobile.

- Full App Experience: Enjoy all desktop features—billing, reports, payments—right from your pocket.