Fund Flow Statement Format

Download Vyapar’s professionally designed Fund Flow Statement Format to easily track the movement of funds in your business. Simplify financial planning and streamline your reporting process

Fund Flow Statement Format Vs Vyapar App

Features

Format

200+ Professional Formats

GST Reports

Auto Calculation

Real-Time Updates

Accounting Integration

Auto Backup

Real-Time Business Insights

Multiple Payment Mode

Free Support and Assistance

Instant Data Sync

Download Fund Flow Statement Format in Excel, PDF and Google Sheet

Get 100+ Fund Flow Statement formats to Customize. Try it Vyapar for FREE!

What is a Fund Flow Statement?

A Fund Flow Statement is a financial report that shows changes in a company’s working capital over a specific period. Also known as the Statement of Changes in Financial Position, it highlights how funds are generated and used within the business.

The Fund Flow Statement Format provides insights into both inflows and outflows of cash and other financial resources. It includes details on sources of funds—like asset sales or loans—and uses of funds, such as equipment purchases or debt repayment.

The Fund Flow Statement Format in Excel helps users understand a company’s liquidity, capital structure, and overall financial health. It’s a valuable tool for investors, creditors, and financial analysts to evaluate how efficiently a company manages its resources.

Why Should You Prepare a Fund Flow Statement Format?

Preparing a Fund Flow Statement Format offers several advantages for businesses. It not only enhances cash management but also supports strategic decision-making. Here’s how:

🔹 Understand Sources and Uses of Funds

A Fund Flow Statement helps track where your money comes from and where it goes. By identifying cash inflows and outflows, businesses can evaluate the impact of financial activities on overall performance.

🔹 Monitor Cash Flow Effectively

The Fund Flow Statement Format provides a clear picture of cash position changes over time. It helps identify potential cash shortages early so businesses can take timely action.

🔹 Spot Cash Management Issues

Using the Fund Flow Statement Format in Excel, businesses can pinpoint issues like delayed collections, excess inventory, or idle assets. Addressing these areas improves operational efficiency.

🔹 Facilitate Financial Planning

Fund flow statements assist in planning key financial decisions—such as capital investments, debt repayment, and dividend distribution—based on available fund sources.

🔹 Ensure Regulatory Compliance

In some regions, preparing a Fund Flow Statement Format in PDF is required by law. Regular documentation ensures compliance and helps avoid penalties.

The Fund Flow Statement Format is a powerful tool that supports liquidity analysis, strategic planning, and financial transparency—making it essential for every business.

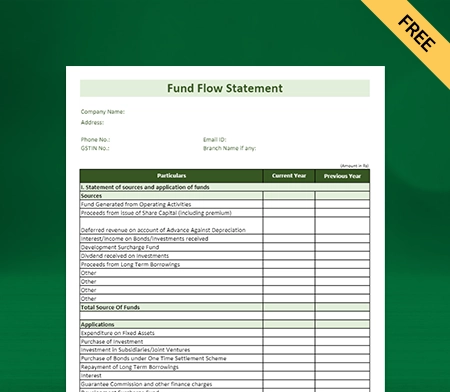

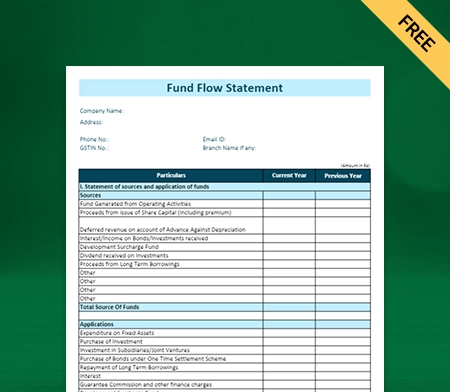

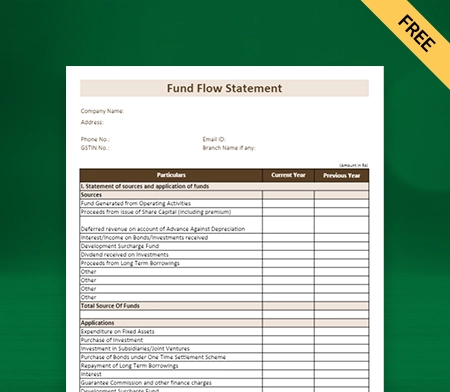

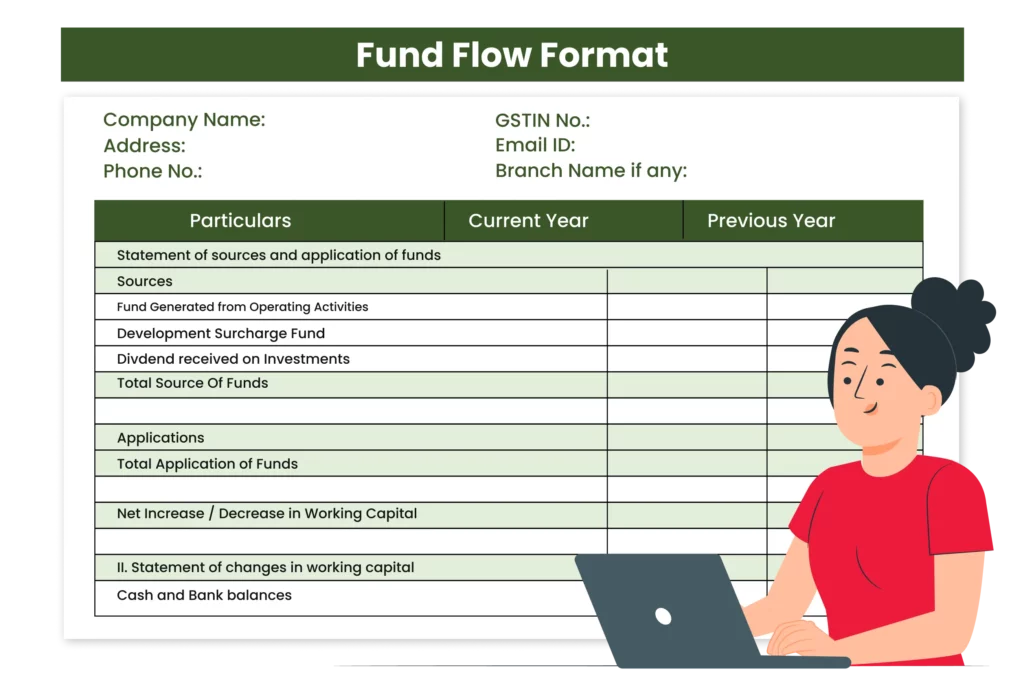

Contents of a Fund Flow Statement Format

A Fund Flow Statement Format provides a structured view of how funds move within a business during a specific period. It highlights where the money came from and how it was used, helping evaluate financial performance and planning.

1. Particulars Column

This section lists the detailed items representing fund inflows and outflows. It includes entries like issue of shares, purchase of assets, or loan repayments. Each row specifies whether the transaction adds to or reduces the fund position, forming the backbone of the statement.

2. Schedule of Changes in Working Capital

It compares current assets and liabilities between two periods to calculate the change in working capital. An increase shows funds used, while a decrease indicates funds generated. This helps analyze the short-term liquidity impact of business operations.

3. Sources of Funds

This includes all financial inflows such as profits, capital raised, loans taken, or proceeds from asset sales. It shows how the business gathered funds during the period to support operations, growth, or financial obligations.

4. Application (Uses) of Funds

This section covers all outflows like asset purchases, debt repayment, dividend payments, or increase in working capital. It reveals how funds were deployed across various business needs and investments.

5. Net Increase or Decrease in Working Capital

After adjusting all sources and uses, this section shows the final impact on working capital. A net increase means more cash tied in operations, while a decrease signals fund release or optimized capital use.

6. Closing Notes or Footnotes (Optional)

These are remarks or explanations added at the end of the statement for clarity. They may highlight assumptions, unusual items, or context behind major fund movements, ensuring the statement is easy to interpret.

How to Prepare a Fund Flow Statement?

Preparing a Fund Flow Statement Format involves tracking changes in a company’s financial position over a specific period. Here’s a step-by-step guide:

- Identify Opening and Closing Balances

Begin by noting the opening and closing balances of cash and cash equivalents. Also, assess changes in other balance sheet accounts for the period. - Calculate Changes in Working Capital

Evaluate changes in current assets and current liabilities. The difference between them shows whether working capital has increased or decreased. - Determine Net Change in Working Capital

Subtract the increase in current liabilities from the increase in current assets. This reveals the net change in working capital—a key component of the fund flow. - Identify Sources and Uses of Funds

List all sources of funds (e.g., loan proceeds, sale of assets) and uses of funds (e.g., loan repayment, asset purchases, dividend payments). - Create the Statement of Sources and Uses

Prepare a detailed summary showing total inflows and outflows. The net amount is calculated by subtracting total outflows from inflows. - Draft the Final Fund Flow Statement

Using the above data, compile the final Fund Flow Statement Format, clearly showing how the funds were generated and utilized throughout the period.

Uses of a Fund Flow Statement

A Fund Flow Statement highlights the sources and uses of funds over a specific period. It helps businesses make better financial decisions by analyzing cash movements. Here are some key uses:

Identifying Sources and Uses of Funds

The statement reveals where funds were generated and how they were utilized, allowing businesses to manage resources wisely and plan for future investments.

Analyzing Liquidity Position

It helps evaluate the company’s liquidity—its ability to meet short-term obligations and repay debts on time.

Measuring Solvency

By studying the long-term flow of funds, businesses can assess their solvency, or ability to handle long-term debt responsibly.

Evaluating Financial Performance

Comparing fund flow statements across different periods helps analyze trends, revealing strengths and areas needing improvement.

Supporting Financial Decision-Making

The insights from a fund flow statement assist in decisions related to capital investment, debt repayment, or raising additional funds.

Benefits of Using Fund Flow Format by Vyapar

Here’s how Vyapar’s ready-to-use Fund Flow Statement Formats in Excel and PDF make your financial reporting smarter, simpler, and more professional:

1. Easy Organisation of Data

Using a structured Fund Flow Statement Format in Excel helps organize financial data clearly. Stakeholders can easily view key metrics like inflows and outflows.

- Personalization Options: Add your company’s logo, address, and custom fields.

- Professional Output: Export to PDF with a polished layout that reflects your brand.

- Stand Out: Professionally designed formats help your business look more credible.

2. Enhanced Clarity

Present your fund flow data in a format that even non-finance stakeholders can understand.

- Simplified Communication: Clear layouts reduce confusion during presentations or reviews.

- Less Risk of Errors: Every field is structured for accuracy and consistency.

- Better Audits: Organized formats help spot discrepancies or outliers quickly.

3. Accuracy of Records

Vyapar ensures your fund flow statements are accurate and consistent across all reporting cycles.

- PDF Format for Clarity: Ensures that financial data is cleanly displayed and easy to interpret.

- Error-Free Tracking: Avoid misinterpretations or reporting mistakes from unstructured formats.

4. Consistency Across Documents

Maintain uniformity in how you present fund movements with a consistent template.

- Professional Perception: A unified format positions your business as reliable and organized.

- Ease of Understanding: Uniform structure across reports reduces confusion.

- Standardization: Helps maintain audit trails and long-term financial consistency.

5. Time-Saving Efficiency

Vyapar formats reduce manual effort, making reporting faster and more reliable.

- Pre-Defined Structure: Saves hours of formatting and report-writing time.

- Smart Features: Some templates include auto-calculations and categorization.

- Ideal for SMBs: Perfect for businesses without a dedicated finance team.

6. Print or Save with Ease

Work digitally or physically — Vyapar’s formats support both.

- Multiple Formats Available: Download, save, or print in standard or thermal printer sizes.

- Free to Use: Entire functionality is available at no extra cost.

- Manual Entry Support: Fill entries by hand after printing, if preferred.

Frequently Asked Questions (FAQs)

A Fund Flow Statement is a financial report that shows the sources and applications of funds in a business. It helps assess how working capital has changed during a period and whether it has been utilized efficiently.

There are two key components in a Fund Flow Statement Format:

Sources of Funds – Includes capital raised, loans, and income from asset sales.

Application of Funds – Covers outflows like asset purchases, debt repayment, or dividend payments.

The standard Fund Flow Statement Format includes:

1. Sources of Funds – Lists all cash inflows.

2. Application of Funds – Lists all outflows or fund usages.

3. Net Change in Working Capital – Shows the overall impact on business liquidity.int

A fund flow statement helps analyze profit fluctuations and working capital changes. By comparing balance sheets from two consecutive periods, it reveals how internal and external financial decisions impact fund movements.

Yes. Vyapar offers both Excel and PDF formats for fund flow statements. These templates are easy to download, edit, and use—perfect for creating professional financial reports.

Business owners, accountants, investors, and financial analysts use fund flow statements to understand a company’s liquidity, solvency, and capital management.

A Cash Flow Statement tracks only cash inflows and outflows, while a Fund Flow Statement analyzes overall changes in financial position, including working capital adjustments.

Yes, you can manually prepare it using Vyapar’s free Fund Flow Statement Format in Excel or PDF. However, using software like Vyapar ensures greater accuracy, consistency, and time efficiency.