Debit Note Format in Excel

Tired of manual adjustments, customisation issues, and errors in Excel? Download our free, hassle-free, offline-friendly Debit Note Excel formats, or let Vyapar automate the process. Start your free trial now!

Debit Note Format in Excel VS Vyapar App

Features

Debit Note Format

Inventory Update

Audit Trail

Tax Report Auto-Sync

Attach Supporting Documents

Share Via WhatsApp/Email

Auto Sync Across Devices

User Access Control

Works Offline

Download Free & Easy-to-Use Debit Note Format in Excel

Effortlessly customise and manage your debit notes with the flexibility and control of Excel, all while maintaining accuracy and ease.

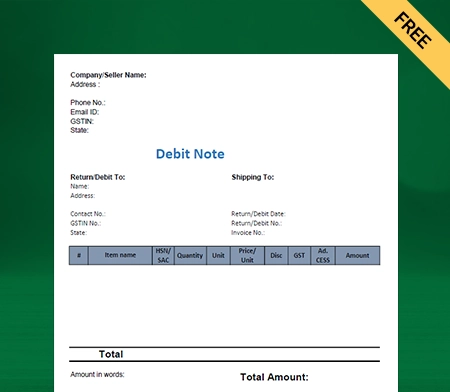

Excel Debit Note Format – 1

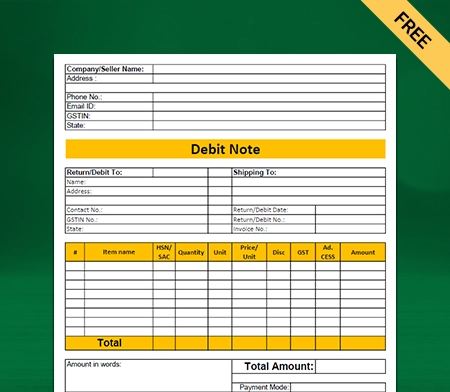

Excel Debit Note Format – 2

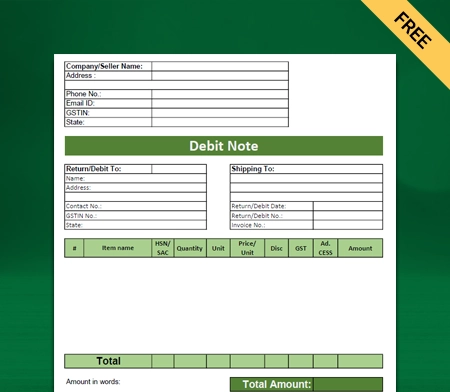

Excel Debit Note Format – 3

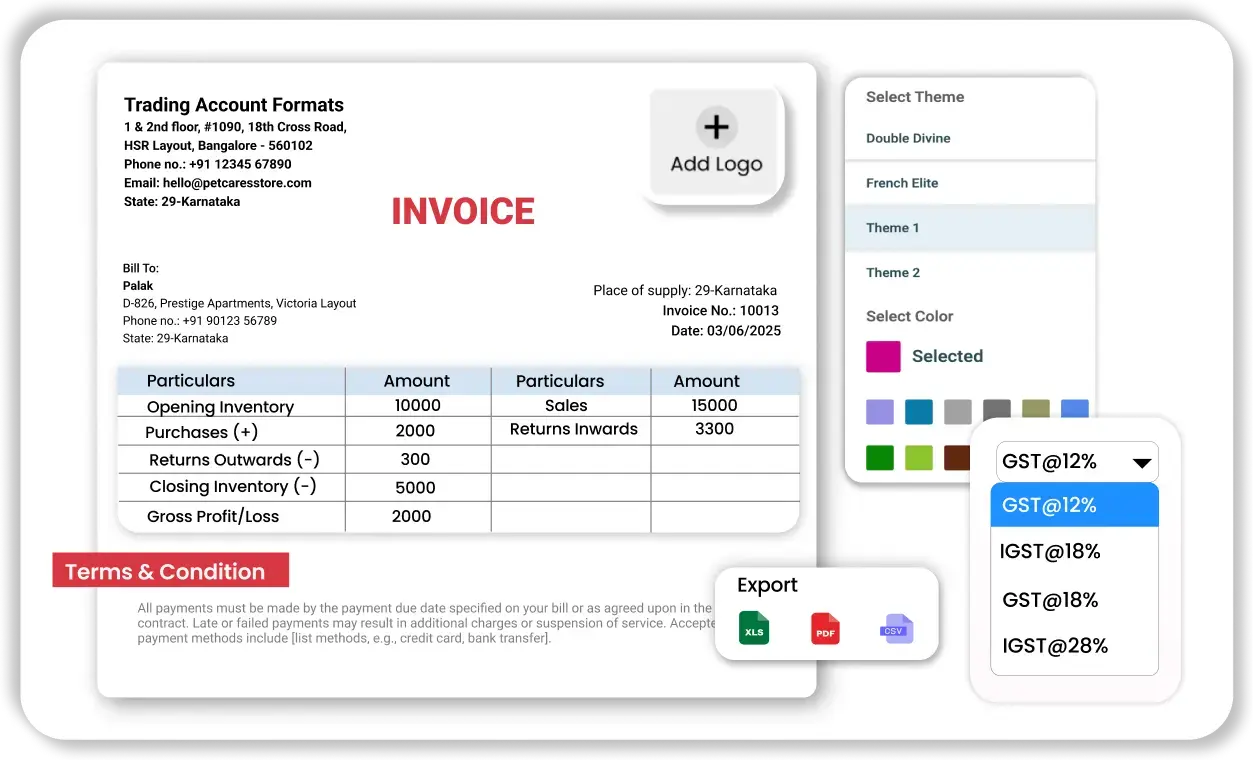

Why Settle for Manual When Vyapar Can Automate It?

What is a Debit Note Format in Excel

A debit note format in Excel is simply a template businesses use to create debit notes, which are handy documents for adjusting invoices when there’s a need for returns, overpayments, or correcting billing mistakes.

The great thing about using Excel for this is that it provides the flexibility to customise the format as you like. Whether it’s adding GST, amounts, or your company logo, you can easily adjust it all. Excel makes it super simple to edit and update as needed.

For many small businesses, it’s the perfect, cost-effective solution to keep things organised without needing to dive into more complicated or expensive software.

If you’re looking for different debit note formats, check out our Debit Note Format page for more options.

Key Components of Debit Note Format in Excel

Header Information

This includes the title “Debit Note,” the note number, issue date, and a reference to the original invoice for easy tracking.

Buyer & Seller Details

Add names, addresses, and GSTINs of both parties. Use separate rows or columns to keep this information organised.

Item Description Table

Create a structured table with columns for item name, quantity, rate, tax, and total. Use formulas for quick calculations

Total Amount Summary

Show subtotal, tax, and final payable amount in bold rows. This helps the recipient quickly understand the total charge.

Reason for Issuance

Add a short note or row explaining why the debit note is being issued—returns, pricing errors, or additional charges.

Authorization Section

Leave space for a digital or handwritten signature and company seal to validate and authenticate the debit note.

Benefits of Using Debit Note Format in Excel

From Format to Full Control — Explore Vyapar Now

How to Create a Debit Note in Vyapar

- Open the Vyapar App and go to the Purchase section.

- Tap on Purchase Return/Debit Return and click Create New.

- Select the Supplier (Party) from whom the items were purchased.

- Add the returned items, including quantity, rate, and applicable GST.

- Optionally, enter the reason for return in notes.

- Preview the debit note and then save it.

- Share or print the Debit Note via WhatsApp, Email, or Printer.

Vyapar Features That Go Beyond Simple Formats

GST Billing & Invoicing

- Create bills in seconds – Whether you’re GST registered or not, create professional invoices quickly with no technical knowledge.

- Add your business touch – Customise your invoices with logo, colours, QR codes, and UPI links for instant payments.

- Send instantly, anywhere – Share bills over WhatsApp, email, or print them on the spot for customers.

- Look pro, get paid faster – Clear, branded invoices reduce confusion and improve trust, helping you get paid quicker.

Inventory & Stock Management

- Know your stock anytime – Instantly see what’s in stock, what’s running low, and what needs restocking.

- Smarter tracking with barcodes – Scan and bill faster with barcode inventory management.

- No expiry surprises – Track MRP, batches, and expiry dates to avoid waste and sell smarter.

- Manage multiple stores easily – Transfer stock between godowns or branches without losing track; it’s all updated automatically.

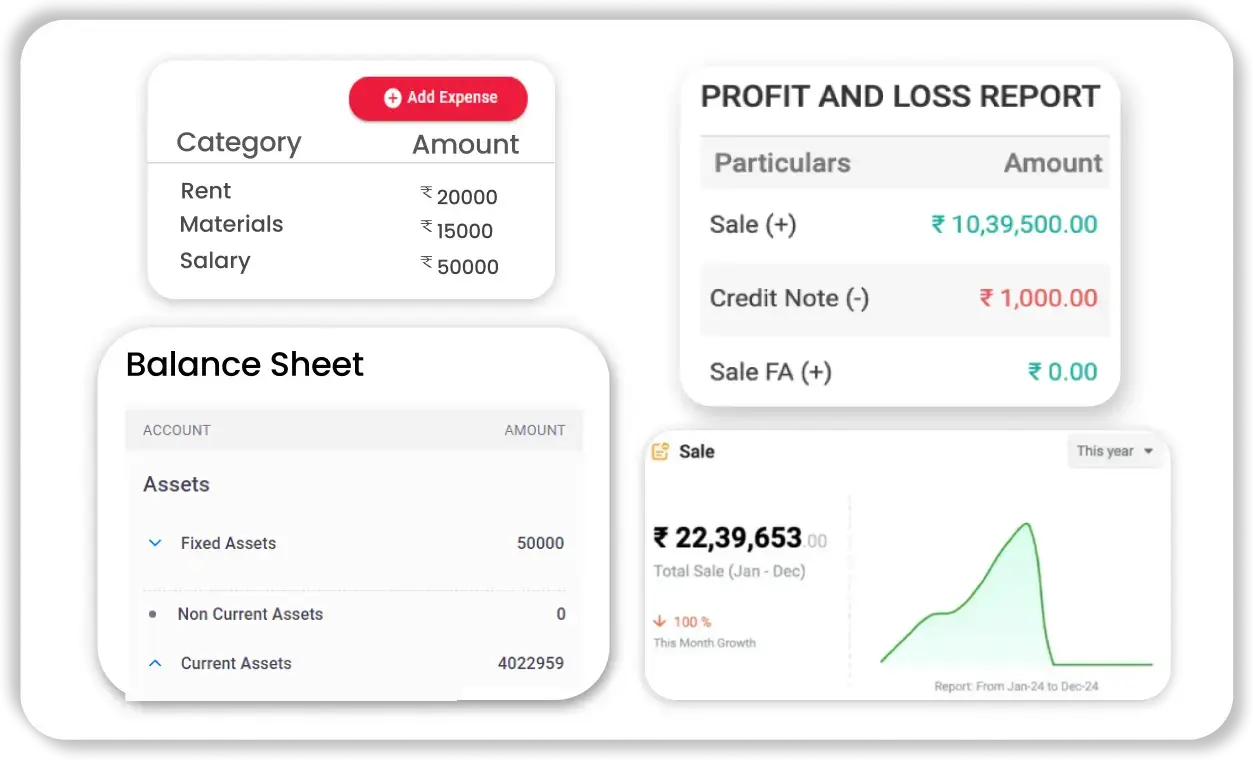

Business Reports & Financial Statements

- Instant business insights – See profits, losses, sales, and expenses at a glance, no accountant needed.

- Be GST-ready anytime – Generate GSTR-1, GSTR-3B, and GSTR-9 reports without complex calculations or stress.

- Track who owes you – Check outstanding payments and follow up confidently with data-backed info.

- Make smarter decisions – Know which items or customers are profitable and when it’s time to invest or scale.

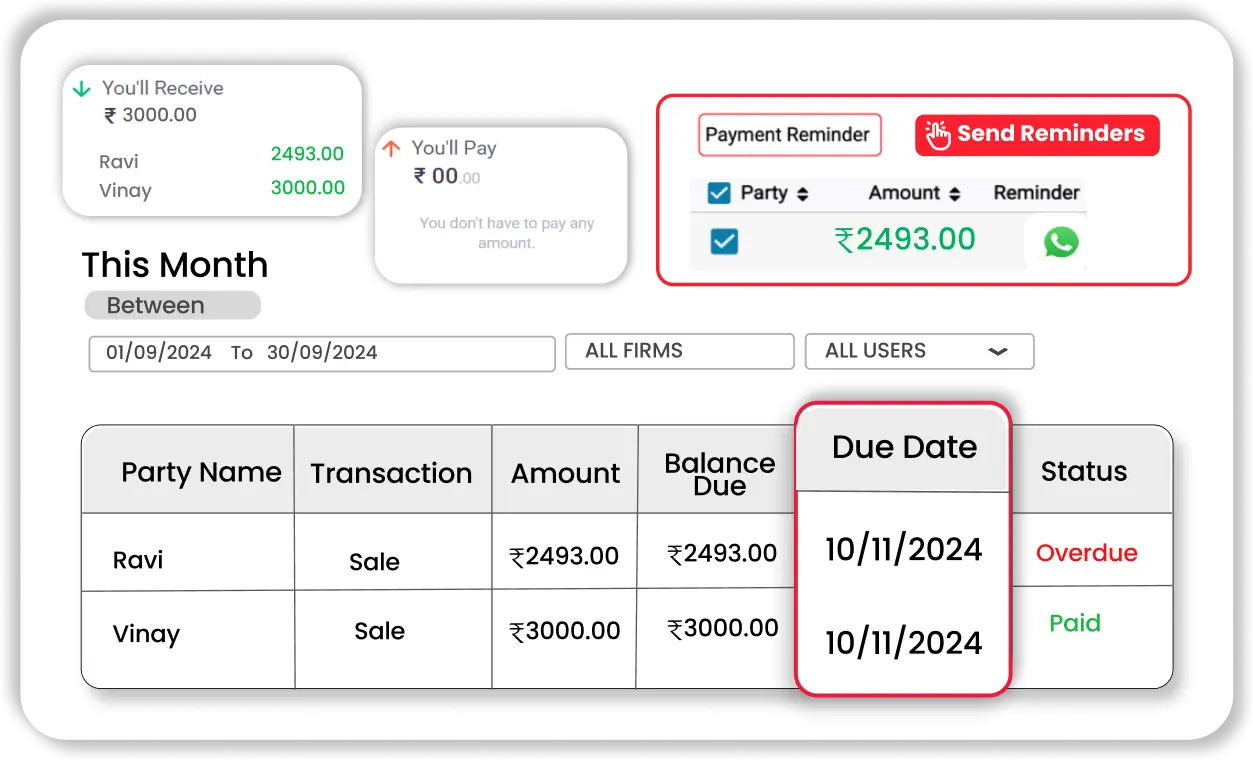

Payment Reminders & Tracking

- Set it and forget it – Add a due date once, and Vyapar reminds your customer automatically.

- No more awkward calls – Gentle WhatsApp or SMS reminders keep things professional and timely.

- Track every rupee – Know which invoices are unpaid, partially paid, or settled — no manual follow-up needed.

- Improve your cash flow – Timely payments mean more money in hand and less business stress.

Frequently Asked Questions (FAQ’s)

What is a debit note format?

When should I issue a debit note?

Is a debit note legally required under GST?

What’s the difference between a debit note and an invoice?

How do I create a debit note format that’s GST compliant?

What should be included in a debit note format?

Can a debit note be cancelled or modified later?

Can I use Excel or Word to create a debit note?

Is there a standard debit note format for small businesses?

Where can I download a professional debit note format?

What is a debit note, and when is it used?

Why should I use a debit note format in Excel?

Is the debit note format in Excel GST-compliant?

Can I customise the Excel debit note format with my logo and company details?

Does the debit note format in Excel support auto-calculation of totals and tax?

Is the Excel debit note template free to use?

Can I create a debit note directly in the Vyapar App?

How is Vyapar better than using a manual or Excel debit note format?

Does Vyapar App support GST-compliant debit notes?

Can I share debit notes with suppliers through WhatsApp using Vyapar?

Can Vyapar automatically adjust inventory after a debit note?