Cash Book App for Your Business

Efficient cash management is the backbone of any successful business. Whether you’re a small shop owner, a service provider, or a freelancer, tracking daily transactions is crucial for financial stability. That’s where a Cash Book App comes in – a modern, digital alternative to traditional registers. Among the top-rated options in India, Vyapar Cash Book App stands out with its simplicity, features, and reliability.

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

Main Features of a Cash Book App

Daily Cash Tracking

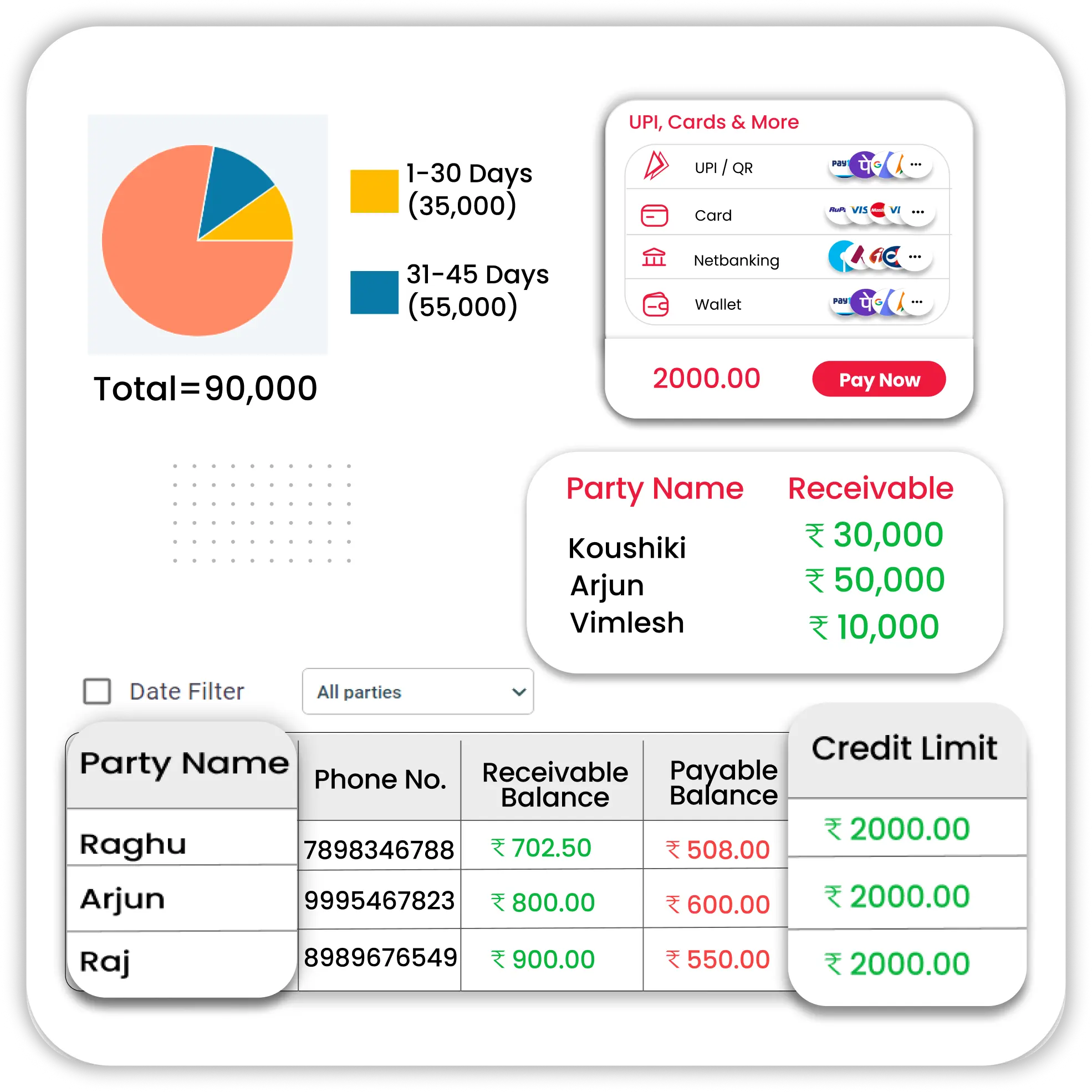

Track all daily cash inflows and outflows in a systematic and organized manner. With a digital cash book, you can log every transaction on the go, ensuring nothing slips through the cracks. The Vyapar Cash Book App allows real-time entry with instant balance updates.

Bank Account Integration

Link multiple bank accounts with your cash book to maintain a combined view of your finances. Whether it’s cash payments, bank transfers, or UPI transactions, the Vyapar app lets you manage it all from one place.

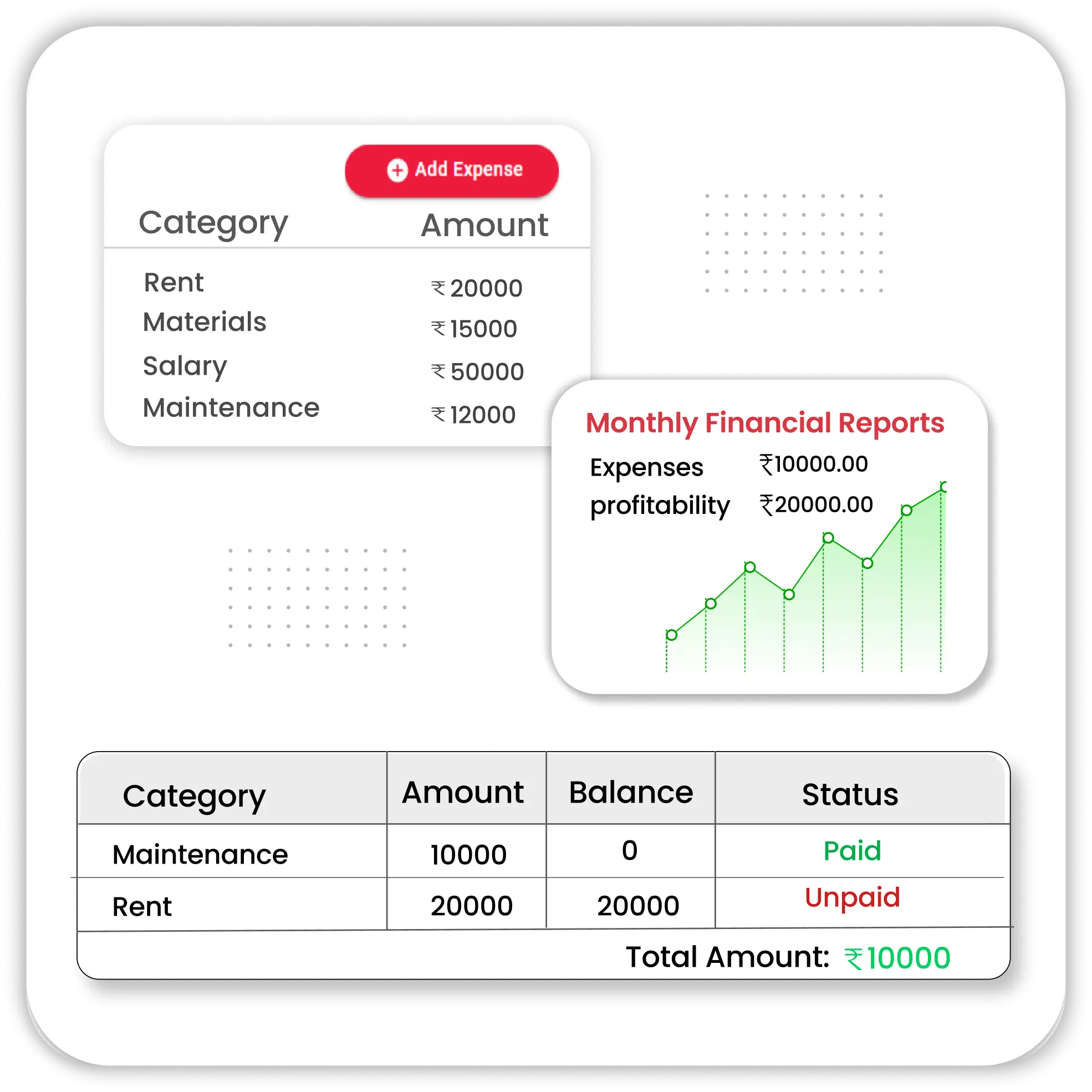

Expense and Income Categorization

Group your income and expenses under clear categories such as Rent, Utilities, Purchases, Salary, and Sales. Categorization simplifies report generation and helps you understand spending behavior, which is critical for business growth.

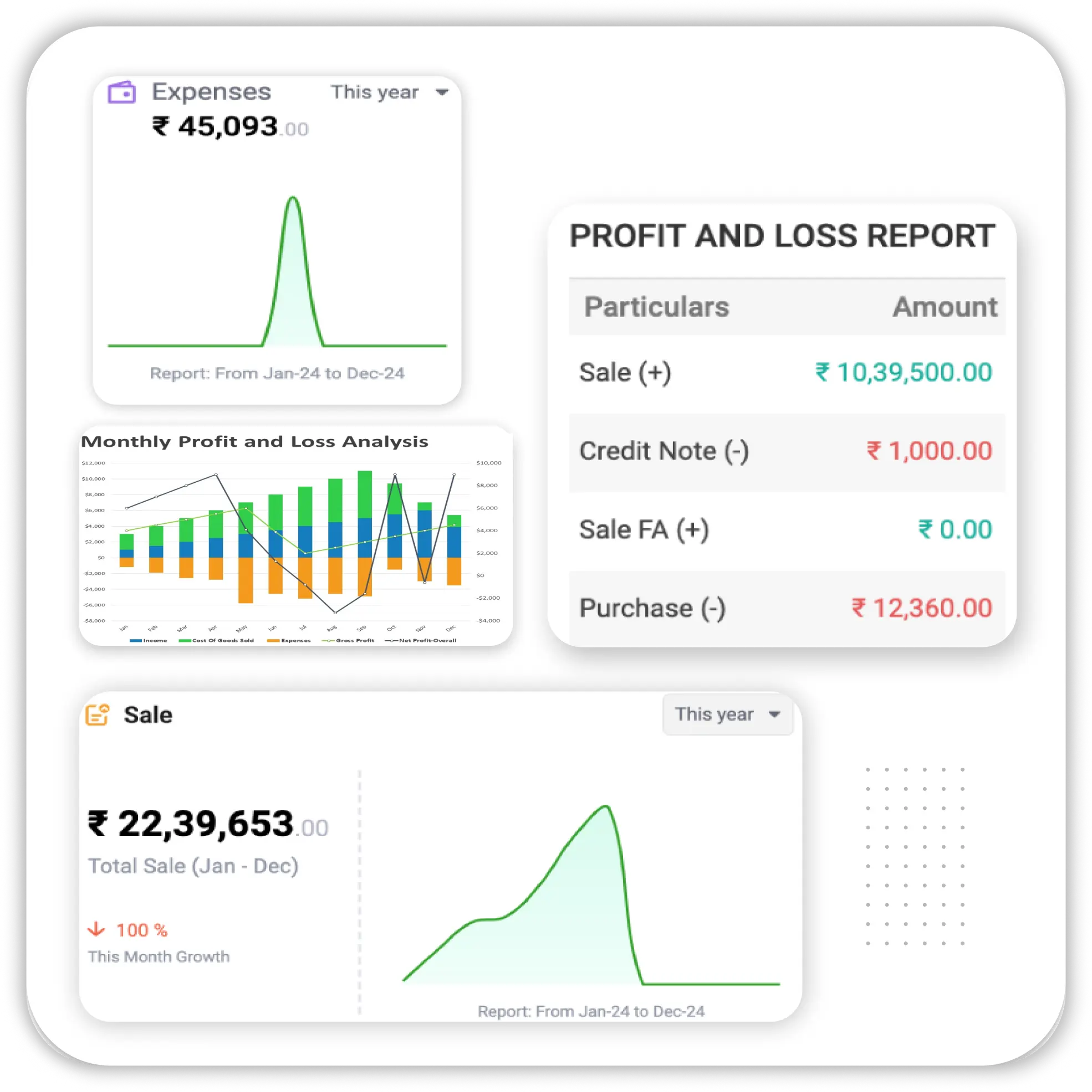

Real-Time Financial Reports

Generate cash flow summaries, profit and loss statements, and detailed transaction reports with one click. Reports update automatically as you enter transactions, giving you a live picture of your financial health.

Best Features of Vyapar Cash Book App

GST & Non-GST Billing

WhatsApp Sharing of Invoices & Reports

Automatic Backup & Data Security

Offline Mode with Sync Option

Credit/Payment Reminder Alerts

Cash Flow Summary & Reports

Why Vyapar is The Best Cash Book App for PC

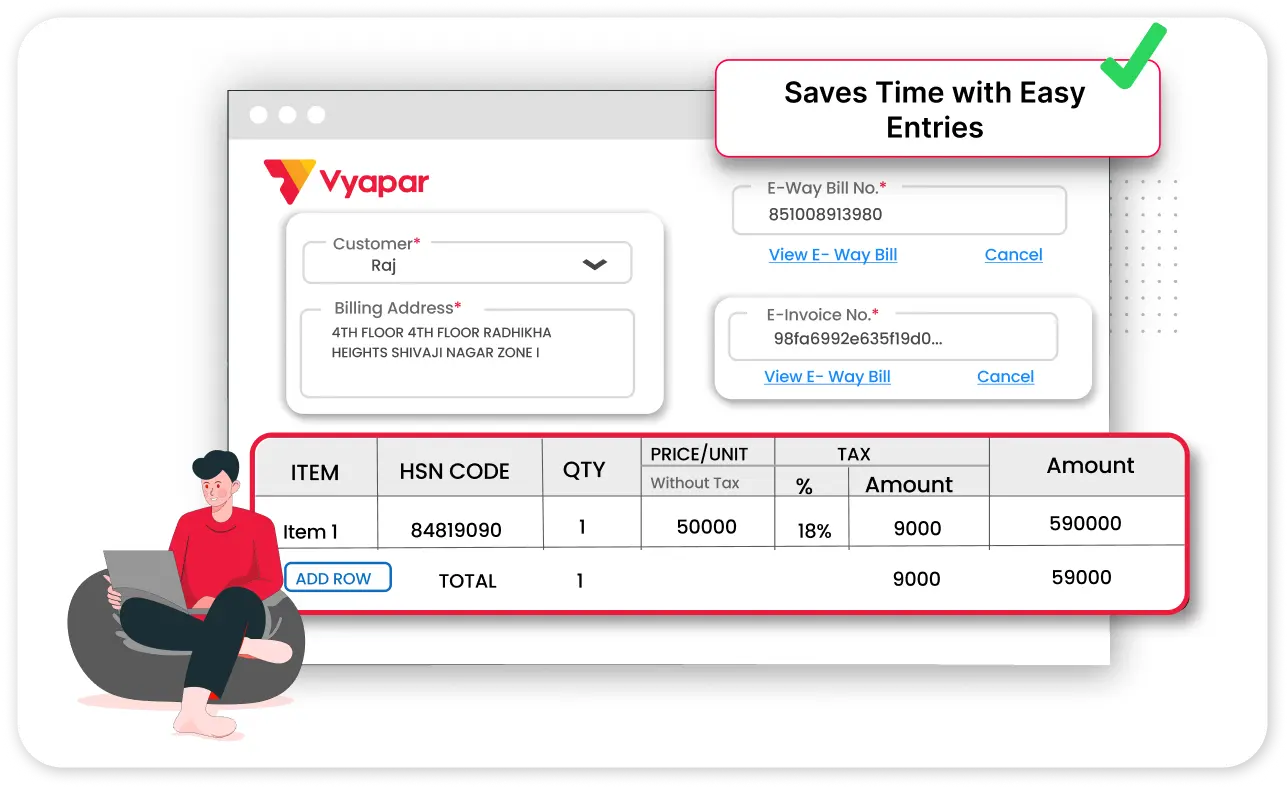

Saves Time with Easy Entries

Instead of juggling between registers and calculators, Vyapar provides a quick entry system that lets you log transactions in a few taps.

You can add descriptions, assign categories, and even attach images for proof. It drastically cuts down the time spent on manual bookkeeping and reduces daily workload.

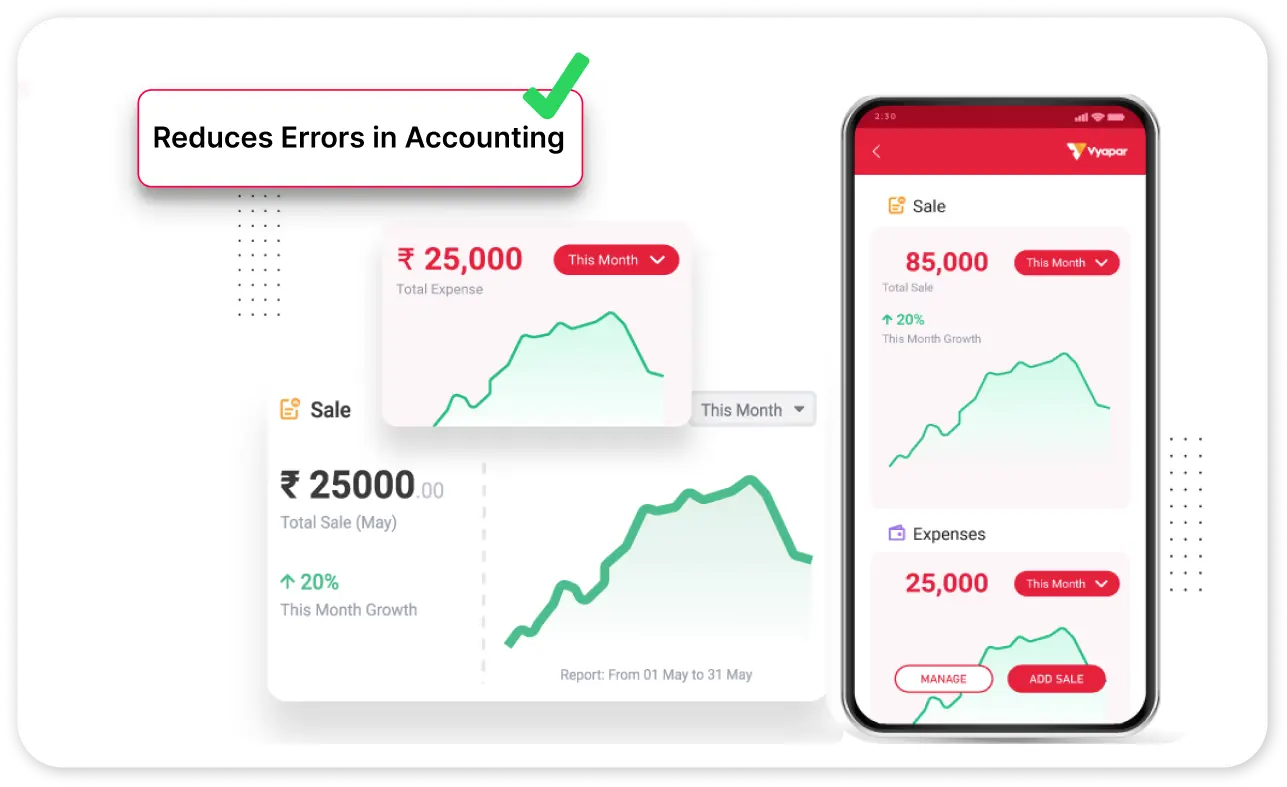

Reduces Errors in Accounting

Human error in manual calculations can lead to inaccurate records. Vyapar automatically calculates totals, balances, and summaries based on your entries.

You can even track corrections and audit trails, ensuring a transparent and reliable accounting process.

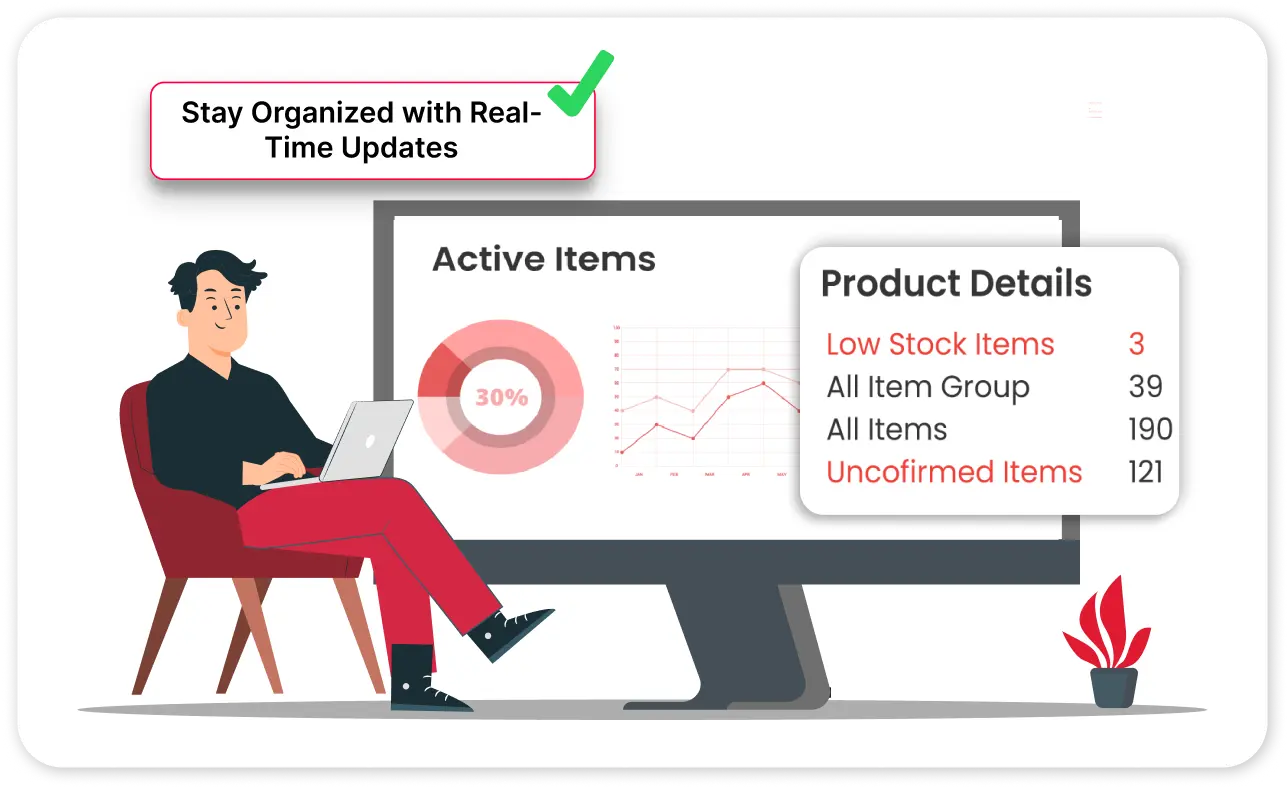

Stay Organized with Real-Time Updates

The app provides instant updates as you enter transactions. Whether it’s your closing balance or a pending payment reminder, Vyapar reflects real-time changes so you never have to second-guess your current cash position.

This accuracy is especially useful during audits or vendor negotiations.

Helps Track Cash Flow Easily

Vyapar’s graphical dashboards and summary reports help you visualize your cash movement. You can filter by date, transaction type, or category to understand exactly where your money is going.

This level of clarity allows you to manage spending and improve savings.

Avoid Late Payments & Missed Dues

The app not only tracks what you owe and what you are owed but also sends timely alerts.

You can customize reminder intervals, set due dates, and even automate follow-ups via WhatsApp or SMS. This feature helps maintain healthy business relationships and prevents late fees.

Access Anywhere, Anytime

Whether you’re at your store, traveling, or working remotely, Vyapar’s multi-platform support means you can use it on Android, desktop, and iOS (beta).

Your data stays in sync, allowing you to continue managing your business without interruption.

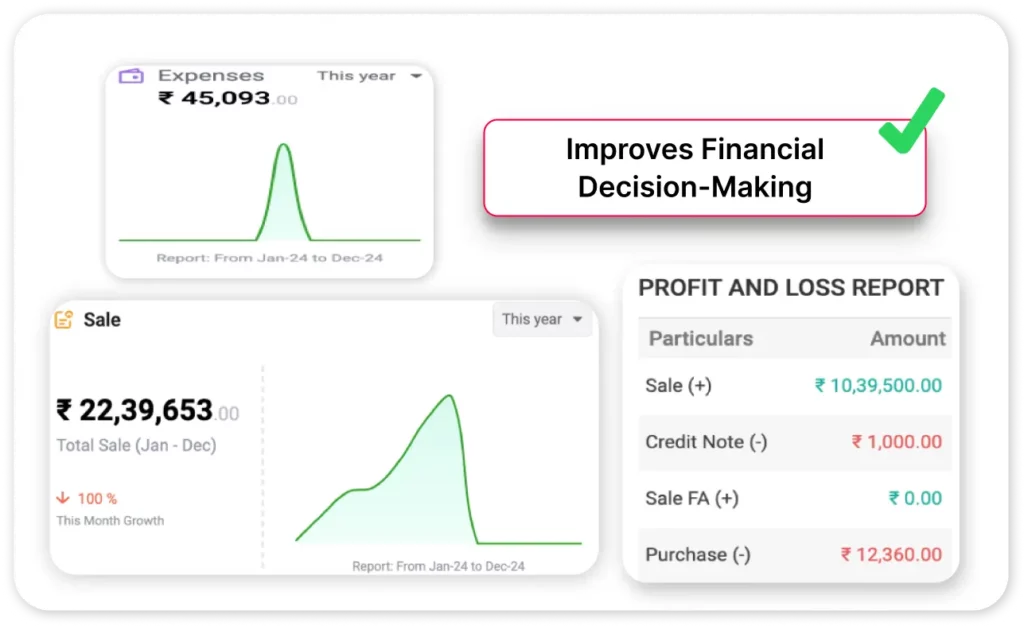

Improves Financial Decision-Making

With built-in reporting tools, you gain valuable insights into your business’s performance. Know your top expenses, profitable months, and high-paying customers.

This helps in setting budgets, negotiating better deals, and planning future investments with confidence.

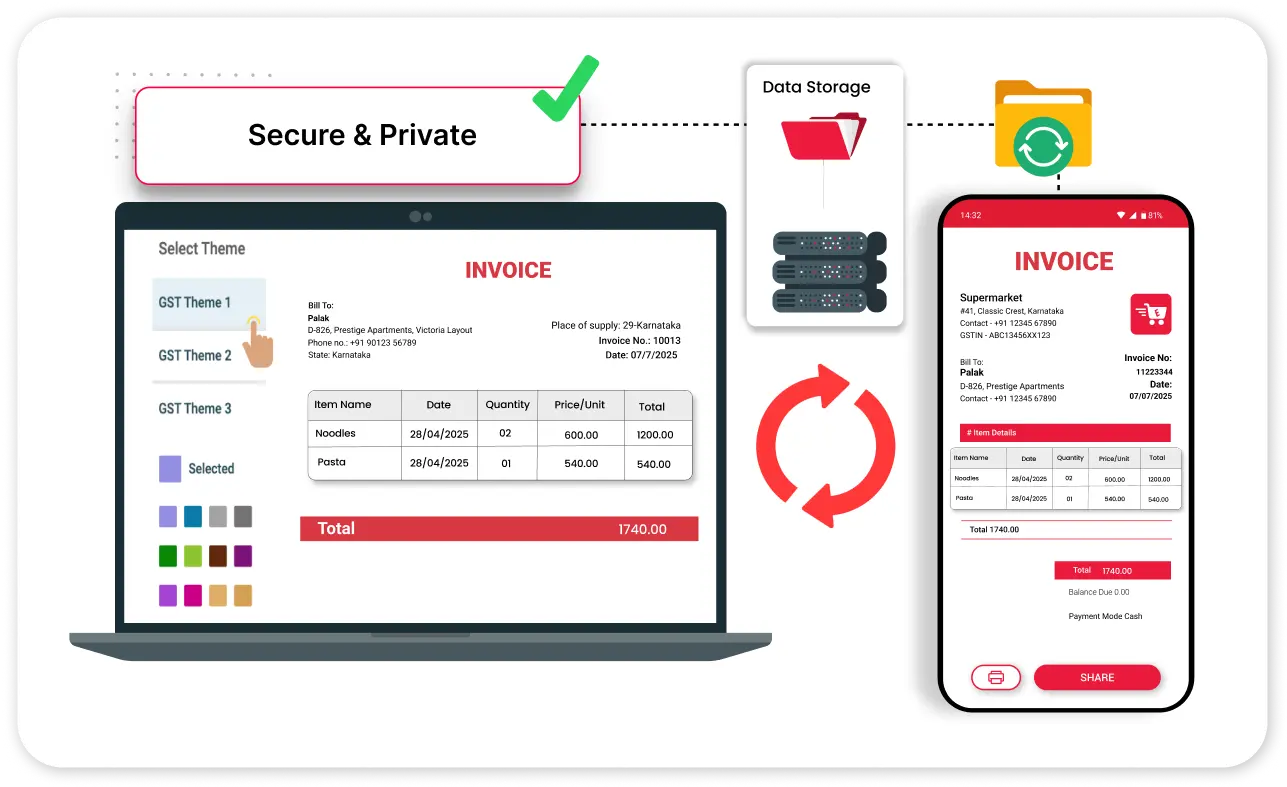

Secure & Private

Vyapar uses end-to-end encryption and local data storage to protect your sensitive financial information.

You can enable app locks, set up backup schedules, and even restrict access by role if your team uses the app. Your data stays in your control, always.

Works for All Businesses

From Kirana shops to mobile repair stores, freelancers to distributors, Vyapar’s cash book adapts to any business type.

You can customize fields, branding, and invoice types, ensuring it fits your workflow perfectly.

Free to Start, Scales with You

You can begin using Vyapar without spending a rupee. As your business grows, you can upgrade for advanced features like barcode billing, multi-user access, and full inventory integration—all at an affordable price.

Vyapar’s Growing Community

Take Your Retail Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

A Cash Book App helps track all your business’s cash and bank transactions. It replaces physical registers with a digital, more accurate method of record-keeping.

Yes, Vyapar supports both cash and bank entries. You can manage multiple bank accounts alongside your cash transactions.

Yes, Vyapar offers a free version with essential features. Advanced features are available in the premium plan.

Absolutely. Vyapar works without the internet and syncs your data when you’re back online. for the first time.

Yes. Your data is stored on your device and can be backed up to secure cloud storage with encryption.

Yes. Vyapar allows you to download and share reports in PDF or Excel formats via email, WhatsApp, or print.

You can generate Cash Flow, Balance Sheet, Profit & Loss, Expense Reports, and more.

Yes, Vyapar is ideal for both product and service-based businesses. You can create custom billing formats and expense types.