Excel Accounting Software

Make a move from spreadsheets to effortless accounting. Our software automates calculations and simplifies your financial reportings to help you to eliminate manual work, Improve accuracy and make better business decisions.

Key Features Of Vyapar Beyond Excel Accounting Software

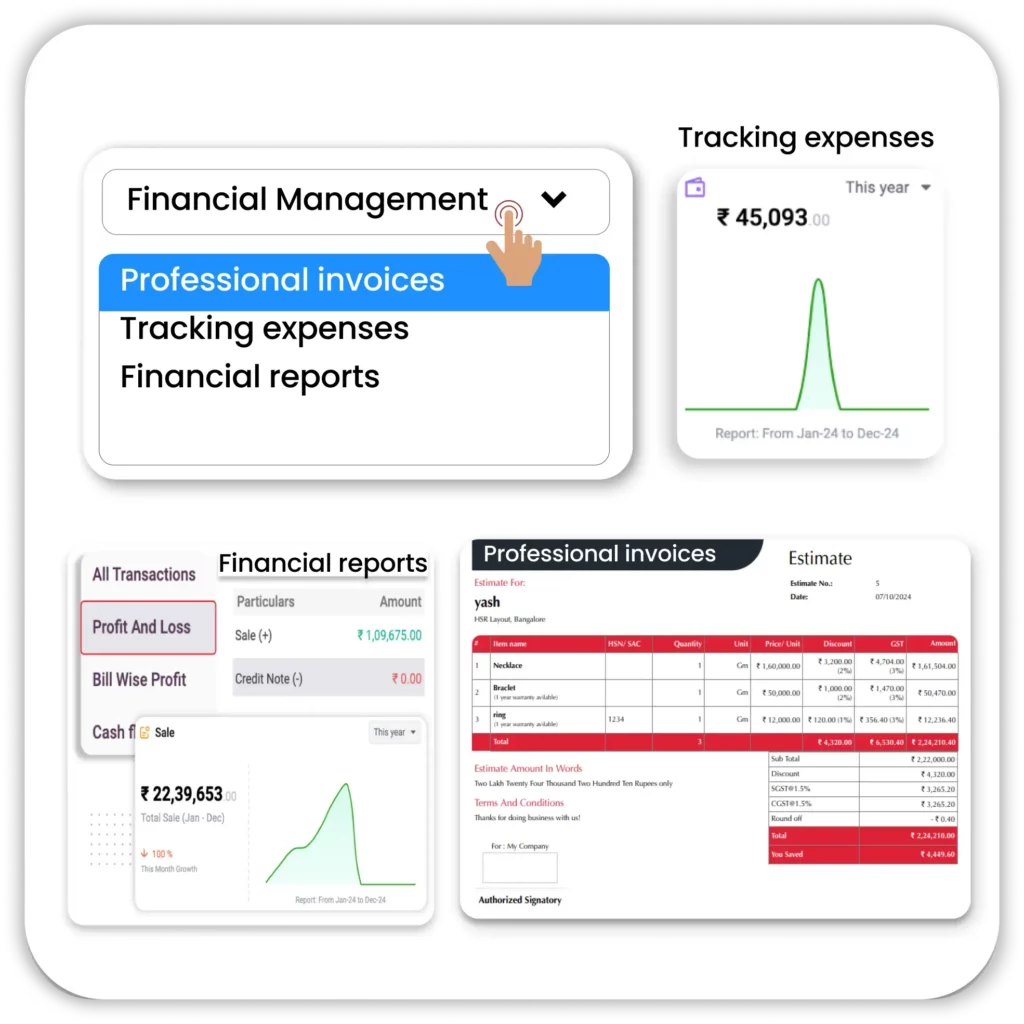

Complete Financial Management

Move beyond the limitations of Excel Accounting Software. Vyapar Accounting Software simplifies your business accounting by handling everything from professional invoices and expense management to quick reports for tax compliance.

- All-in-one Accounting: Manage Invoices, track expenses and all other financial reports all in a single place.

- Automated for Accuracy: Keep all the details in software once, and then reduce manual errors to keep all the data with accurate calculations without any manual work.

- Global & Tax Ready: It supports the local currency, so anyone can access this software from any place and customise taxes as per the requirement to reduce the effort for tax compliance across borders.

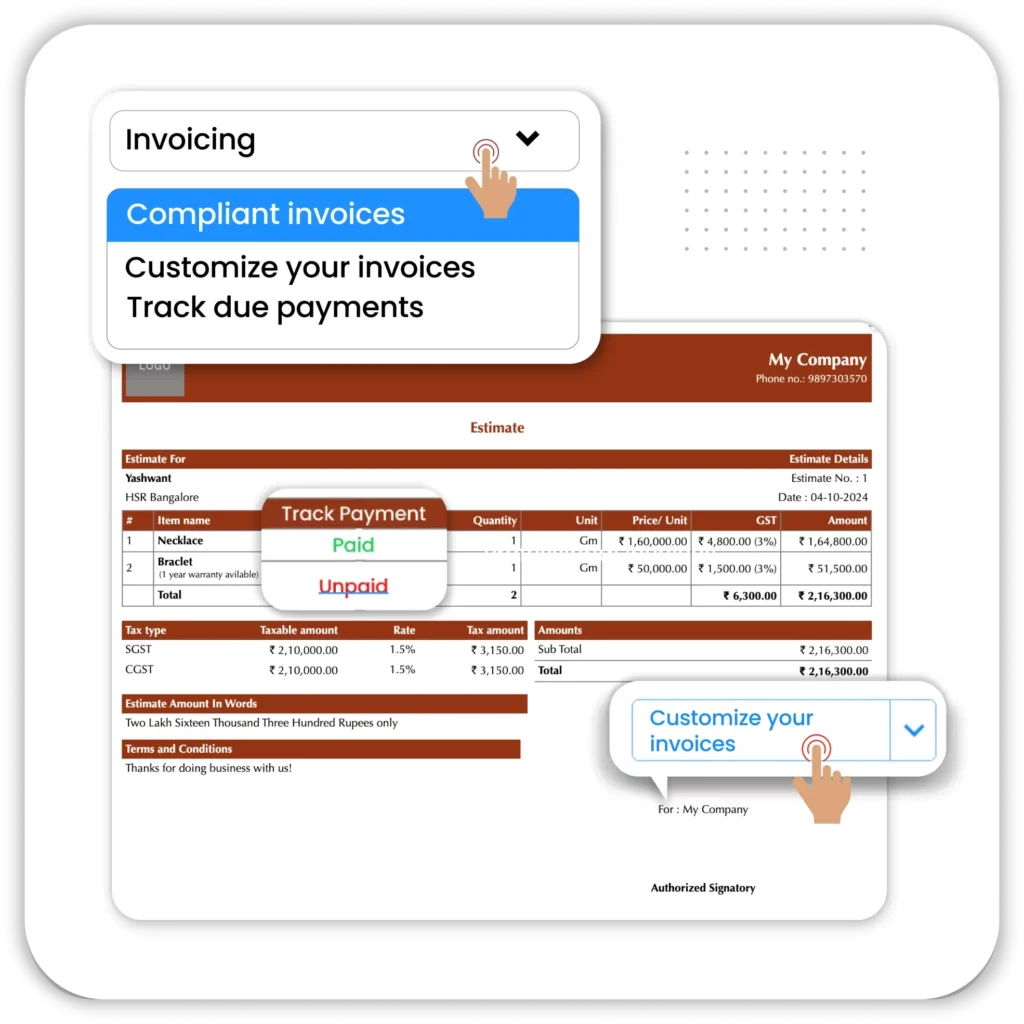

Simple and Automated Invoicing

Move beyond the payment tracking difficulties and calculation errors of XL accounting software. Vyapar billing system simplifies the entire process, letting you create invoices in a single click.

- Professional Invoice Creation: Generate GST and Non-GST compliant Invoices in just a few clicks with a quick, accurate and professional way with full customisation.

- Payment Tracking and Reminders: Keep a track of all the due payments and send friendly reminders to your customers without affecting the customer relationship.

- Error-Free Billing: All the billing and GST, and totals are done automatically. No need for further adjustments, without any errors bills are ready.

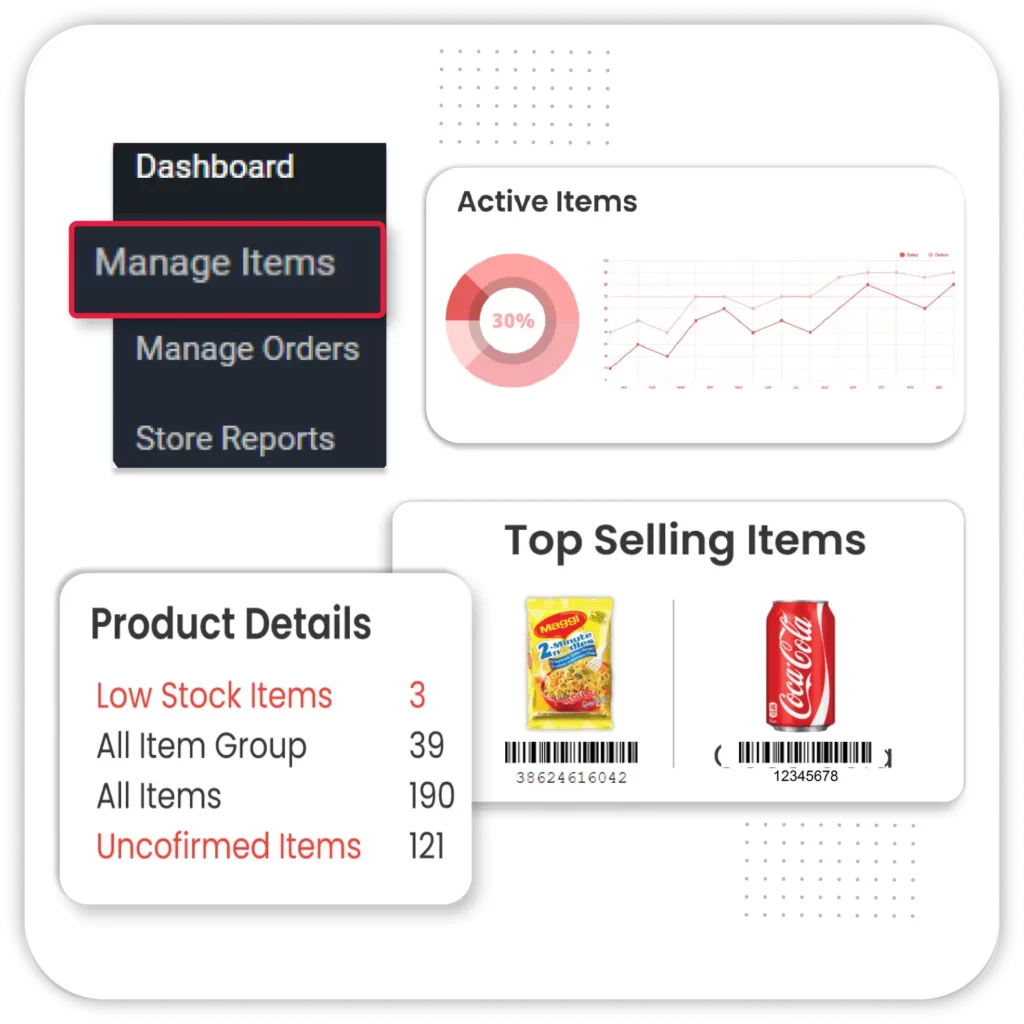

Complete Inventory Management

Managing inventory with Excel bookkeeping software is a difficult and time-consuming task for Indian business owners. Shift to Vyapar Inventory Management Software to simplify your tasks and avoid errors from manual stock updates.

- Automatic Stock Updates: For every sale and purchase entry in Vyapar, stock will be automatically updated on a real-time basis. If damages and losses are made, adjustment entries in a few clicks.

- Low Stock Alerts: Always stay informed about low stock and receive an instant alert when the stock reaches the minimum item quantity. Reorder the items timely manner to avoid stockouts and fulfil customer needs.

- Detailed Tracking & Reports: Monitor item movements, categorise according to your needs and get more insightful reports like fast-moving and slow-moving goods.

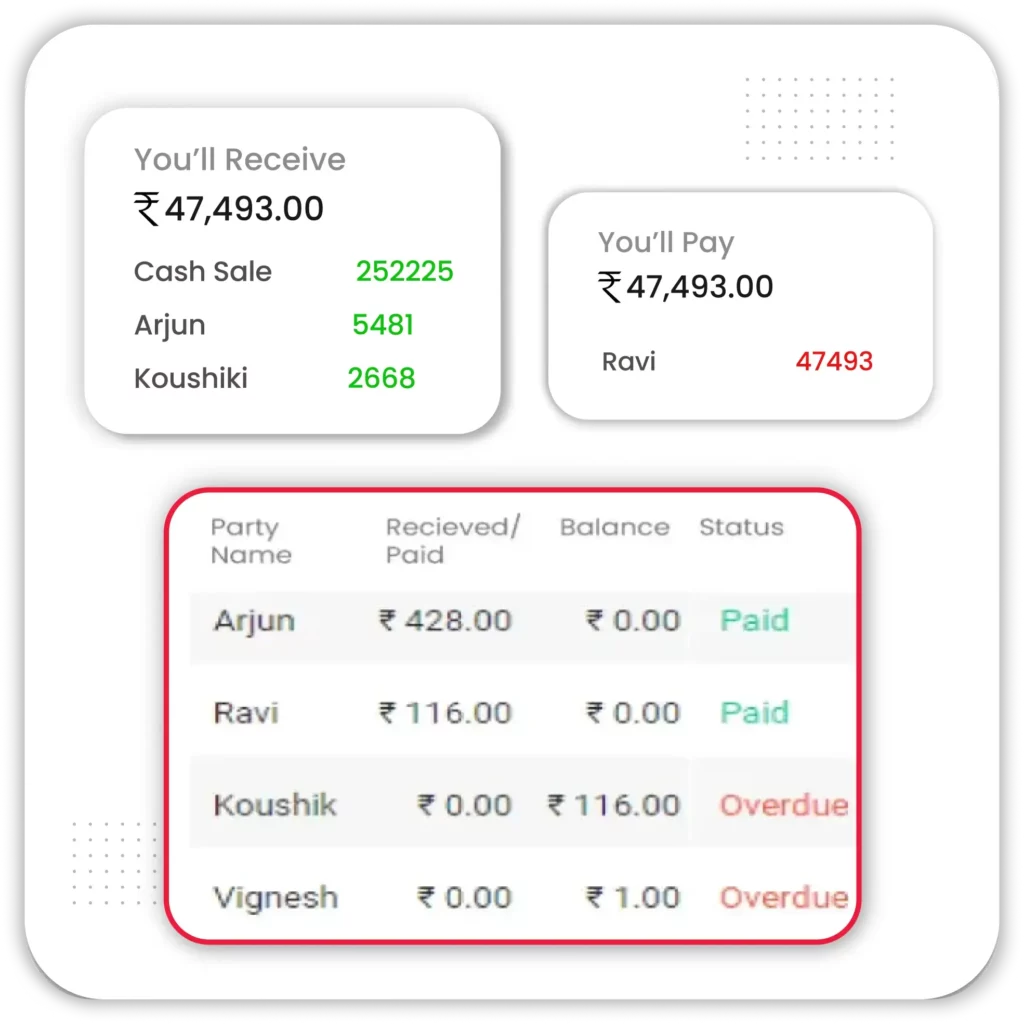

Manage Receivables & Payables

Tracking receivables and payables can be tough in XL Accounting Software. This is actually true when your business expands and has many daily transactions. Start using Vyapar Accounting software to track what you are owed and what you owe.

- Transaction Overview: Get the complete picture of your unpaid invoices, your pending payments and partial balances in real time.

- Accurate Accounting: Record double entries and journal entries whenever needed for the payment adjustments to keep your books accurate and precise.

- Faster Collections: Use Vyapar payment reminders, check histories and sales ageing reports to collect payments on time and monitor a healthy cash flow for your business.

Vyapar Accounting Software VS Excel Accounting Software

Features

Excel Accounting

Accounting Software

Financial Reports

Automation Capabilities

Data Backup

GST Compliance & Tax Filing

Mobile App Support

Ease Of Use

Manual formulas, no guided UI

User-friendly interface for all skill levels

User Collaboration

No multi-user support or real-time sharing

Real-time collaboration

Invoicing Customization

No native templates or branding options

Fully customizable invoices with templates

Invoice Sharing & Follow-ups

Manual sharing, no reminders

One-tap sharing via WhatsApp/SMS with auto follow-up reminders

Time Savings

Manual processes take time and slow productivity.

Vyapar automates tasks, saving time and increasing efficiency.

Why Vyapar Is the Ideal Choice Over Excel Accounting Software

All-in-One Accounting

Vyapar App combines invoicing, Expense tracking, Inventory management and all reporting in one place. It saves your time, reduces errors and keeps all financial data in well well-organised way.

Real-Time Accuracy

Excel requires manual entries that are error-prone, while Vyapar automates updates and calculations for every transaction, keeping your books accurate without any complex formulas or coding.

Professional and Fast Invoicing

Create GST and non-GST invoices in just a few clicks, customise them with your logo and brand details, and share instantly via WhatsApp. This saves hours of manual work.

Inventory Management

Track stock in real time, set low-stock alerts, and categorise products with ease. With Vyapar, you don’t need extra sheets. You can avoid both overstocking and stockouts.

Automated Tax Compliance

Vyapar App keeps you updated with the latest GST rules and handles all tax calculations automatically. You can generate GST reports instantly and file your GST return without any errors.

Dedicated Customer Support

Get the experts’ help whenever you’re needed through WhatsApp, Call or Email Support. Vyapar’s support team helps you to resolve your queries quick and effective way to make sure your business runs smoothly.

Secure Data Backup

Excel files risk corruption and data loss, but Vyapar keeps your business data safe with encrypted cloud backups that are always restorable.

Accessible Anytime, Anywhere

Access your business data from a desktop or a mobile from any place, wherever you are. Multiple members can work without any conflicts with user role-based access.

Better Financial Insights

Generate real-time reports like Profit & Loss, Cash Flow, and Balance Sheets with Vyapar. It gives you a clear view of your business health for smarter decisions without any rough calculations.

Upgrade from Excel to Smarter Accounting

Automate calculations, reduce errors, save time, and manage finances with Vyapar – choose the plan that fits your workflow.

Free (Mobile)

₹0/month

Perfect for getting started

![]() Audit Trial

Audit Trial

![]() GSTR Reports

GSTR Reports

![]() Expense Tracking

Expense Tracking

![]() 1 Firm/Organisation

1 Firm/Organisation

![]() Invoice & Bill Creation

Invoice & Bill Creation

Silver Plan

₹283/month

Billed annually + GST@18%

Great for Small Businesses

![]() Everything in Free plan

Everything in Free plan

![]() 3 Firm/Business

3 Firm/Business

![]() Multi Device Sync

Multi Device Sync

![]() Fixed Assets

Fixed Assets

![]() WhatsApp Integration

WhatsApp Integration

![]() Import Parties

Import Parties

![]() Share with CA

Share with CA

Most Popular

Gold Plan

₹308/month

Billed annually + GST@18%

Most popular for Growing Businesses

![]() Everything in Silver plan

Everything in Silver plan

![]() 5 Firm/Businesses

5 Firm/Businesses

![]() Service Reminders

Service Reminders

![]() Journal Entries

Journal Entries

![]() Chart of Accounts

Chart of Accounts

![]() Account Statement

Account Statement

![]() Accountant Access

Accountant Access

Platinum Plan

₹833/month

Billed annually + GST@18%

Popular for Large Businesses

![]() Everything in Gold plan

Everything in Gold plan

![]() Add Unlimited Businesses

Add Unlimited Businesses

![]() Complete Party Management

Complete Party Management

![]() Comprehensive Reports

Comprehensive Reports

![]() Marketing Tool Access

Marketing Tool Access

![]() Import/Export Data (Tally)

Import/Export Data (Tally)

![]() Priority Customer Support

Priority Customer Support

Most Important Features of Excel Accounting Software

If you are planning to manage your business with an accounting excel sheet or an Offline Excel Accounting Software, there are several core features that every small business needs. To help you get started, you can try our free and downloadable accounting templates:

Bookkeeping and Transactions Management:

Create a professional document of your business records easily in Excel.

General Ledger

This is a master data entry log where you need to enter all business transactions, such as sales, purchases, payments in and out, as they occur.

Chart of Accounts

This is a list that organises all your financial accounts into categories, such as cash, Bank Account, sales revenue, and any other business expenses.

Reconciliation

A process where you need these reconciliation statements to compare with the actual data. Like Bank reconciliation, Audit, etc.

Sales & Invoicing

Creating professional documents for your customers is Easy and simple in Excel

Invoice Creation

Create professional invoices with your company logo, business details and terms with our pre-defined templates without any calculations.

Estimates and Quotation

Generate and share the quotations and estimates to clients with attractive prices, with a simple and attractive template.

Credit and Debit Notes

Issue the credit and debit notes to manage any returns or refunds and any price adjustments after an Invoice has been created in a freely defined template.

Financial Reporting

Generate the most important financial reports and snapshots for your business using the templates below

Profit and Loss Statement

This report will give a clear picture of revenues and expenses for a particular period to calculate your business’s net profit or loss.

Balance Sheet

Create a snapshot of your company’s financial health at a single point with a listing of all the assets, liabilities and equity with a predefined format.

Cash Flow Statement

Log all the money coming in and going out of your business to track the flow of cash and understand the liquid cash in your hand.

What Customers are Talking About Vyapar’s Accounting Software?

Has saved me cost of accounting, given a professional touch to my transactions and helped me focus more on business.

Deepak

(Small Business Owner)

Source: Capterra

For my small business I’m using Vyapar. It’s very simple and can be used by anyone who doesn’t have accounting knowledge.

Abdul kader

(Fine Art, Owner)

Source: Capterra

All the business transactions are done by Vyapar. I don’t need to carry account books or ledgers.

Sanjay

(Food & Beverage Business)

Source: Capterra

Still not sure? Download for Free and see the difference in your accounting process!!

Frequently Asked Questions (FAQs’)

Yes, Vyapar allows you to seamlessly import your existing Excel accounting program data, making the transition from spreadsheets hassle-free. You can easily import your customer lists, product details, and past transactions. This makes moving to the Vyapar app smooth and efficient.

Not at all! Vyapar is designed with user-friendliness in mind. Its intuitive interface and clear workflows make it easy to learn, even for those accustomed to Excel. Plus, Vyapar offers comprehensive onboarding resources and dedicated customer support to ensure a smooth transition.

Absolutely. Vyapar offers a range of customisation options, allowing you to tailor the app to your unique business requirements. You can customise invoices, create personalised reports, and even set up specific workflows to match your accounting processes.

Vyapar takes data security seriously. We store your financial information securely in the cloud using robust encryption and access controls. Automatic backups protect your data against loss or damage and provide you with peace of mind.

Yes, Vyapar has a mobile app. It lets you access your accounting data and do important tasks from your smartphone or tablet. Whether you’re in the office, on the go, or at a client meeting, you can stay connected to your business finances with Vyapar.

Vyapar provides comprehensive onboarding resources, including tutorials and guides. It can help you start fast. Additionally, our dedicated customer support team is available to answer your questions and provide assistance whenever you need it.

Excel may be free, but there are hidden costs. Manual errors, lost productivity, and compliance issues can add up. Vyapar offers affordable pricing plans that provide exceptional value, especially when considering the time savings, improved accuracy, and enhanced decision-making capabilities they provide.

Yes, there are several options for GST accounting software in Excel for free download. However, they often require manual data entry and updates. For more automation and ease, you might consider transitioning to a dedicated accounting software like Vyapar.

Yes, you can find Vyapar small business accounting software in Excel available online. It can help you track income, expenses, and GST. However, you will get more advanced accounting options in Vyapar, which provides automation and real-time updates.

Using Excel-based accounting software in India can be limiting due to the lack of automated features for GST compliance, invoicing, and inventory management. While an Excel-based accounting software India free download might seem convenient, it often requires manual updates, increasing the chance of errors.

When comparing Excel vs accounting software, Excel offers flexibility but requires manual input for most tasks. On the other hand, dedicated accounting software like Vyapar automates many functions like GST filing, inventory tracking, and invoice generation, saving time and reducing errors.

Yes, you can download Vyapar, free Excel accounting software with basic plus advanced GST features. However, Vyapar Excel accounting software offers advanced features, such as automated GST reports and integrated inventory management, compared to Excel.

Using Excel-based accounting software in India can be limiting due to the lack of automated features for GST compliance, invoicing, and inventory management. While an Excel-based accounting software India free download might seem convenient, it often requires manual updates, increasing the chance of errors.

There are many complete accounting software in Excel templates available, but they often lack automation. Most tasks like GST calculations, payment tracking, and report generation need to be done manually. For a more efficient system, Vyapar provides a fully automated solution that handles all these tasks effortlessly.

Yes, you can use accounting tools in Excel, but it may require manual setup and regular maintenance. For small businesses, free business accounting software in Excel can be a starting point, but it might not scale well as your business grows. Vyapar offers a better long-term solution.

There are several sources for a simple accounting system in Excel available for free download. However, these systems often require manual intervention. A dedicated accounting software like Vyapar simplifies this by automating key tasks, including invoicing, GST filing, and inventory management.

Yes, free accounting software in Excel format is available online, but keep in mind that it lacks the automation and advanced features of software like Vyapar Excel-based accounting software. While these templates help with basic accounting tasks, they require manual updates for GST compliance and inventory management.

Yes, you can use Excel-based accounting software templates to manage inventory, but this requires manual data input and updates. For more efficient inventory tracking with real-time updates, consider using Vyapar, which offers integrated inventory management alongside accounting and billing features.

Vyapar simplifies daily accounting far beyond what Excel can offer. While Excel requires manual data entry and constant updates, Vyapar automates tasks like invoicing, expense tracking, and GST calculations. With Vyapar, you can manage your daily transactions seamlessly without the errors and limitations that come with using Excel for accounting.

Using cracked accounting software is risky and can lead to data breaches, security issues, and unreliable performance. Cracked software often lacks important updates, security patches, and customer support. With Vyapar, you get a secure, regularly updated accounting solution with features like GST compliance, inventory management, and customer support, ensuring your business data remains safe and your operations run smoothly. It’s always better to invest in legitimate, trusted software like Vyapar.

Creating the basic accounting system in Excel from the beginning involves a few steps shared below:

Set-up Worksheets: Create separate sheets for the Chart of Accounts, General Ledger, and transaction logs of sales and purchases.

Use of Formulas: Use formulas like Sum, SUMIF, Vlookup, and Pivot Tables

Design Templates: Create a well-looking professional template for invoices and quotations that can get the Data from other sheets.

While creating this requires Strong Excel skills and Time to build it. For a ready-made template, use our free templates with all these requirements.

The Best Excel Accounting Template for small businesses is the one that is simple and Easy to use, and it includes pre-built formulas for the calculations. It should have at least:

A General Ledger for transaction entries.

A chart of accounts to categorise your finances.

Professional and well-looking invoice & Quotation Templates

Formulas and calculations

Pre-defined sheets for P&L Reports and Balance Sheet.

The templates that we have provided offer all these requirements and are specifically designed for Indian small and medium businesses.

Yes, you can create a balance sheet and a profit & loss (P&L) statement in Excel. But the process is complicated and completely manual. You have to design the report completely yourself with complex formulas to pull the data from your transactions. These reports are not in real time; you have to update the data whenever you need and recalculate them again, which can be time-consuming and lead to errors.

Basic bookkeeping in Excel follows a simple, manual process:

Establish a Chart of Accounts: First, create a list of all your financial categories (e.g., Sales, Rent, Supplies).

Create a Transaction Log: Use a separate sheet as your general ledger to record every single transaction. Each entry should include the date, a description, the amount, and the relevant category from your Chart of Accounts.

Summarise Data: Regularly use formulas or pivot tables to summarise your transaction data into financial reports.

Reconcile Accounts: Manually compare your spreadsheet records against your bank statements to ensure everything matches.