GSTR-1 Format in Word, Excel, PDF

Facing issues with the GSTR-1 format? Download ready-to-use GSTR-1 format in Excel, PDF, and Docs from Vyapar app and file your returns effortlessly. Start your free trial today!

- ⚡️ Create professional return filing with Vyapar in 30 seconds

- ⚡ Share GSTR reports automatically on WhatsApp and SMS

- ⚡️ Connect with parties via reminders, greetings, business cards, and more

GSTR-1 Format Vs Vyapar App

Features

GSTR-1 Format

Auto-filled invoice data

GSTIN auto-verification

Smart HSN Code suggestions

Multi-Device Access

Real-time inventory sync

Bulk upload of B2B/B2C invoices

Multi-business profile support

Tax calculation automation

User-friendly interface

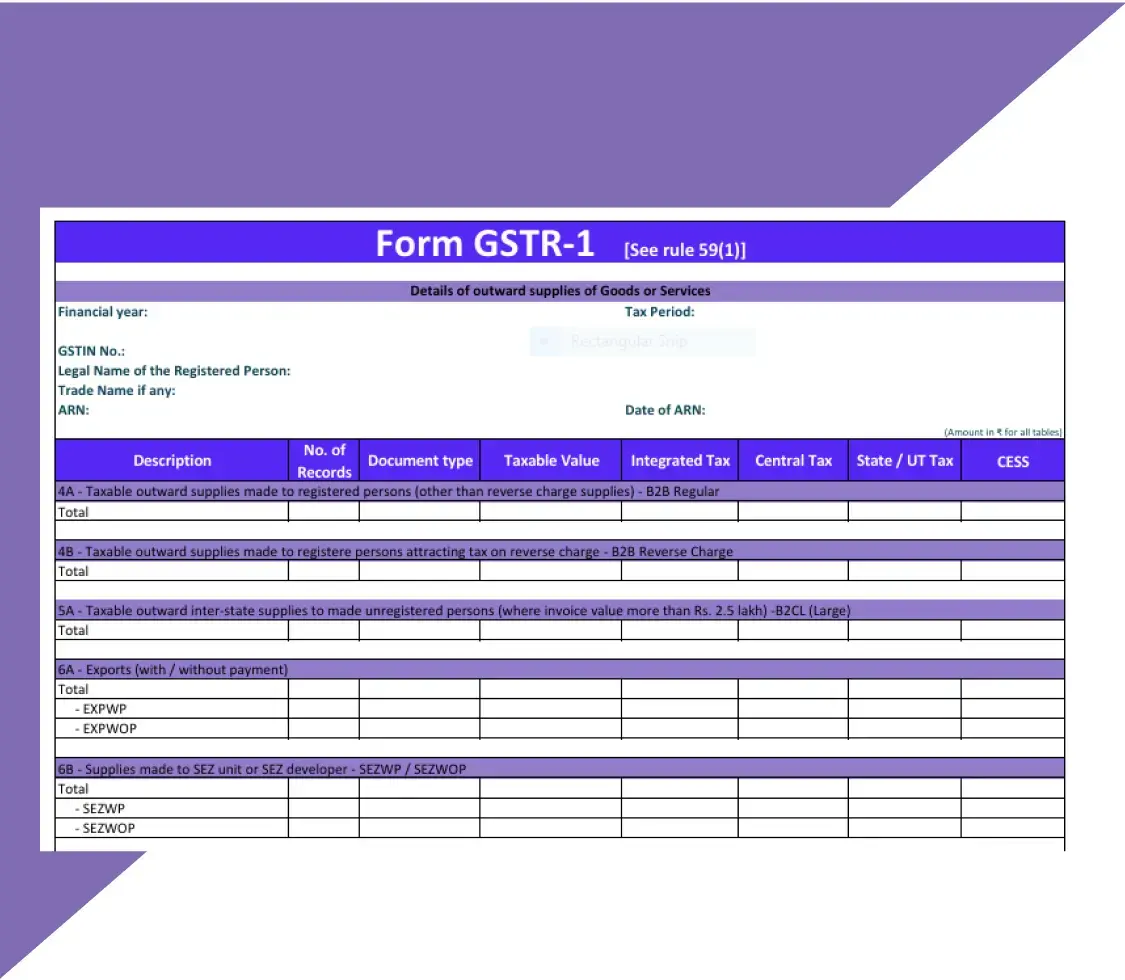

Download Free & Easy-to-Use GSTR-1 format in Excel, Word, PDF

Download GSTR-1 format in Excel, Word, and PDF to file your GST returns accurately and stay compliant with the latest government guidelines—free of cost.

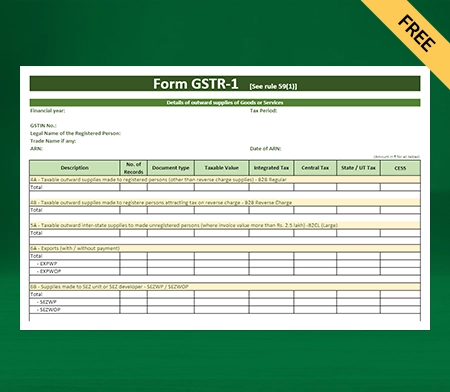

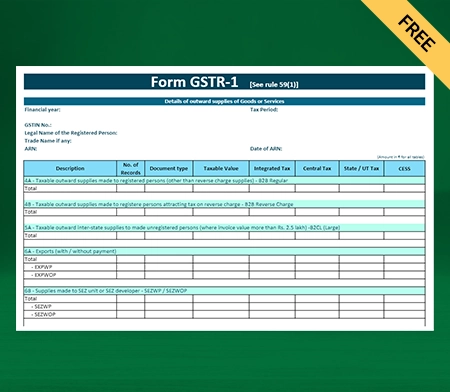

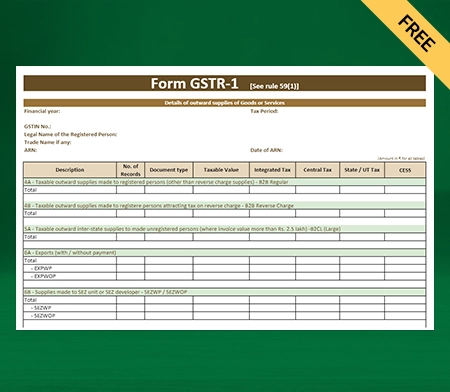

GSTR-1 Format – 1

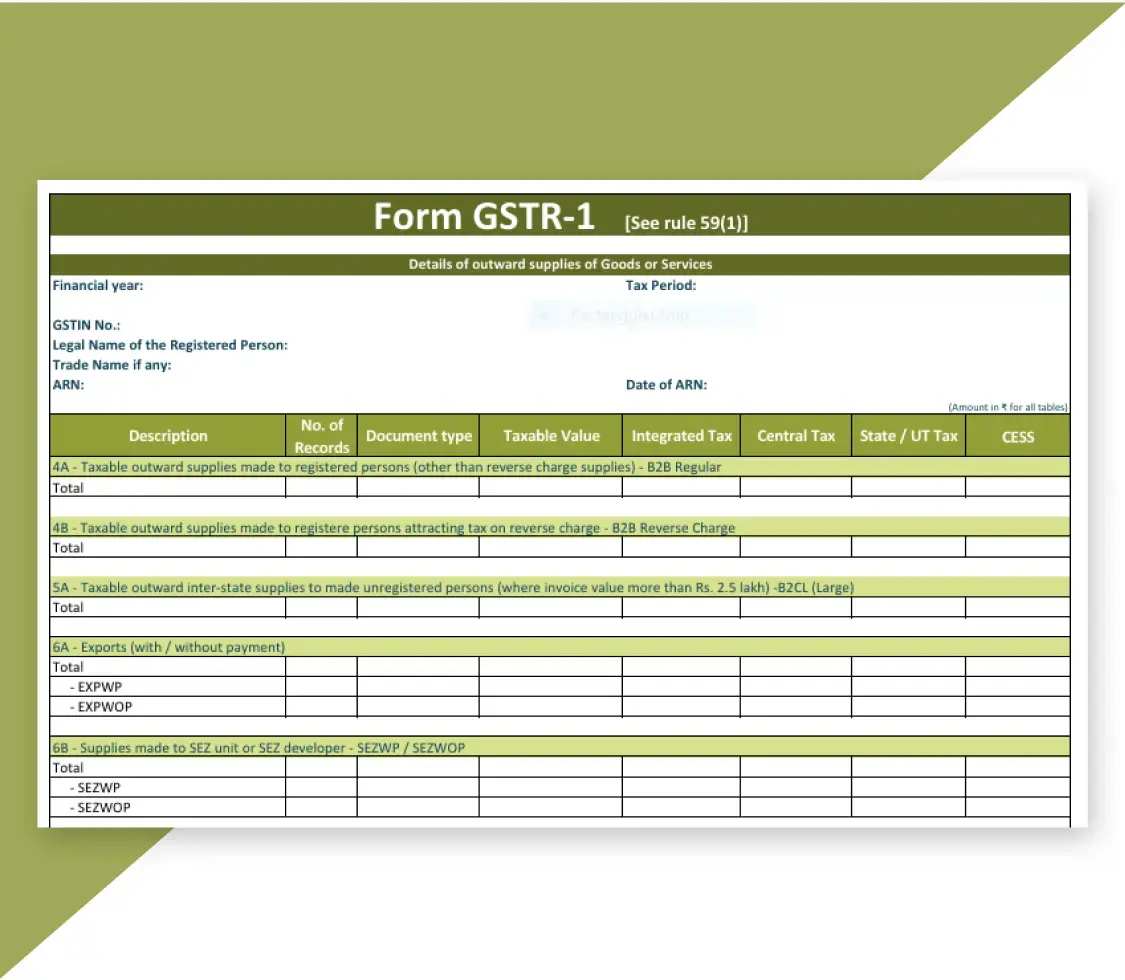

GSTR-1 Format – 2

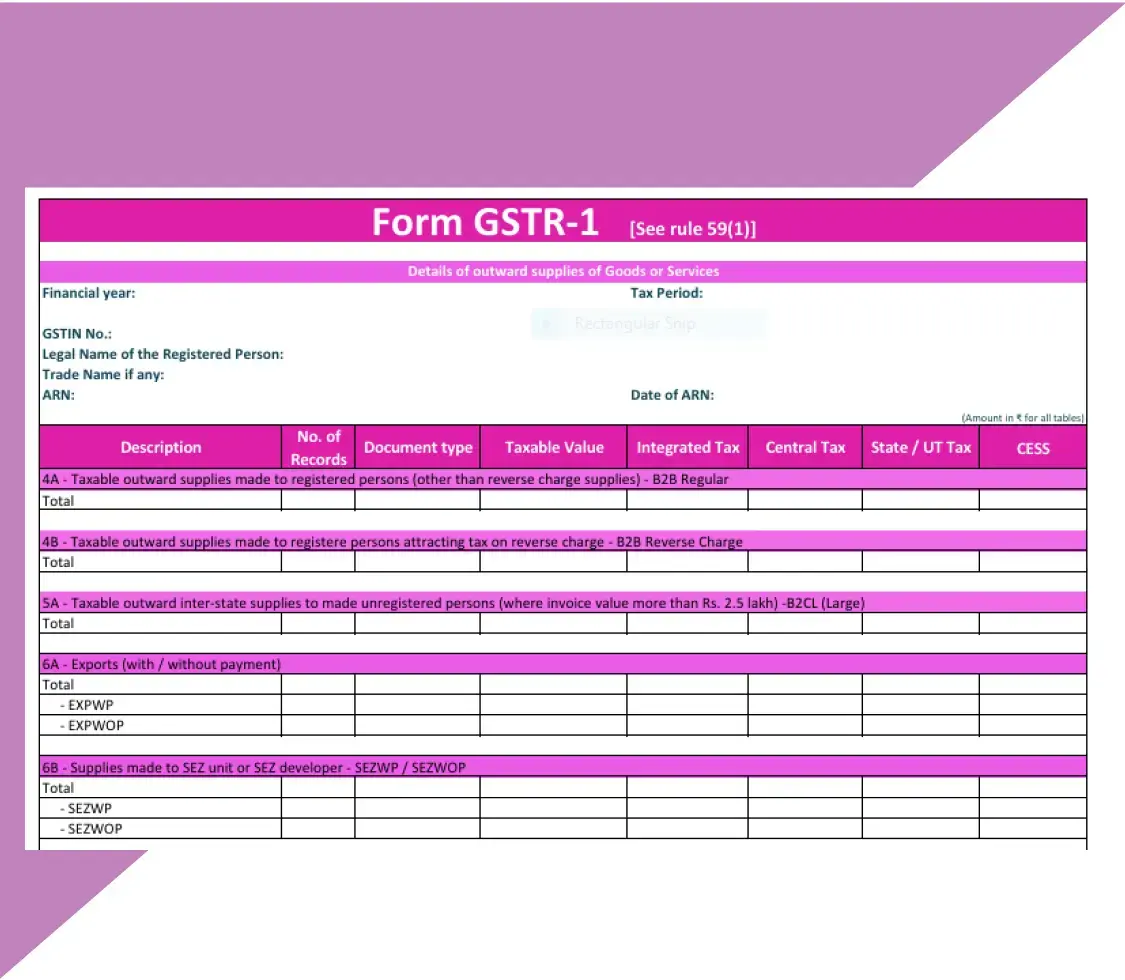

GSTR-1 Format – 3

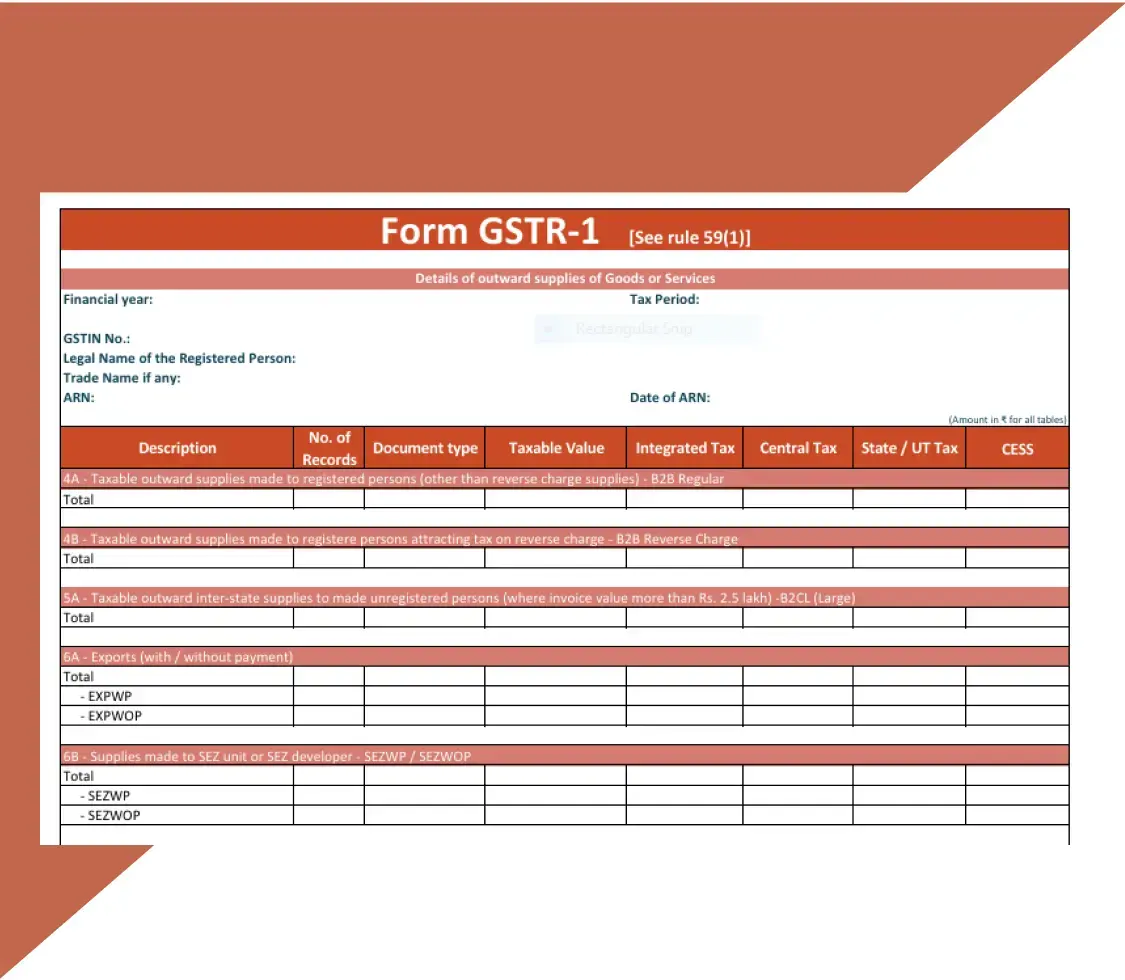

GSTR-1 Format – 4

GSTR-1 Format – 5

GSTR-1 Format – 6

GSTR-1 Format – 7

GSTR-1 Format – 8

Auto-Generate GSTR-1 Reports with Vyapar

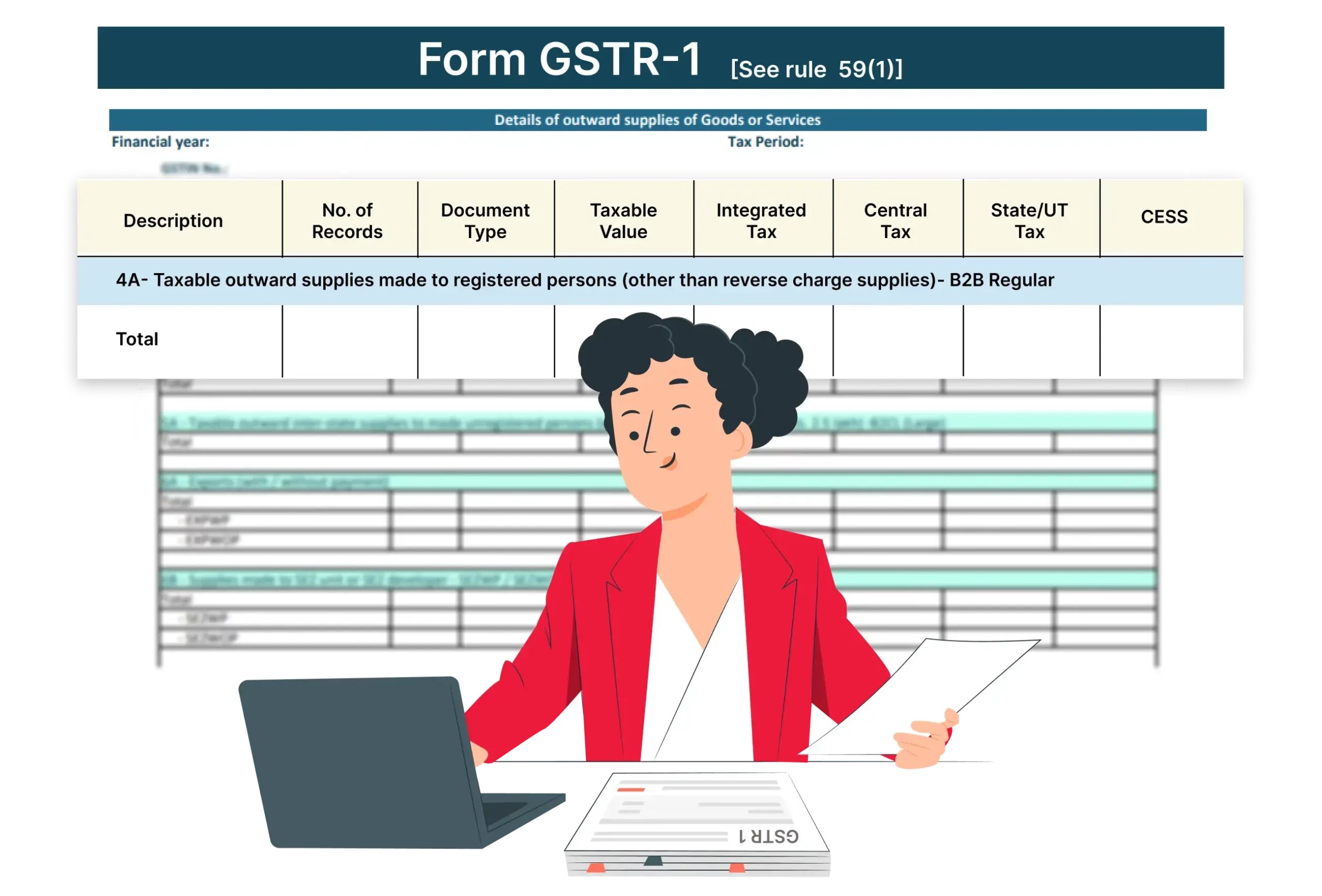

What is GSTR-1?

GSTR-1 is a monthly or quarterly GST return that must be filed by every GST-registered business involved in outward supplies of goods or services. This return captures all invoice-level details of sales transactions made during the tax period.

In simple terms, outward supply refers to the sale, transfer, barter, exchange, lease, rental, or disposal of goods and services carried out in the course of business. Filing GSTR-1 on time is crucial for GST compliance and helps buyers claim an input tax credit (ITC) based on the supplier’s data

🔑 Key Components of GSTR-1 Format

Taxpayer & Document Details

Includes GSTIN, legal name, and summary of all documents issued—like invoices, credit notes, and debit notes—during the specific GST return period.

Outward Supplies (Invoice-wise)

Lists invoice-level details, including date, number, taxable value, place of supply, HSN codes, and recipient’s GSTIN, for all sales made during the period.

Amendments to Filed Returns

Records any corrections or updates to outward supplies and debit or credit notes from previous returns already submitted for earlier tax periods.

Credit & Debit Notes

Covers all credit or debit notes issued, including their values and any modifications to notes from previously filed tax periods if applicable.

Advance Receipts & Adjustments

Covers advance payments received for upcoming supplies and their adjustments in future periods, ensuring accuracy in your GST return reporting.

Who Should File the GSTR-1 Return?

All the registered taxpayers are required to file the GSTR-1 return except:

- Input Service Distributors

- Non-resident taxable person

- Composite dealers

- OIDAR suppliers

- Taxpayers are liable to deduct TDS

- Taxpayers liable to collect TCS

Due Dates For Filing GSTR-1

The due date for monthly returns is the 11th of the following month; quarterly returns are due on the 13th of the month following the end of the quarter.

Businesses with an aggregate turnover of less than or up to Rs 5 crores can file quarterly returns. However, A company with an aggregate turnover of over Rs 5 crores must file monthly returns.

GSTR-1 Table-wise Structure and Details

What Are the Prerequisites For Filing A GSTR-1 Return?

- You must be a registered taxpayer and have an active PAN-based GST Identification Number (GSTIN).

- You must have a valid user ID and password to access the GST portal.

- The taxpayer should have issued invoices for the outward supply of goods or services during the tax period covered by the return.

- The taxpayer should have paid the tax due for the tax period covered by the return.

- The GSTR-1 return should be filed on or before the due date, which is the 11th day of the following month for monthly filers and the 13th day of the month following the quarter for quarterly filers.

- You must have access to the registered mobile number to receive the OTP for verification if you wish to use EVC (electronic verification code).

- You must maintain detailed invoices with specific serial numbers for all your transactions, including intrastate and inter-state supplies, business-to-business transactions, and retail sales.

- It also covers stock transfers between your company’s locations in other states and transactions involving nil-rated, exempt and non-GST outward supplies.

Late Fees And Penalties For GSTR-1

The government levies the late fee as compensation for the late submission of a GST return. When a taxpayer forgets to submit their GST return, the government imposes a late fee for each day that passes.

The government charges a minimum amount of Rs 50 for every day of delay. The maximum late fees can range from Rs 2000 to Rs 10,000 based on the company’s annual aggregate turnover in the previous financial year.

- If a company’s aggregate turnover is up to Rs 1.5 crore, the maximum late fees can be Rs 2000.

- If a company’s aggregate turnover ranges from Rs 1.5 crore to Rs 5 crore, the ultimate late fees levied can be Rs 5000.

- If a company’s aggregate turnover exceeds Rs 5 crore, the maximum late fees can be Rs 10,000.

Procedure for Filing GSTR-1 Through the GST Portal

- Log in to the GST portal using your GSTIN, username, and password.

- Navigate to the Returns Dashboard from the home screen.

- Select the relevant financial year and return month for GSTR-1 filing.

- Click on GSTR-1 (Outward Supplies) to start preparing the return.

- Enter all required details such as invoice data, HSN codes, and taxable values.

- Click on Generate Summary to process and compile the return data.

- Review the summary and confirm the accuracy of all entries.

- Click on File Return to proceed with the final submission.

- Choose the authorised signatory responsible for filing the return.

- Select File with EVC to receive an OTP on your registered mobile/email.

- Enter the OTP and click Verify to complete the GSTR-1 filing process.

How to File the Return Using the Vyapar GSTR-1 Format?

- Open Vyapar App and navigate to Reports

- Select GST Reports and then GSTR-1

- Choose the month for which you want to file the return

- Review all sales transactions for accuracy

- Export the GSTR-1 report in JSON format

- Log in to the GST portal (gst.gov.in)

- Go to Returns Dashboard, select the period, and open GSTR-1

- Upload the JSON file generated from Vyapar

- Review the uploaded data and make corrections if needed

- Submit the return and file it using DSC or EVC

Importance of Filing GSTR-1

Mandatory for GST Law Compliance

Filing GSTR-1 return is legally required under the GST Act. Missing the deadline can lead to late fees, interest, and penalties.

Enables Accurate Input Tax Credit (ITC)

The information filed in GSTR-1 directly impacts the GSTR-2A and GSTR-2B reports of buyers. Accurate filing ensures your buyers can claim the correct Input Tax Credit.

Ensures Outward Supply Accuracy

GSTR-1 captures details of outward supplies, including B2B and B2C invoices. Timely filing helps verify and correct errors in sales data and tax amounts.

Helps in GST Reconciliation

Regular GSTR-1 filing makes it easier to reconcile outward supplies with the inward supplies shown in the recipient’s GSTR-2A/2B. This prevents mismatches and tax disputes.

Essential for GST Assessment and Audits

Tax authorities use GSTR-1 data during audits and tax assessments. A complete and accurate GSTR-1 report builds credibility and reduces chances of notices.

Supports Auto-Population of Other Returns

Data filed in GSTR-1 is used for auto-populating GSTR-3B, reducing manual entry and chances of mismatch between returns.

Valuable Features of the Vyapar App for Business Owners

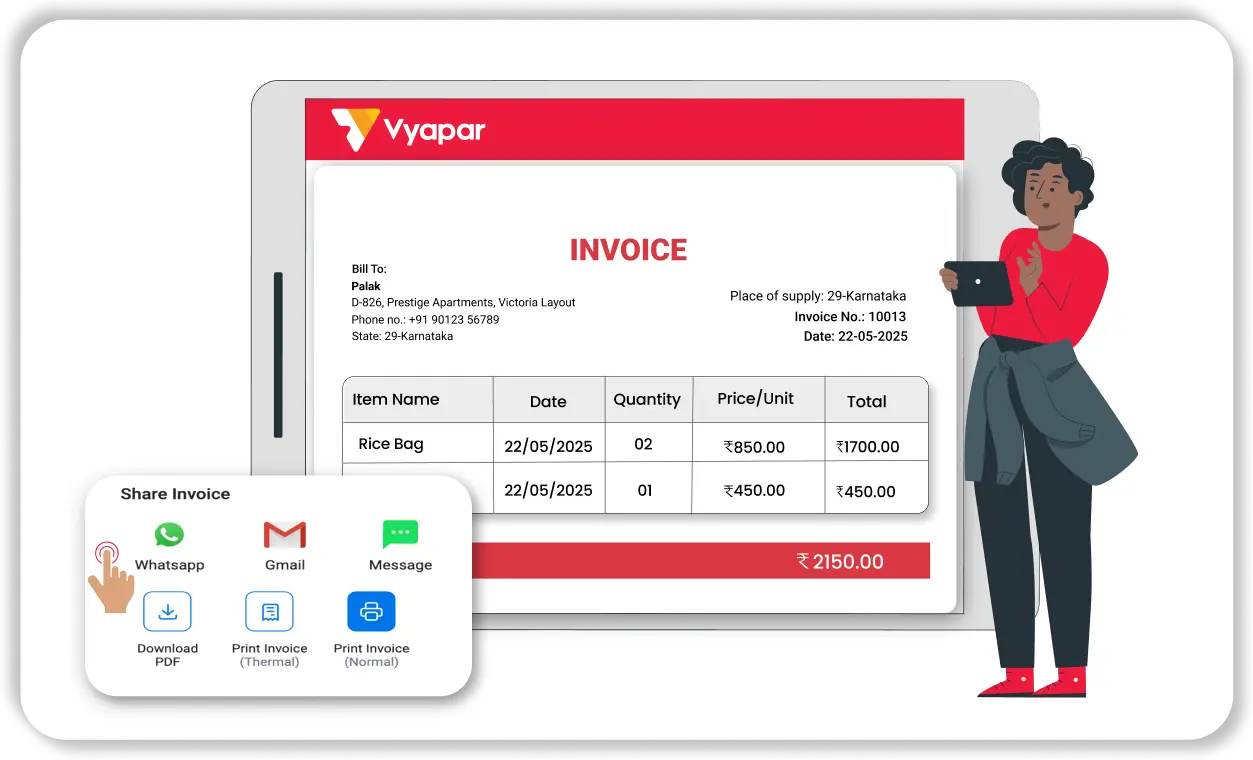

Create GST Invoices Instantly

Creating GST-compliant invoices in Excel requires time and knowledge of tax rules. Vyapar makes invoicing effortless and fully compliant with Indian GST laws

- Instant GST Billing: Generate tax invoices in seconds using pre-set tax rates and item details.

- Custom Templates: Choose from 10+ professional invoice formats tailored to your brand’s look.

- Multi-Channel Sharing: Send invoices via WhatsApp, email, or print—no need to convert files or attach Excel sheets.

.

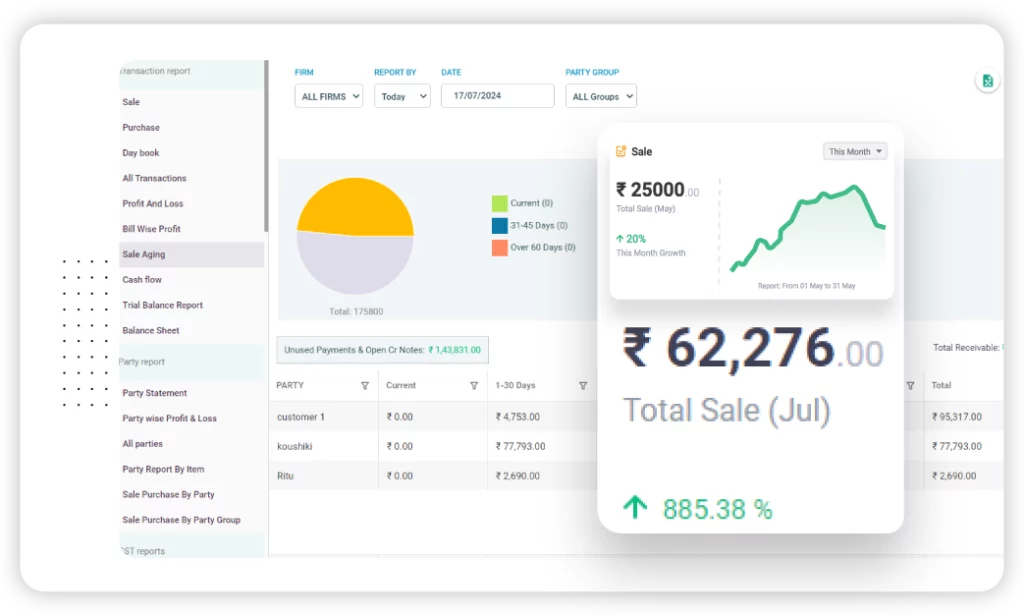

Generate Business Reports

Excel reporting is slow, manual, and prone to human error. Vyapar auto-generates business reports to help you make informed decisions.

- Multiple Business Reports: Access balance sheets, GSTR-1/3B, cash flow, and GST reconciliation reports instantly.

- Export-Friendly: Download in PDF or Excel with a click—perfect for CA review or sharing with partners.

- Visual Dashboards: Understand sales trends, top products, and expense breakdowns with easy-to-read graphs.

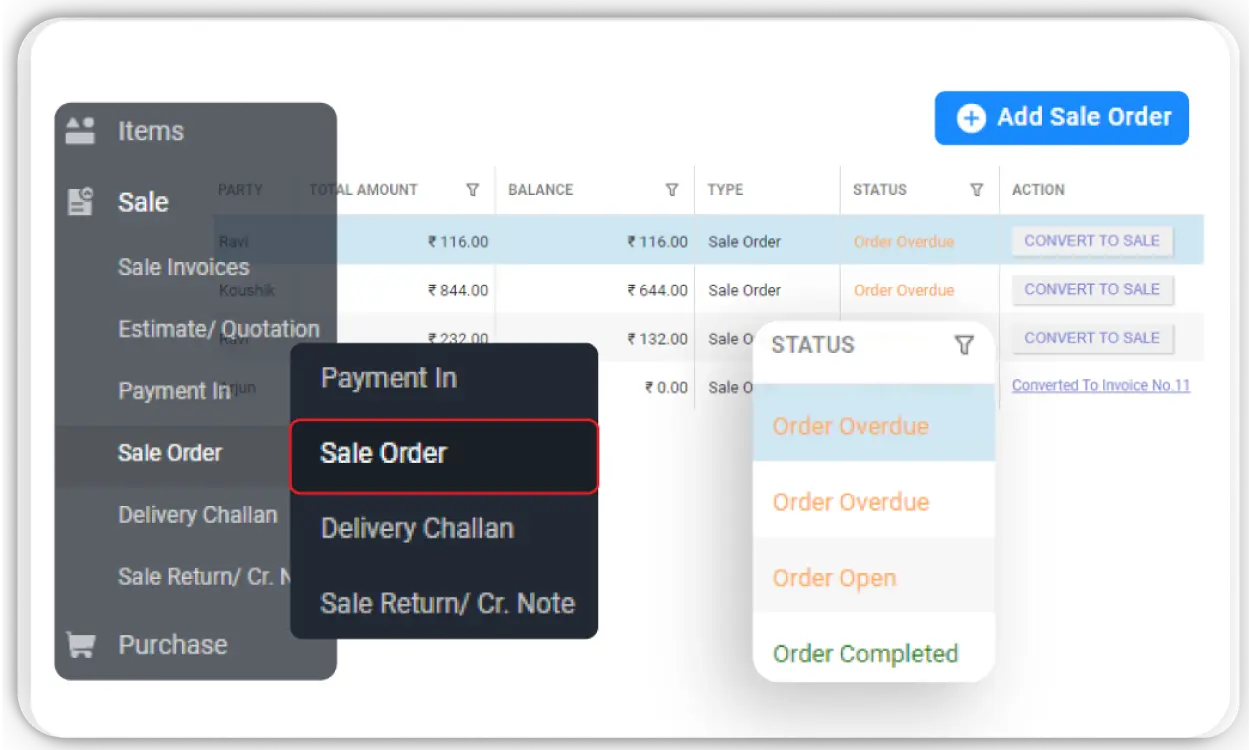

Order Tracking & Management

Excel needs multiple files and updates for tracking sales and purchase orders. Vyapar automates the full order management cycle.

- Auto-Convert Orders: Convert sales/purchase orders into invoices without duplication.

- Real-Time Order Status: View pending, completed, or overdue orders in one place.

- Smart Alerts: Get reminders for due dates, pending payments, or stock status.

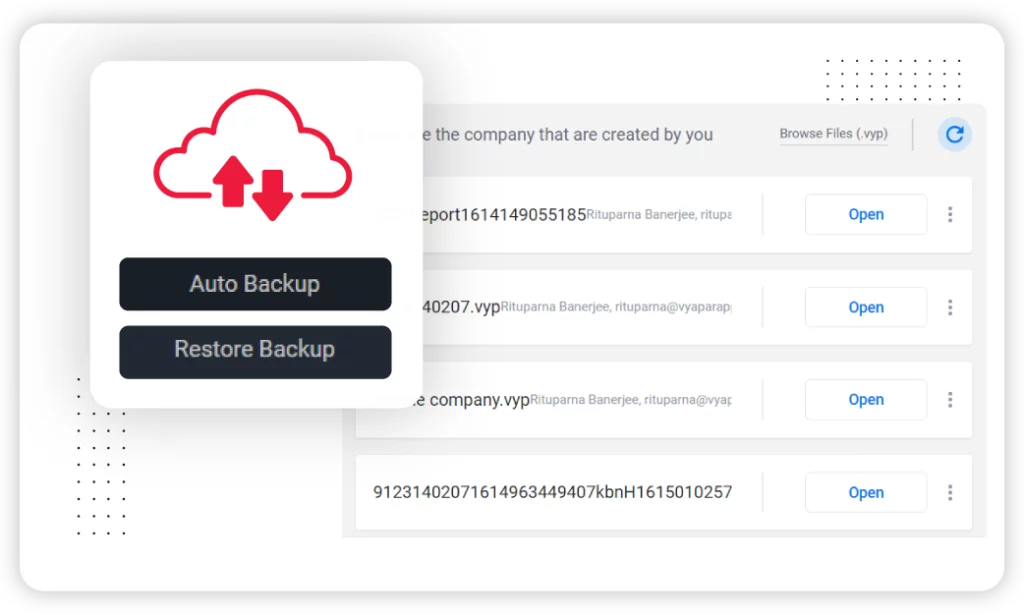

Data Security

Excel files can be lost, tampered with, or shared without consent. Vyapar protects your data with enterprise-grade security features.

- Cloud & Local Backups: Auto-sync your business data with Google Drive or save it locally.

- User Access Control: Restrict access to authorised staff only—no more accidental data leaks.

- Encrypted Storage: Your sensitive business and GST information is always protected with strong encryption.

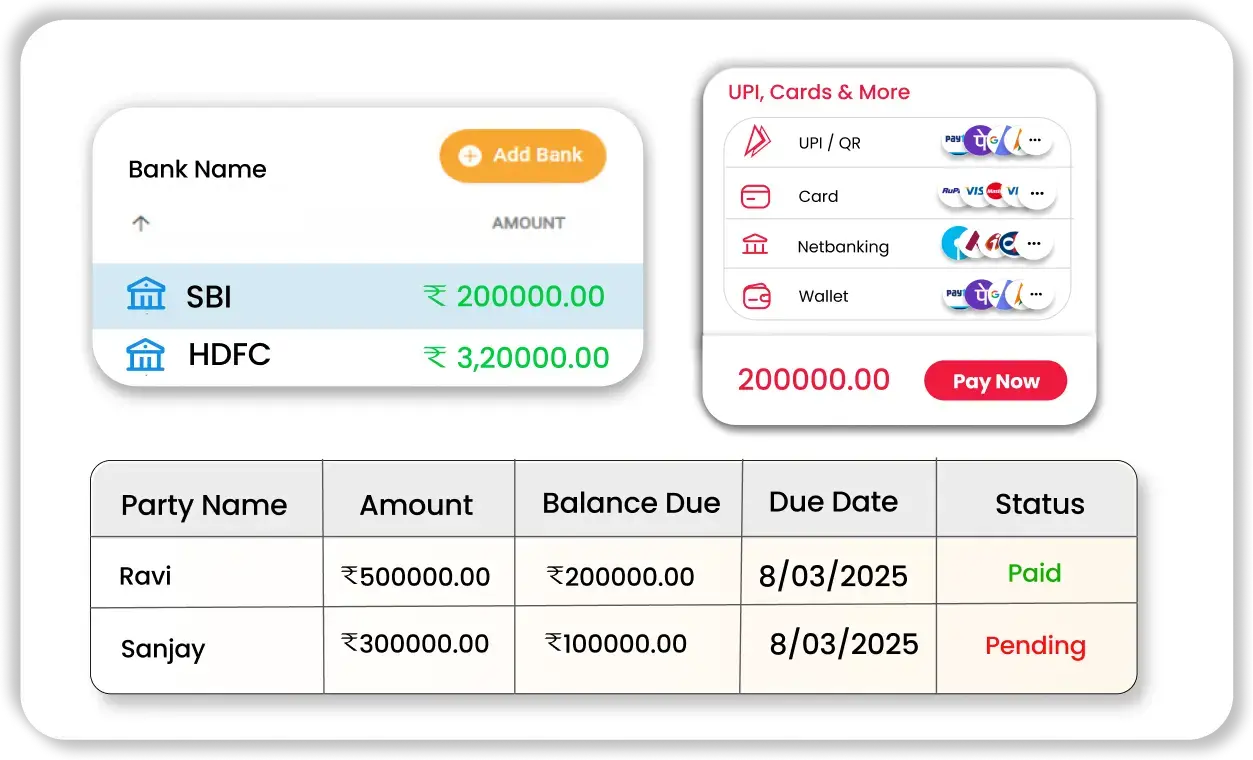

Seamless Payment Tracking

Managing payments through Excel often means switching between files and bank statements. Vyapar simplifies this with built-in payment tracking tools that centralise your financial records.

- Multi-Source Tracking: Easily record and categorise transactions from cash, UPI, wallets, bank deposits, and loan payments.

- Manual Bank Entry Support: Maintain clear records of deposits, withdrawals, and outstanding dues—even without direct bank linking.

- Cheque Status Management: Track issued, cleared, or bounced cheques to maintain accurate records and avoid payment delays.

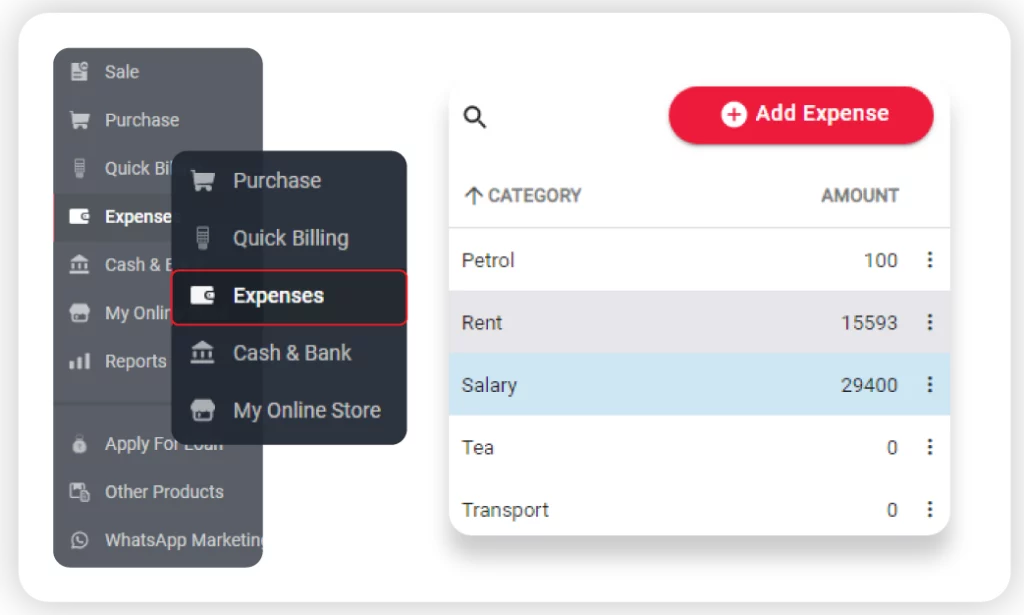

Track and Control Expenses

Expense tracking in Excel lacks real-time insights and can be prone to missing entries. Vyapar makes it easy to monitor every rupee spent.

- Detailed Expense Logs: Record delivery charges, supplier payments, fuel, and daily operating costs.

- GST vs Non-GST Expenses: Separate taxable from non-taxable spending for clearer reporting.

- Budget Smarter: Generate expense reports to identify waste and save money month after month.

Benefits of Using Vyapar’s GSTR Format for Filing GSTR-1

Accuracy in GST Filing

Vyapar’s GSTR-1 format is designed to deliver high accuracy in GST return filing by pulling critical data automatically from your transactions. The software captures GSTINs, invoice numbers, taxable values, and tax rates directly from your records, leaving no room for manual entry errors.

Whether it’s B2B or B2C invoices, Vyapar intelligently maps the transaction data into the correct fields of the GSTR-1 format. This automation ensures your filing aligns with GST norms and avoids penalties due to mismatches or omissions.

This not only enhances data accuracy but also builds confidence in your tax submissions. For small and medium businesses, this means fewer corrections and smoother audits. You can rely on Vyapar to ensure every GST return is filed with precision and peace of mind.

Faster And Efficient Return Filing

Vyapar’s GSTR-1 format makes GST return filing faster and more efficient by eliminating the most time-consuming step—manual data entry. It auto-imports data directly from your daily invoices, bills, and transaction records, mapping them into the GSTR-1 return structure.

Instead of wasting hours copying information manually into spreadsheets or the GST portal, you can generate your return-ready file in just a few clicks. The app exports GSTR-1 data in JSON format, which is directly compatible with the GSTN portal, making the upload process seamless.

This built-in automation significantly reduces errors caused by manual input. Business owners and accountants can focus on real work while the Vyapar App does the heavy lifting. Whether you file monthly or quarterly, Vyapar’s efficient format saves time, enhances productivity, and ensures that your filings are always on time and in order.

Standardised and Consistent Filing

Consistency is key when filing GST returns, and Vyapar ensures it with a standardised GSTR-1 format that simplifies compliance. Whether you file monthly or quarterly, the app uses a fixed structure that doesn’t change, making it easier to track your filings across periods.

All your invoices, tax values, customer details, and HSN codes are aligned in a uniform format each time you generate your return. This standardisation simplifies GST reconciliation because the data is structured the same way every time, making it easier to cross-check with government records or your accountant’s books.

It reduces confusion, minimises mismatch issues, and ensures every return you file looks and performs the same. For growing businesses, this means better organisation, smoother audits, and fewer GST disputes. Vyapar’s consistent GSTR-1 formatting helps create a strong foundation for long-term compliance success.

Time-Saving And Error-Free

Time is money, and Vyapar’s GSTR-1 format is built to save both. By automating tax calculations and invoice mapping, Vyapar reduces the time required to prepare and file returns.

Instead of manually entering customer details, tax rates, and invoice values, the system fetches it all from your existing records. Not only does this save hours of effort every month, but it also ensures that the data is accurate, reducing the chance of errors that could lead to fines.

Additionally, you can reuse saved GSTR-1 templates each month, which means you don’t need to start from scratch every time. Just update the new entries and generate your return—quick, easy, and error-free. This streamlined workflow helps small businesses meet deadlines effortlessly while maintaining 100% compliance. With Vyapar, filing returns becomes a smooth, predictable process you can look forward to.

User-Friendly GSTR Filing Experience

Filing GST returns can be overwhelming, especially for small business owners with no accounting background. That’s why Vyapar’s GSTR-1 format is built with simplicity in mind. The app offers an intuitive interface with clear instructions at every step, so you never feel lost.

Whether you’re uploading invoices, verifying tax amounts, or exporting your final return, Vyapar walks you through the entire process. You don’t need to be a tax expert—just follow the easy prompts and your GSTR-1 will be ready for upload in no time.

Plus, with in-app support and smart tips, even first-time users can handle returns confidently. This user-centric design ensures that businesses of all sizes, especially MSMEs, can stay compliant without hiring dedicated tax consultants. Vyapar empowers you to take control of your tax filings and avoid the stress that usually comes with it.

Boosts Business Efficiency

Vyapar’s GSTR-1 format does more than just file returns—it boosts your overall business efficiency. By integrating billing, inventory, and tax functions in one place, the app streamlines your financial operations.

Every time you generate an invoice, Vyapar records essential data like customer details, GSTIN, product-wise tax rates, and values. When it’s time to file GSTR-1, the app pulls this data instantly, saving time and effort. This means you don’t have to switch between multiple systems or manually gather data from various sources.

It reduces redundancies, eliminates data duplication, and helps you stay focused on core business activities. With better organisation of information, fewer errors, and seamless syncing, you not only improve compliance but also make faster decisions. Vyapar transforms GST filing from a burden into a value-adding process that supports your business growth.

Frequently Asked Questions (FAQ’s)

What is the GSTR-1 format and why is it important?

Where can I download the GSTR-1 format in Excel, PDF, or Word?

Can I use the Vyapar GSTR-1 format for GST filing?

What are the components included in the GSTR-1 form format?

How many tables are there in the GSTR-1 return format?

Is Vyapar’s GSTR-1 Excel format GSTN compliant?

What are the prerequisites for using the GSTR-1 format for return filing?

How do I file GSTR-1 using Vyapar’s template or format?

What is Table 13 of Form GSTR-1?

What is Table 14 and Table 15 in GSTR-1?