GSTR-4 Format In PDF, Excel And Word

Filing GSTR-4 can be frustrating when the format is confusing or incomplete. That’s why we’ve provided accurate, ready-to-use GSTR-4 formats in Excel, PDF, and Word—compliant and easy to fill.

But why stop at just the format? Download the Vyapar App to manage GST billing, inventory, and accounting —all in one place. Try it free today!

GSTR-4 Format Vs Vyapar App

Features

GSTR-4 Format

Auto-filled invoice data

GSTIN auto-verification

Sale/Purchase Reports Linked to GSTR-4

Multi-Device Access

Tax Auto-Split

Outward Supplies Summary

GSTIN Validation for Parties

Offline Usage

User-friendly interface

Download Free & Easy-to-Use GSTR-4 format in PDF, Excel, and Word

Stay compliant with the latest GST norms, reduce filing errors, and save time with pre-formatted GSTR-4 templates designed for clarity, accuracy, and ease of use.

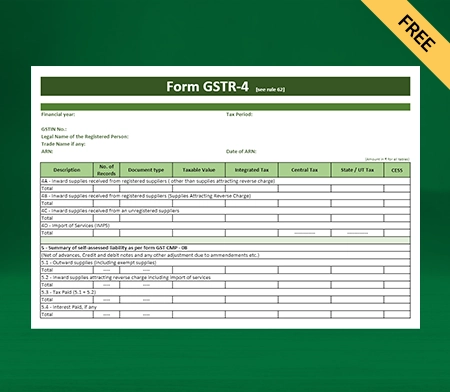

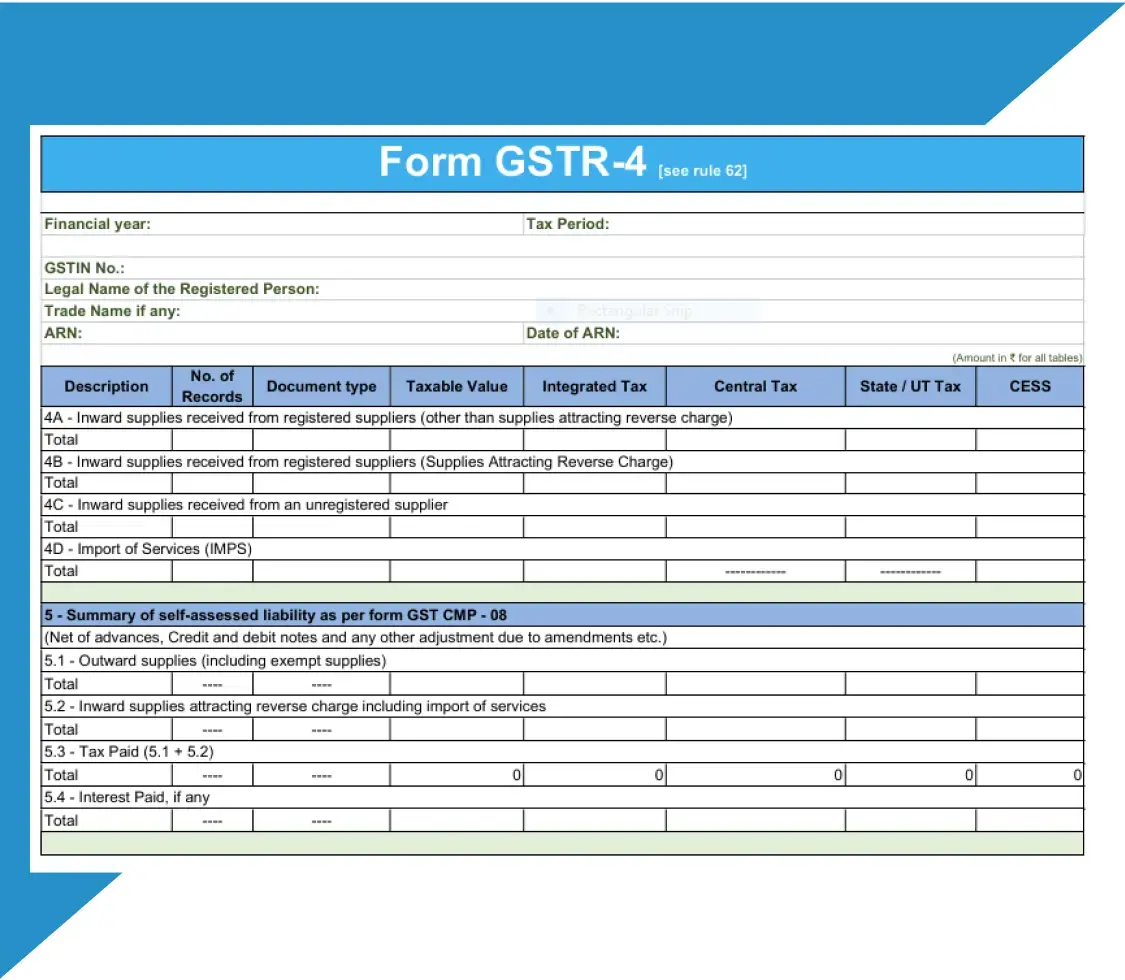

GSTR-4 Format – 1

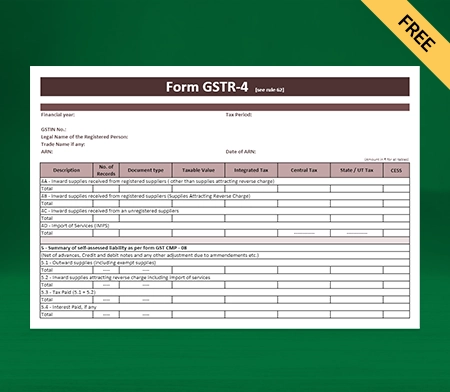

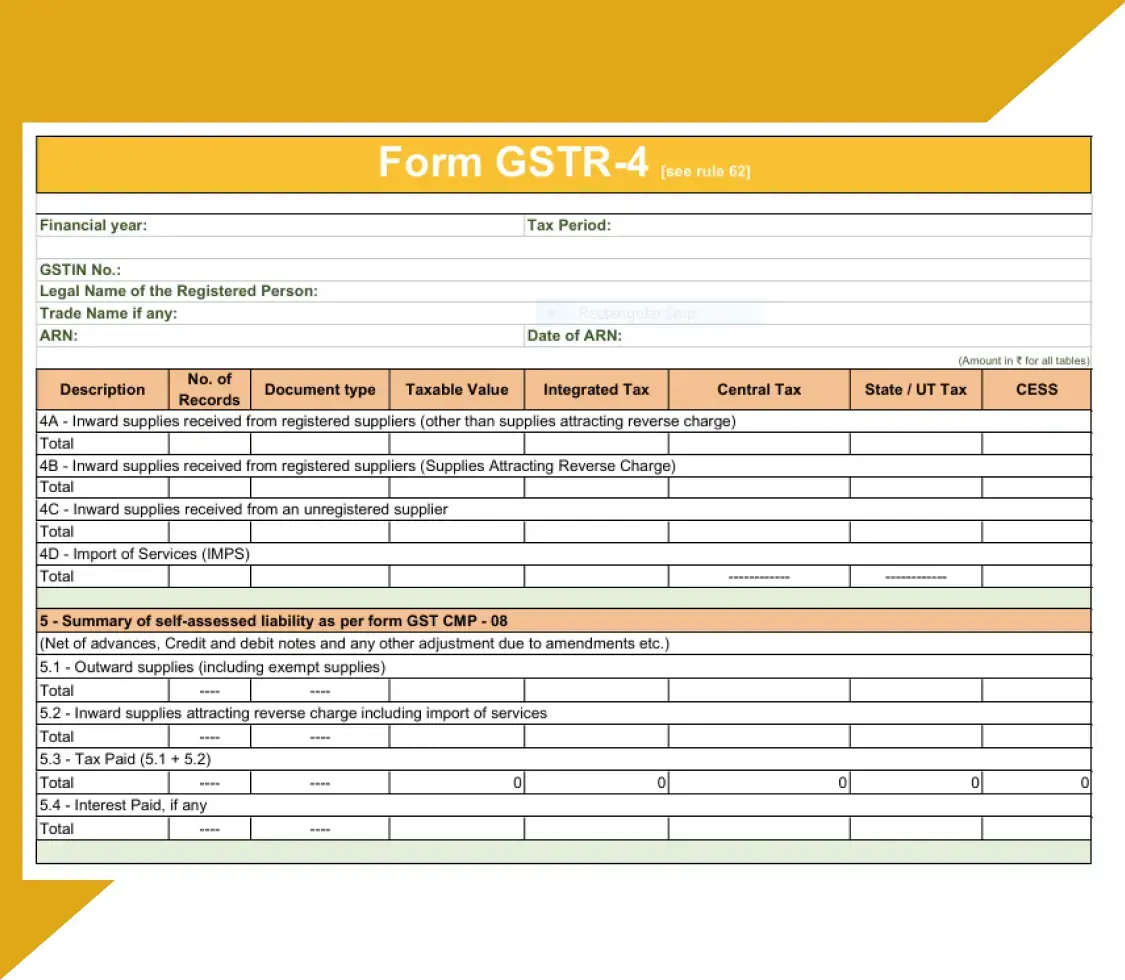

GSTR-4 Format – 2

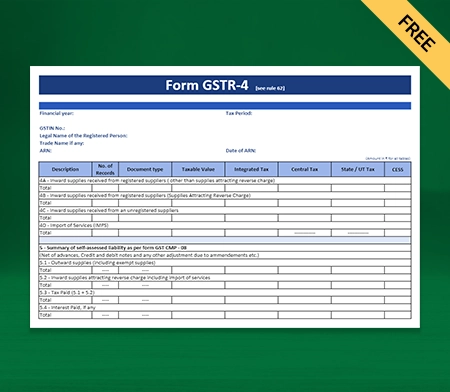

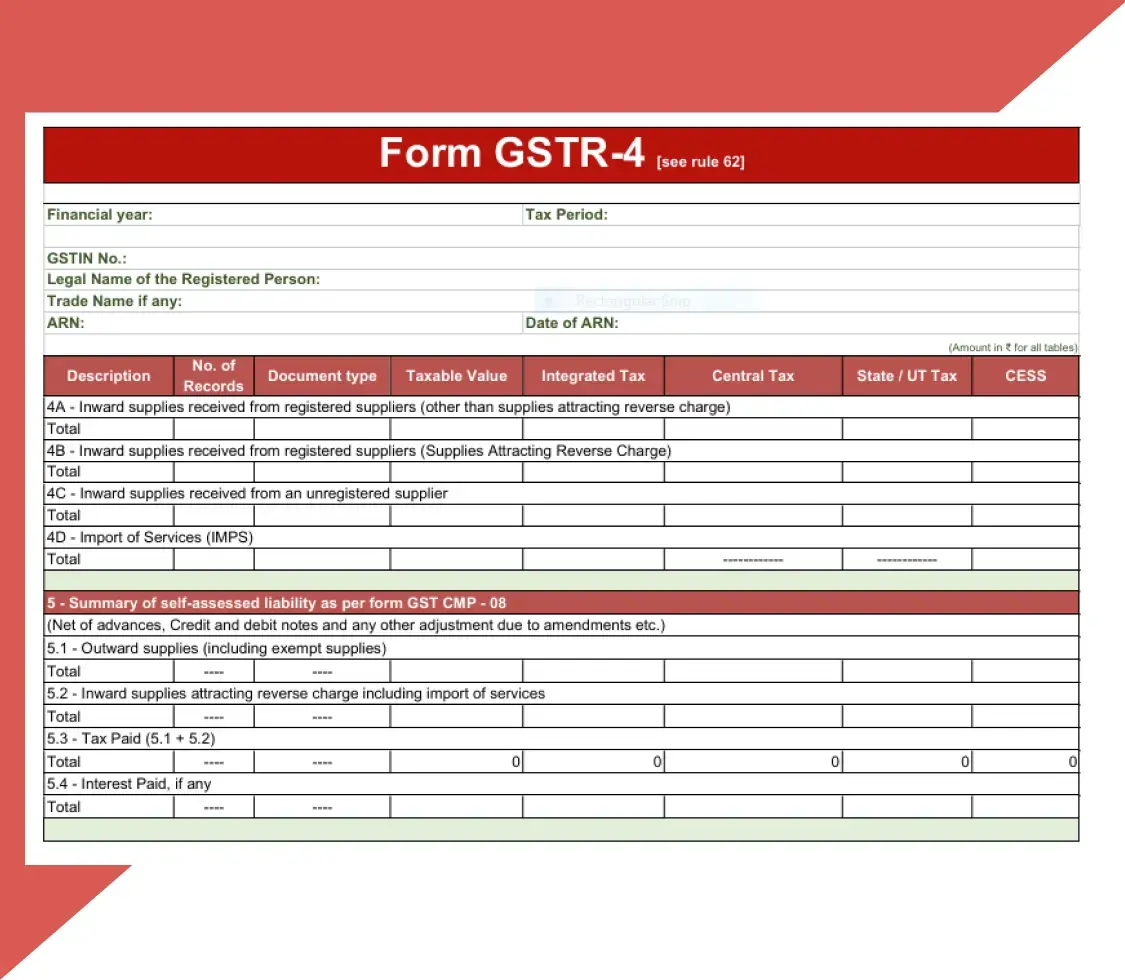

GSTR-4 Format – 3

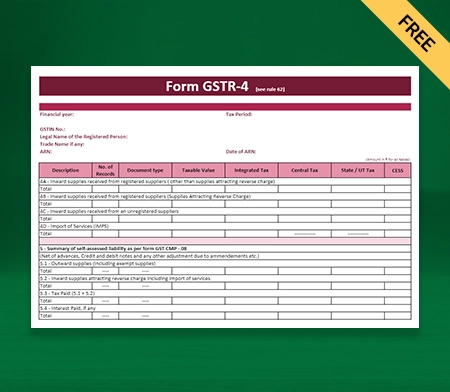

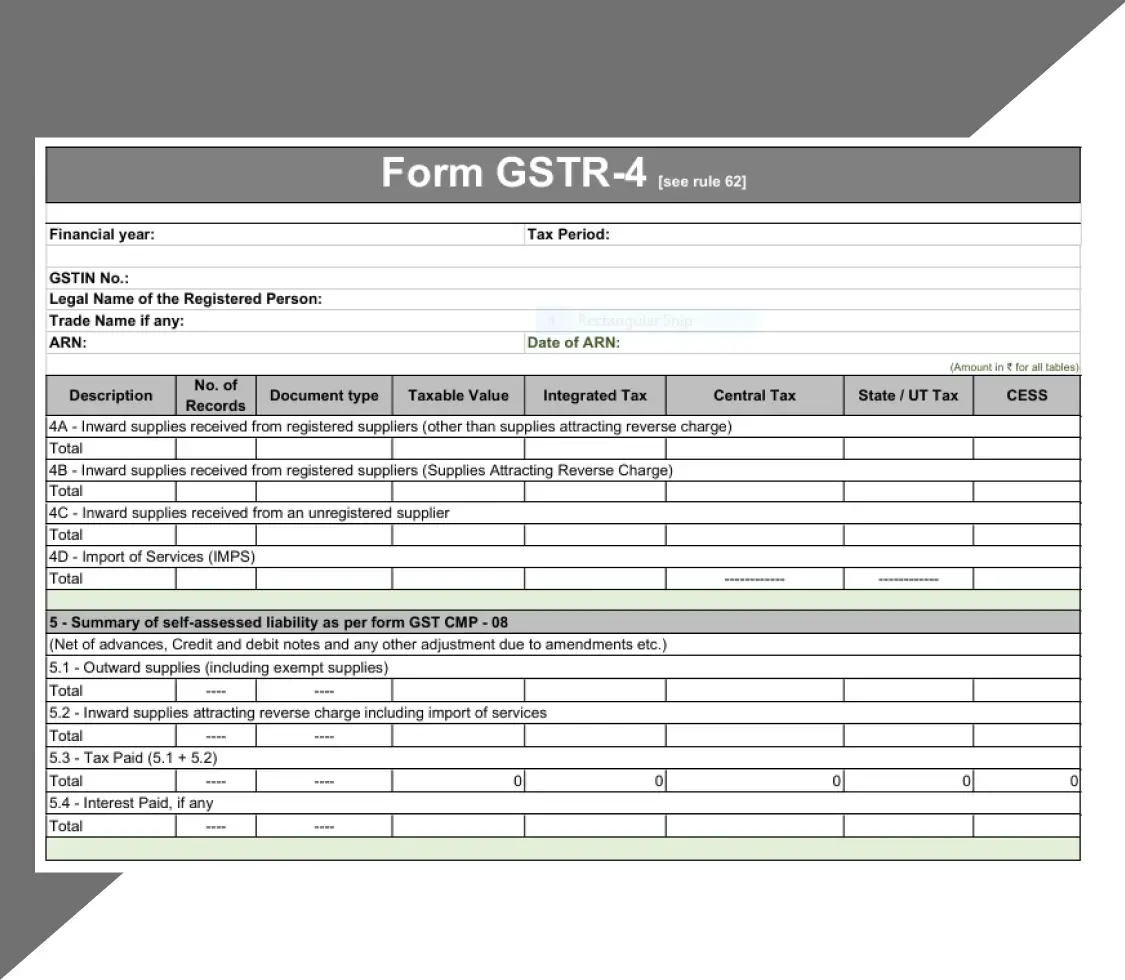

GSTR-4 Format – 4

GSTR-4 Format – 5

GSTR-4 Format – 6

GSTR-4 Format – 7

GSTR-4 Format – 8

Why Just Format? Get Auto-Ready GSTR-4 Reports With Vyapar!

What is GSTR-4?

GSTR-4 is a GST return that must be filed annually by taxpayers enrolled under the Composition Scheme. Unlike regular taxpayers who file monthly returns, composition dealers file one annual return using the GSTR-4 form and pay taxes quarterly through the CMP-08. The GSTR 4 format captures details like outward supplies, inward purchases under reverse charge, tax liability, and tax paid.

It is specifically designed to ease compliance for small businesses by simplifying the return filing process.

Who Can Opt for the Composition Scheme?

- For Manufacturers and Traders of Goods: Turnover should not exceed ₹1.5 crore.

- For Service Providers and Mixed Suppliers: Turnover limit is ₹50 lakh.

- For Special Category States: Limit is ₹75 lakh.

GSTR-4 Due Date

GSTR-4 Late Fee and Interest

- ₹50/day (₹25 CGST + ₹25 SGST), max ₹2,000

- Nil return late fee capped at ₹500

- 18% annual interest on outstanding tax

GSTR-4 Section-Wise Table Breakdown

How to File GSTR-4 Online

Step 1: Log in to the GST Portal

Go to the GST portal and log in with your valid ID and password.

Step 2: Go to the Returns Dashboard

On the GST dashboard, click the “Services” tab and then “Returns Dashboard.”

Step 3: Enter Year and Filing Period Details

The file return page will appear. Select the “Financial Year” and the “Return Filing Period.” Click on “Search,” and separate tiles of all GST returns that can be filed will be displayed.

Step 4: Select the GST Return Type You Want to File

You can prepare a GST return online by clicking “Prepare Online” or opt for an offline method by clicking on “Prepare Offline.”

Step 5: Enter the Details

You need to enter all the details required in the GSTR-4 form. Once done, save the details and submit it. After submitting all the relevant information, you can pay through a challan.

Now that the form has been filed successfully, the “Filing Successful” message will appear on the screen with the ARN (Acknowledgement Reference Number).

Got The Format? Now Get The Full Solution — Auto-GST Reports, Billing, And More With Vyapar.

Features That Make Vyapar the #1 Choice for Indian Businesses!

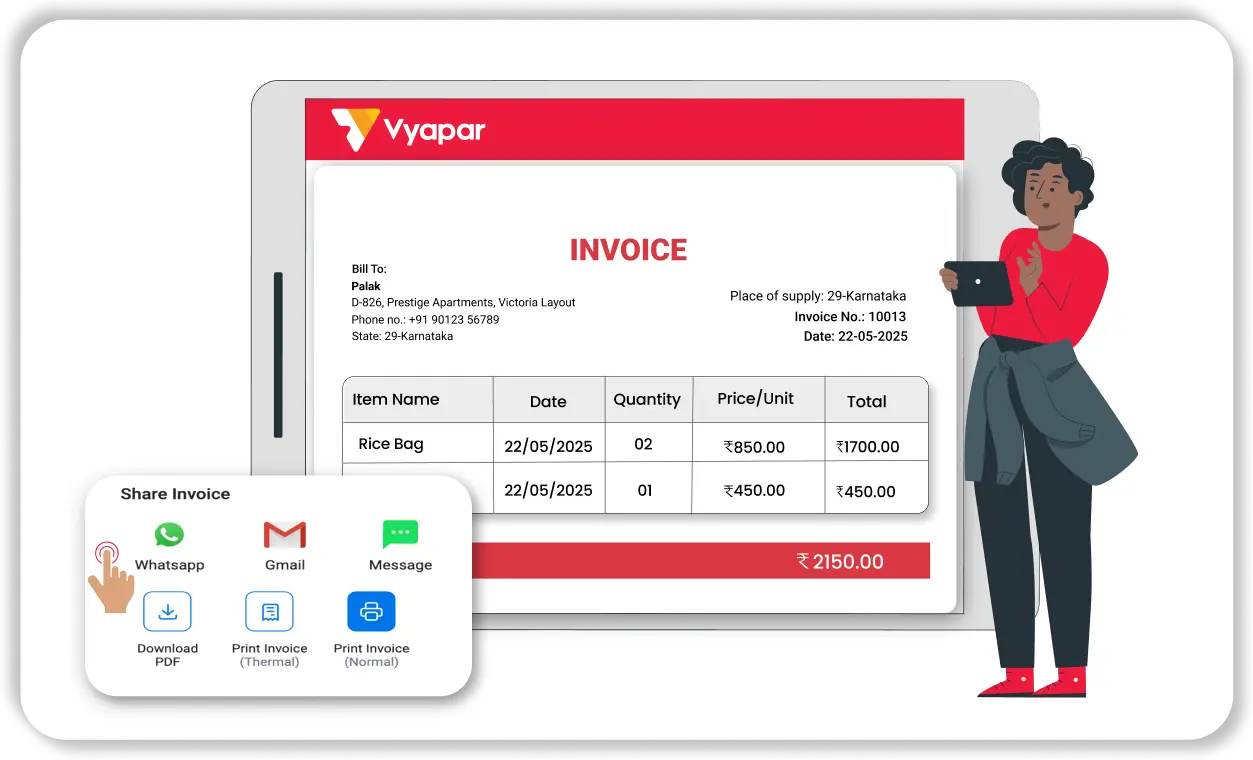

Generate Invoices Easily

Create professional, branded invoices with automated calculations and real-time tracking.

- Customise invoice templates with logo, colours, and payment terms

- Auto-calculate taxes, discounts, and totals with accuracy

- Track invoice status, send reminders, and offer multiple payment options (UPI, card, cash)

.

Inventory Management

Track, organise, and manage your stock in real-time to ensure smooth operations.

- Get low-stock alerts and categorise inventory by type, vendor, or location

- Use barcode scanning for faster item tracking and stock updates

- Generate purchase orders and detailed reports on sales, stock, and purchases

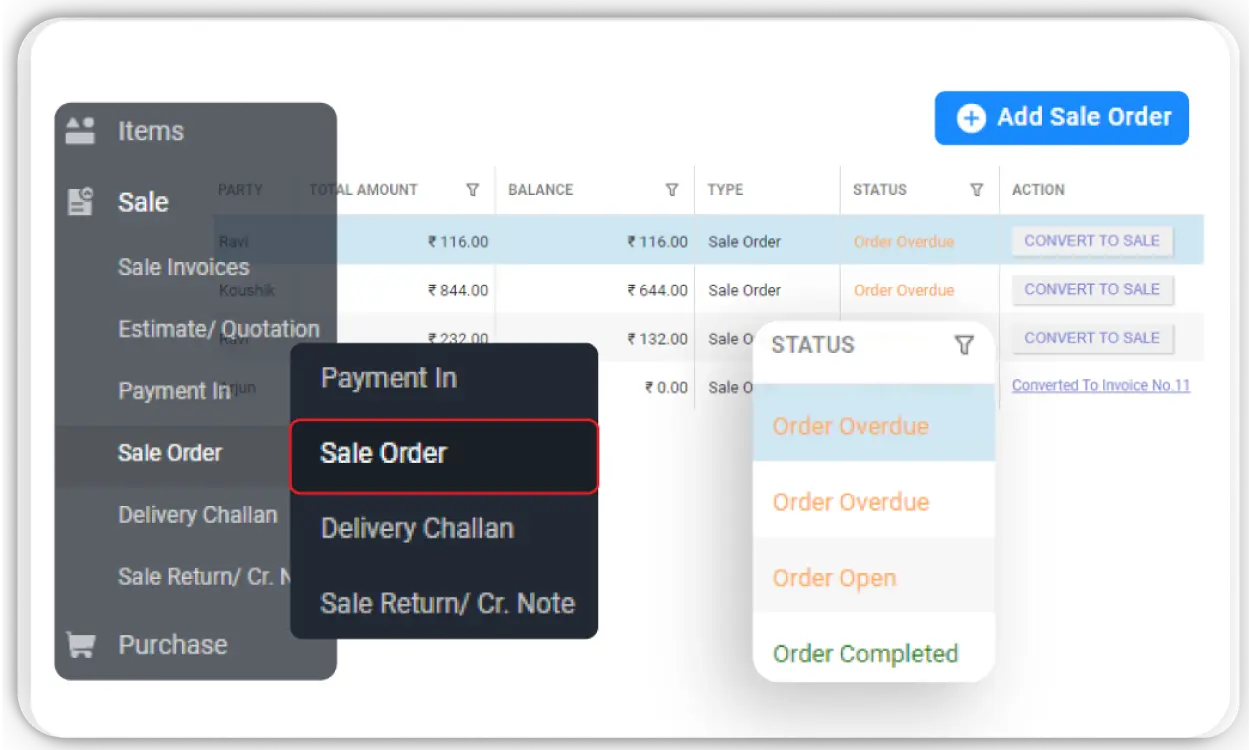

Order Tracking & Management

Excel needs multiple files and updates for tracking sales and purchase orders. Vyapar automates the full order management cycle.

- Convert sales/purchase orders into invoices without duplication.

- View pending, completed, or overdue orders in one place.

- Get reminders for pending payments or stock status.

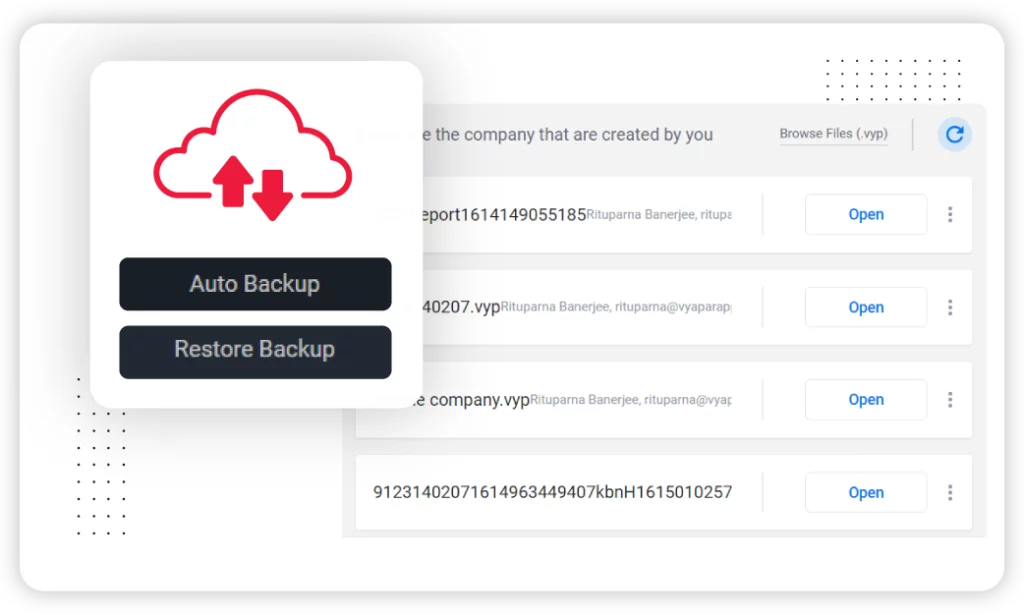

Data Security

Vyapar protects your business data with encryption, backups, and advanced access control.

- Auto cloud backup and password authentication ensure secure access

- Set user permissions to control who can view or edit sensitive data

- Encrypted storage and secure data transfers prevent unauthorised access

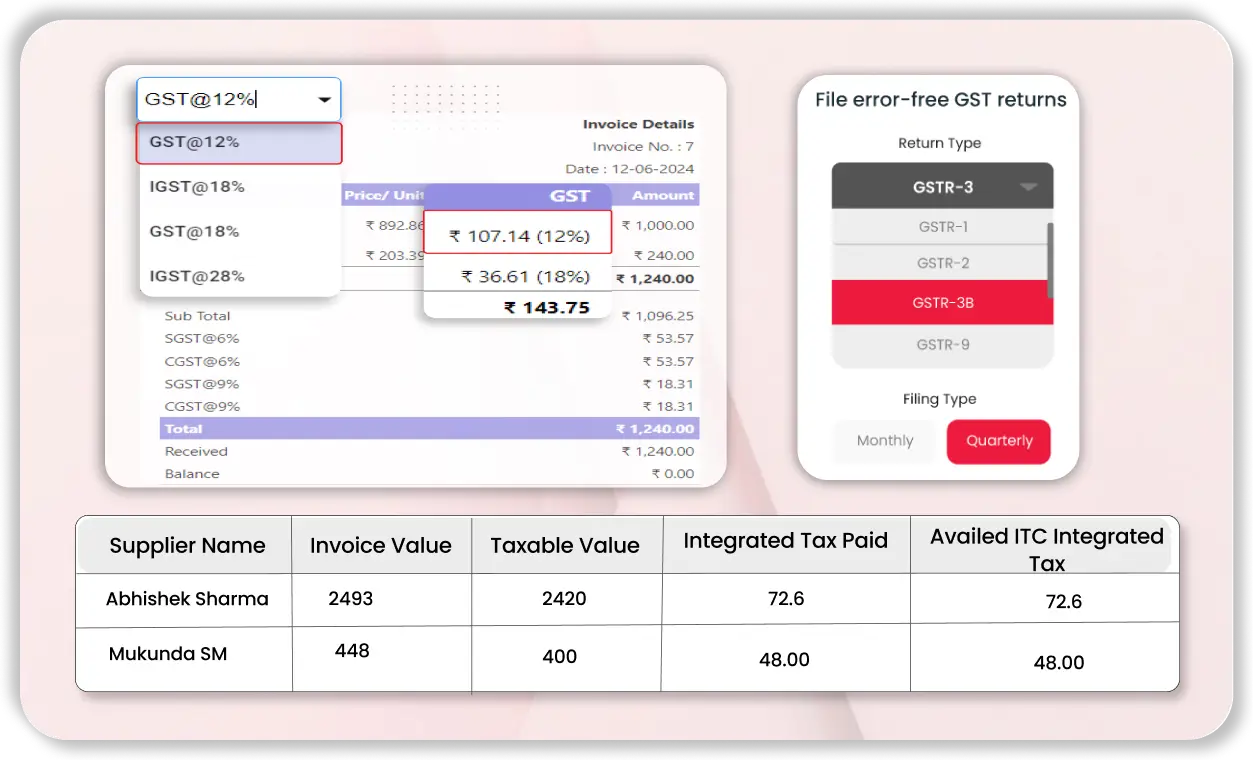

GST Compliance

Ensure hassle-free GST billing, filing, and reconciliation with built-in compliance tools.

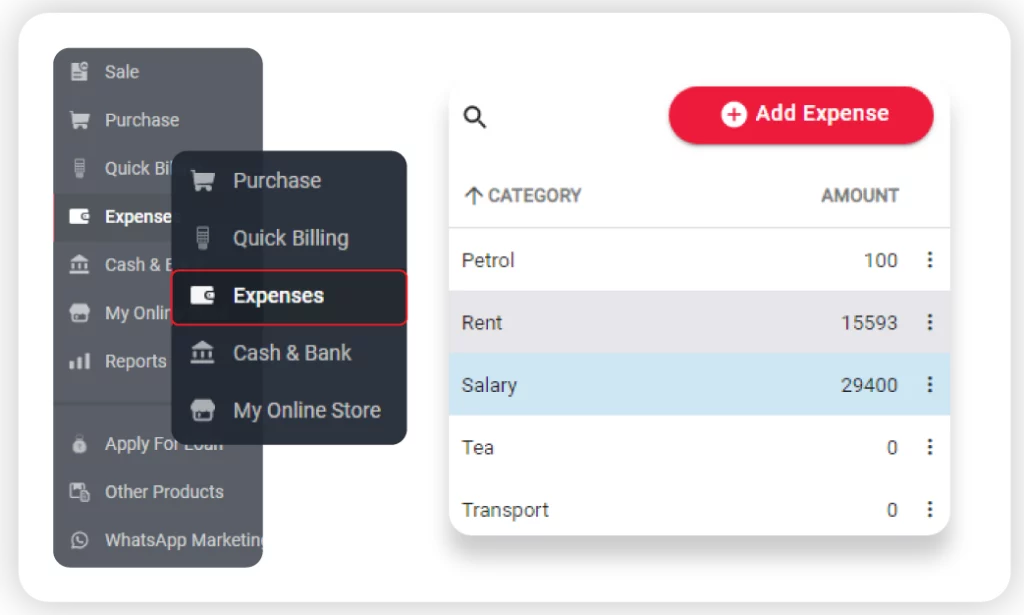

Track and Control Expenses

Easily record and categorise expenses to stay on budget and manage cash flow efficiently.

- Add bills, purchases, and receipts with OCR support.

- Monitor daily, monthly, and project-wise expenses in one place

- Generate real-time reports for better financial decision-making

How to File GSTR-4 Using the Vyapar App?

- Open Vyapar Desktop Software.

- Go to Reports > GST Reports > GSTR-4.

- Select the financial quarter

- Review the tax summary based on your transactions

- Export the report as Excel

- Enter the details of any amendments or corrections to your previous GSTR-4 filings, if applicable

- Generate a JSON Format of that Excel file.

- Once the JSON file is generated, log in to the GST portal and upload the file.

- Review the details and click the “Submit” button to file your GSTR-4 return.

Benefits of Using GSTR-4 Format By Vyapar

Ease of Filing

Vyapar’s GSTR-4 format offers a user-friendly interface that simplifies return filing for businesses under the GST Composition Scheme. With predefined templates for sales, purchases, and expenses, it allows users to categorize data easily. The GSTR-4 form auto-populates data from previous periods, minimizing manual entry and speeding up the filing process.

Accurate Reporting

The GSTR-4 format in Vyapar ensures accurate reporting by automatically validating the entered sales and purchase data. Businesses using Vyapar’s GSTR-4 format can avoid errors and ensure their tax liability is correctly calculated and reported within the GSTR-4 form.

Increased Efficiency

With automated calculations and streamlined workflows, Vyapar’s GSTR-4 format helps businesses save time and effort. The tool minimizes repetitive tasks and allows teams to focus more on business operations than manual GST data management—leading to better efficiency in handling GSTR-4 returns.

Mobile Accessibility

Thanks to its mobile accessibility, the Vyapar GSTR-4 format works on both Android and IOS, even without an internet connection. This allows businesses to access the GSTR-4 form anytime, anywhere—reducing dependency on desktops and enabling seamless return filing on the go.

Saves Time

Vyapar’s GSTR-4 format helps reduce filing time by offering automated calculations, pre-filled data from previous tax periods, and a simplified data entry process. With built-in compliance checks, it ensures faster preparation of returns—saving valuable business hours before uploading to the GST portal.

Helps Reduce Errors

By offering automated calculations and smart field population, Vyapar’s GSTR-4 format minimizes human errors in tax reporting. The software guides users through simplified data entry for sales, purchases, and expenses—making the GSTR-4 format reliable and error-resistant for small businesses.

Frequently Asked Questions (FAQ’s)

What is GSTR-4?

Who is required to file GSTR-4?

What details are required in GSTR-4?

– Summary of outward supplies

– Inward supplies from registered/unregistered persons

– Tax liability

– Tax payment

– Late fees (if applicable)

– TDS/TCS credit (if any)

Is GSTR-4 applicable for regular taxpayers?

Can I file GSTR-4 directly from the Vyapar app?

Is Vyapar’s GSTR-4 format suitable for small businesses?

Can a taxpayer switch from Composition Scheme to Regular Scheme?

How to check GSTR-4 filing status?

What happens if I miss the GSTR-4 filing deadline?

What is the current due date for filing GSTR-4?