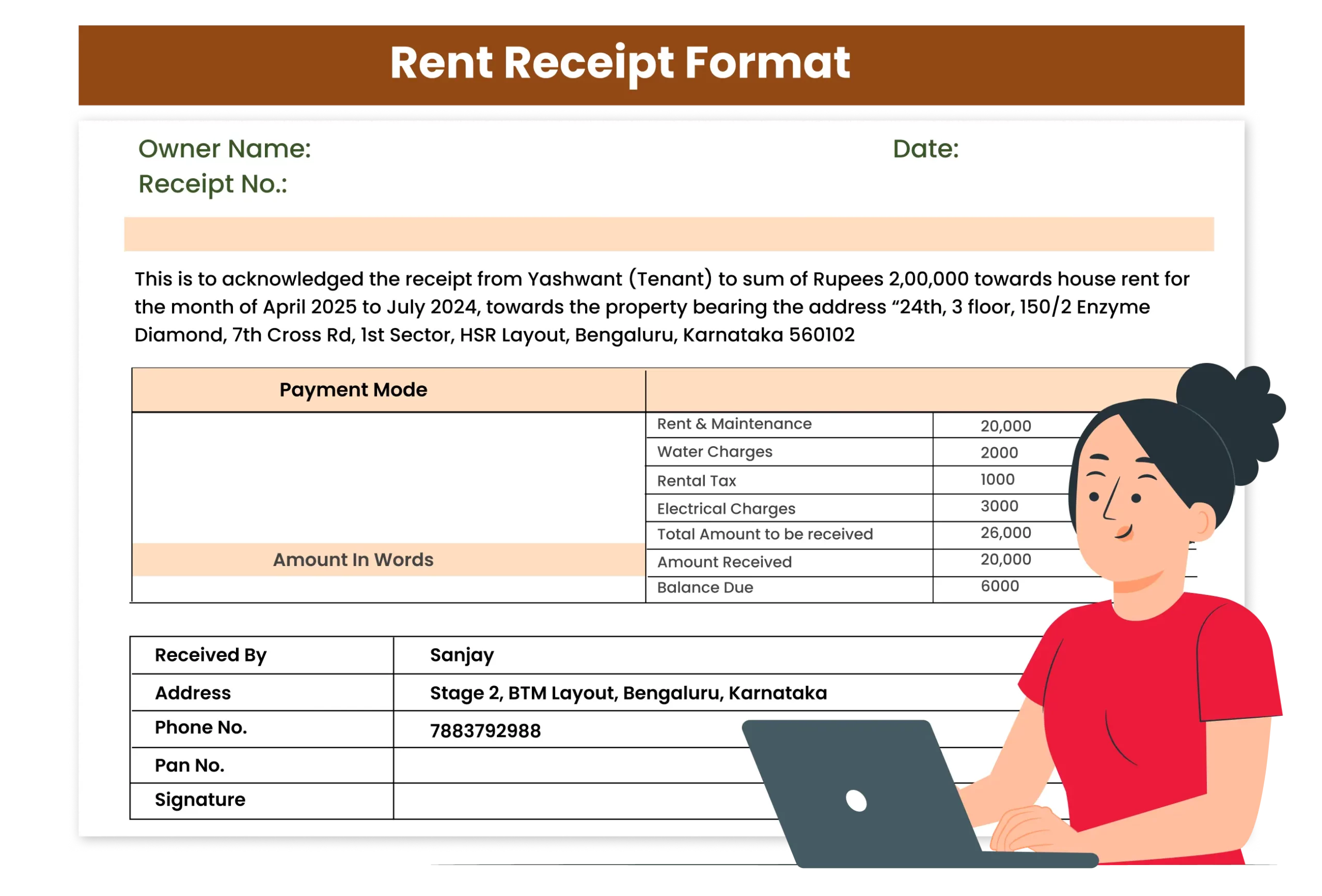

Rent Receipt Format

Download a professional Rent Receipt Template for tenants to simplify your billing, inventory, and accounting processes with the Vyapar App.

Rent Receipt Format Vs Vyapar App

Features

Rent Receipt Format

200+ Professional Formats

GST Reports

Auto Calculation

Real-Time Updates

Accounting Integration

Auto Backup

Real-Time Business Insights

Multiple Payment Mode

Free Support and Assistance

Instant Data Sync

Download Free Customizable Rent Receipt Format

Access Premium Rent Receipt Formats!

Streamline Your Business with the Vyapar App.

What is the Rent Receipt Format?

The Rent Receipt Format is ideal for individuals looking to shift to metropolitan cities for employment. To facilitate the process of availing the House Rent Allowance (HRA), your HR and accounting departments will request the rent receipt.

As an employee seeking HRA, it is vital to furnish the rent receipt as proof to your employer. Once the rent receipt is verified, your employer may grant deductions and allowances.

Typically, employees request 3-4 months’ worth of rent receipts, as these serve as documentation for the HRA allowance. Streamline this process by effortlessly generating the Rent Slip Format using Vyapar billing software, ensuring all necessary details are automatically included.

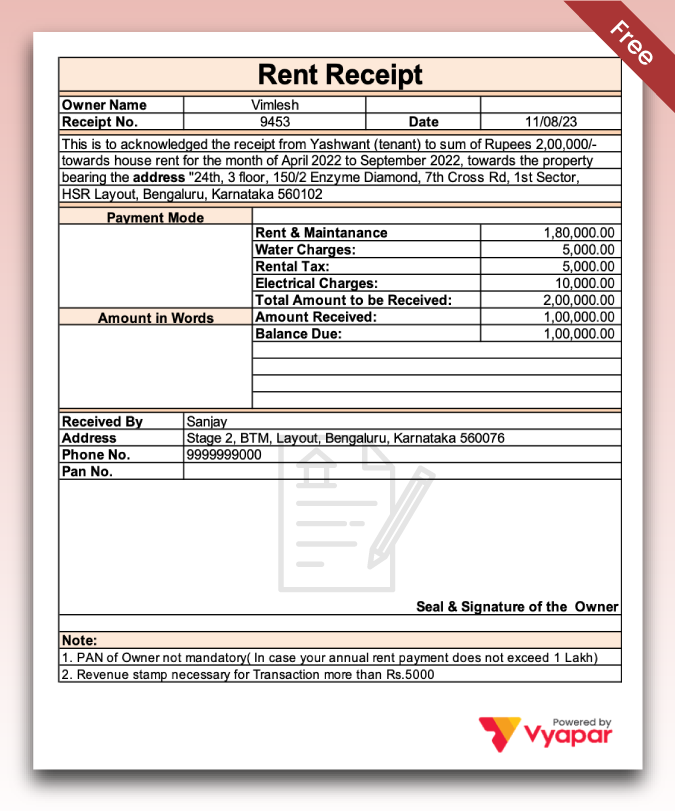

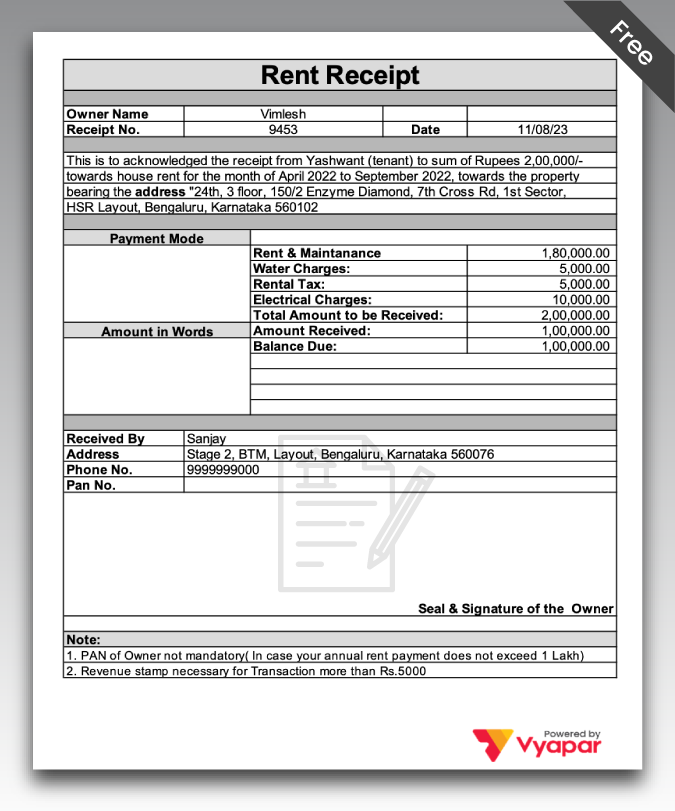

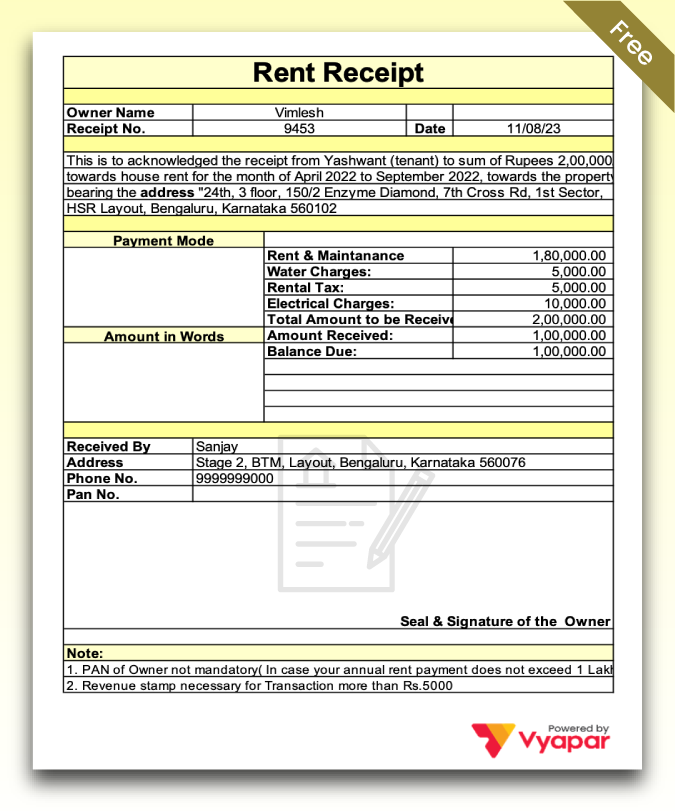

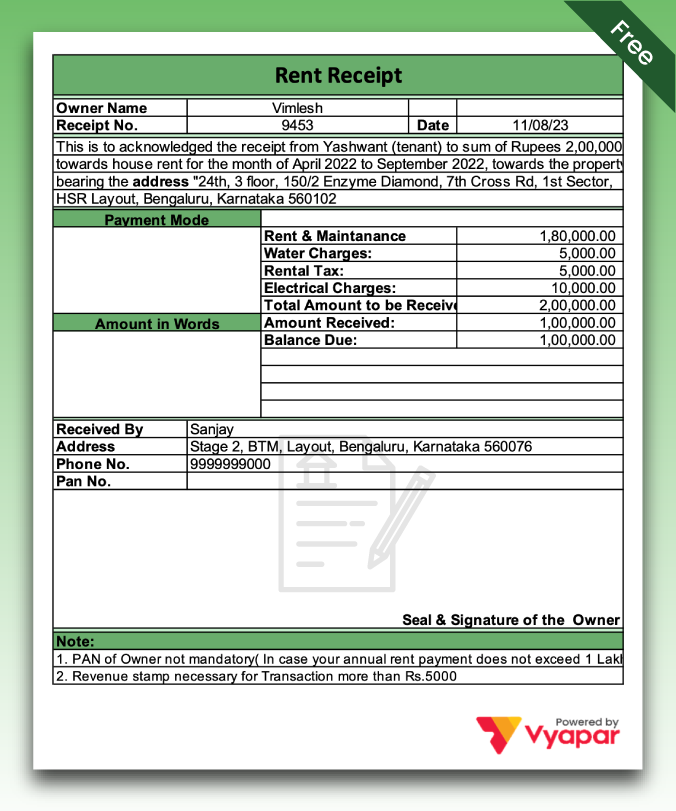

Key Components of Rent Receipt Format

Tenant and Landlord Details

Full names of both the tenant (payer) and landlord (recipient), clearly identifying both parties involved in the transaction.

Property Address

The complete address of the rented property for which the rent is being paid. This provides location-specific clarity.

Rent Amount Paid

The exact rent amount received for the specific month or rental period. Helps in financial tracking and HRA claims.

Rental Period Covered

The month or range of months the receipt applies to (e.g., “Rent for July 2025”).

Date and Mode of Payment

Includes the date the rent was paid and how—cash, bank transfer, UPI, cheque, etc.—for proper payment documentation.

Landlord’s Signature

A signature adds authenticity. A ₹1 revenue stamp is required for cash payments above ₹5,000, making it legally valid.

Why is the Vyapar App a superior choice over traditional rent receipt formats?

While traditional rent receipt formats in Word or PDF are helpful, they often come with manual effort and room for error. That’s where the Vyapar App stands out — making rent receipts faster, smarter, and more professional.

Generate Professional Rent Receipts in Seconds

Avoid the mess of editing templates every month. Vyapar simplifies the process with a guided form that fills your receipt instantly.

- No formatting errors — every receipt follows a consistent design

- Add your business logo or digital signature

- Create receipts on mobile or desktop, even offline

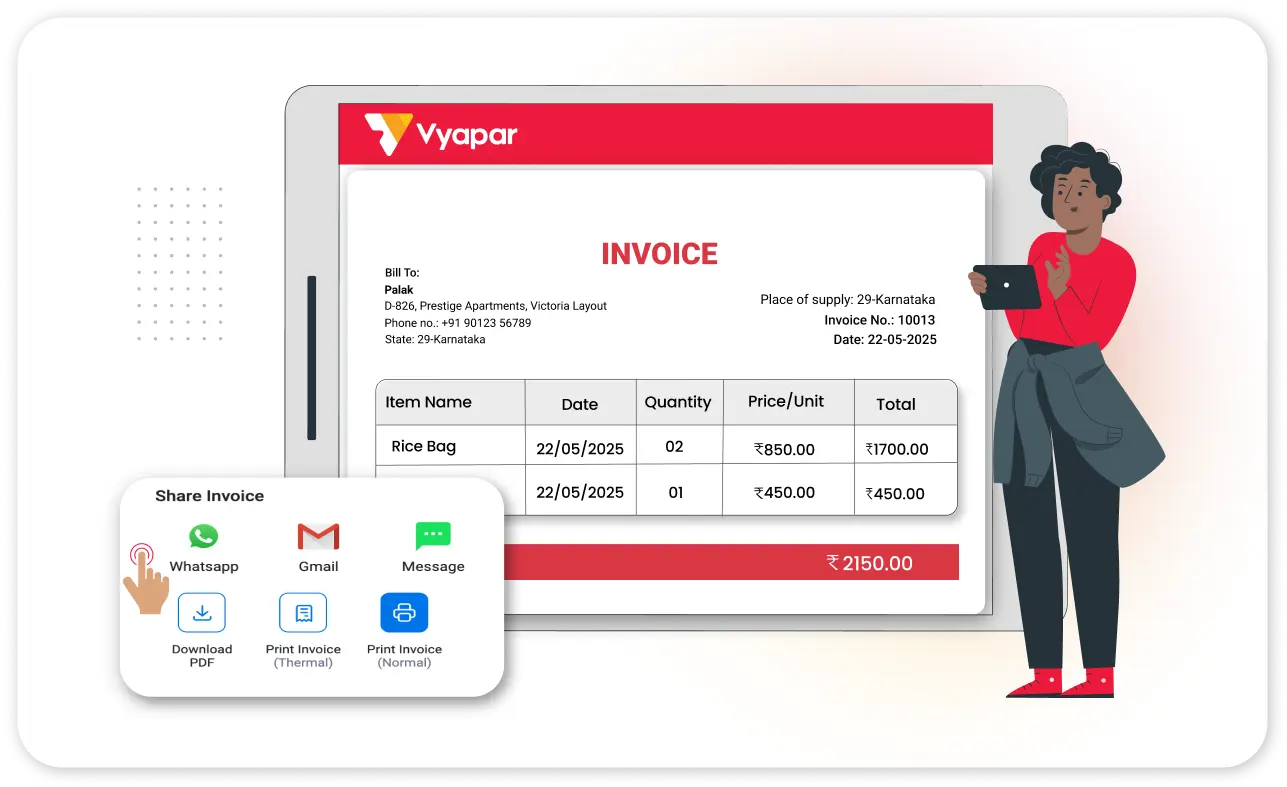

One-Tap Sharing & Multiple Export Options

Traditional templates require multiple tools to convert, save, or share. With Vyapar, it’s all built-in.

- Download in PDF with one click

- Share instantly via WhatsApp, Email, or Bluetooth

- Connect to a thermal or inkjet printer for physical copies

You spend less time managing files and more time running your business.

Built for HRA and Tax Compliance

Vyapar receipts include everything HR or the Income Tax Department needs to accept your rent proof.

- Auto-fills tenant/landlord details and rent period

- Shows payment mode (cash, UPI, bank transfer, cheque)

- Space for revenue stamp and digital signature

- Legally valid for HRA claims and audits

Smart Recordkeeping with Cloud Backup

Tired of searching for old receipts? Vyapar auto-saves everything and keeps it safe — no manual effort needed.

- View past receipts anytime — by date, tenant, or amount

- Easily track monthly rent history and late payments

- Data is securely backed up on the cloud, so nothing gets lost

This is perfect for landlords managing multiple tenants or tenants filing year-end claims.

More Than Just Receipts

Vyapar is not a one-trick tool. It’s a full billing, invoicing, and accounting solution for small business owners and property managers.

- Manage rent payments, security deposits, and late fees

- Generate GST or non-GST invoices, delivery challans, and estimates

- Track expenses, payments, and generate reports

- Works offline + supports multi-language use

Why settle for just receipts when you can manage your whole business?

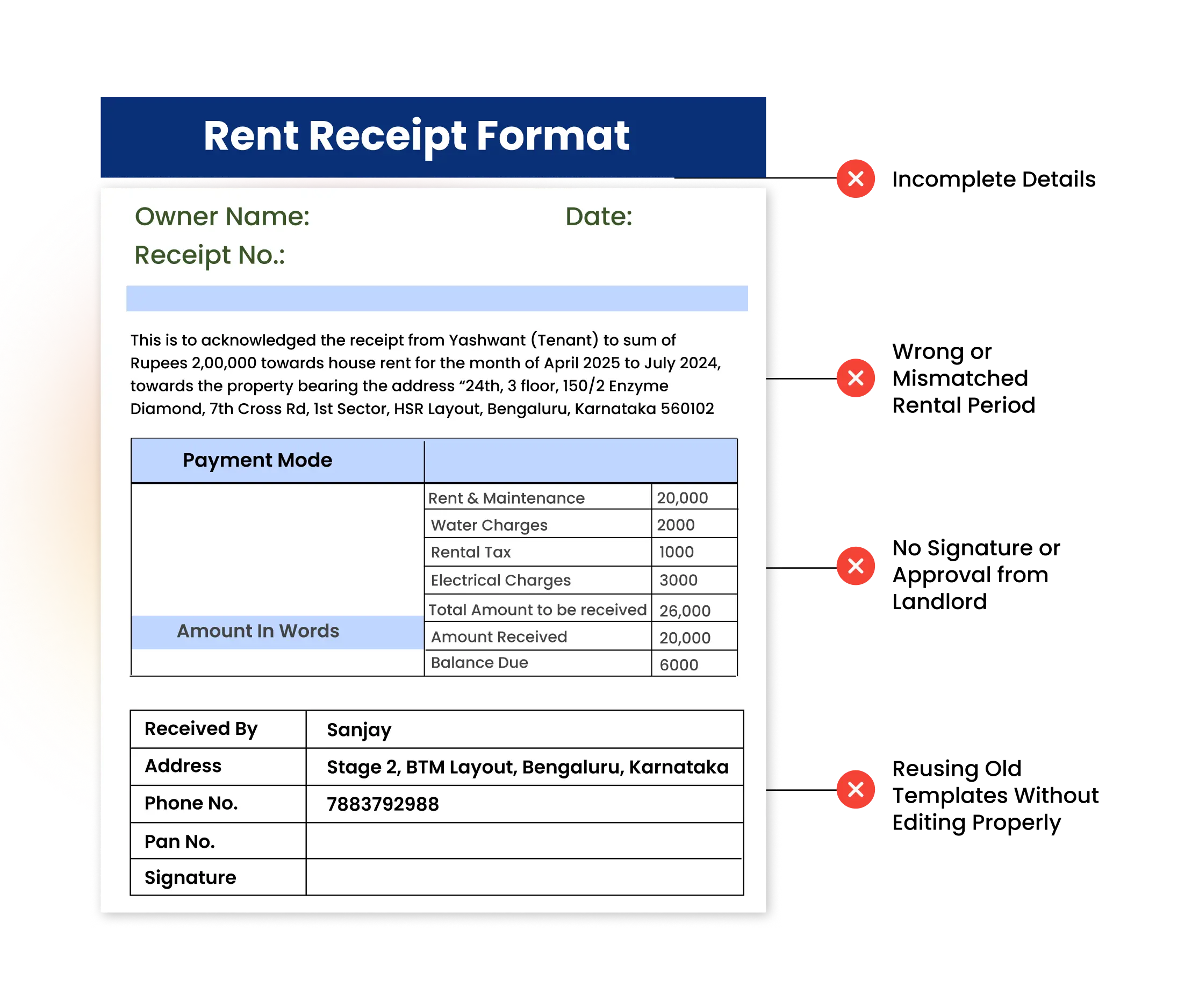

Common Mistakes to Avoid in Rent Receipts

Even small errors in a rent receipt can lead to rejected HRA claims, legal issues, or missed tax benefits. Whether you’re a tenant, landlord, or HR professional, it’s important to avoid these common mistakes when creating or submitting a rent receipt.

- Missing Revenue Stamp on Cash Payments Above ₹5,000 – If you pay rent in cash exceeding ₹5,000, a ₹1 revenue stamp is legally required on the rent receipt to make it valid. Skipping this can lead to your HRA claim being denied.

- Incomplete Details – Rent receipts without essential fields like rental period, payment mode, full address, or landlord signature are often considered invalid by employers or tax authorities.

- Wrong or Mismatched Rental Period – Entering an incorrect month or rental duration can raise red flags during audits or HRA verification. Always double-check the period covered by the receipt.

- No Signature or Approval from Landlord – A rent receipt must include the landlord’s signature (physical or digital) to confirm the payment. Without it, the document may not be considered valid.

- Reusing Old Templates Without Editing Properly – Copy-pasting old Word or Excel templates without updating the tenant name, amount, or date can result in misleading or incorrect records.

Why You Need a Rent Receipt

A rent receipt is more than just a formality — it’s a vital document for both tenants and landlords. Whether you’re living in a rented home or managing a property, having a properly filled rent receipt serves multiple purposes, especially when it comes to legal proof and tax benefits.

For Claiming HRA (House Rent Allowance)

If you’re a salaried employee receiving HRA as part of your salary, you must submit valid rent receipts to claim tax exemption. Without proper receipts, your HRA claim can be rejected by your employer or the Income Tax Department.

Vyapar makes it easier by generating receipts with all HRA-compliant fields in just one tap.

As Legal Proof of Rent Payment

Rent receipts act as official proof that you’ve paid the rent to your landlord. In case of disputes, they serve as valid evidence to protect both parties.

A signed receipt with date, amount, and mode of payment can prevent misunderstandings or false claims.

For Address Verification & KYC

Rent receipts are often accepted as a proof of residence by banks, telecom operators, passport offices, and government institutions during KYC or documentation processes.

Vyapar receipts can be printed or shared digitally, making them perfect for such verification needs.

For Maintaining Personal or Business Records

Tracking your monthly rent expenses becomes easier when receipts are stored systematically. This is especially helpful for freelancers, entrepreneurs, or landlords who need to maintain expense records.

With Vyapar, your receipts are securely stored and easy to retrieve when needed.

Required During Visa Applications

Some embassies ask for rental proof when processing visa or immigration documents. A formal, signed rent receipt with full address and tenant details helps establish your current residence.

Using Vyapar gives you professional, printable receipts that meet documentation standards.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs)

What is a rent receipt format?

Why is a rent receipt important?

Is a revenue stamp required on rent receipts?

What should a rent receipt include?

Can I claim HRA without rent receipts?

How many rent receipts are needed to claim HRA?

Can I use the Vyapar App to generate rent receipts?

Are digital rent receipts valid for tax or KYC?

Can I use rent receipts as address proof?

What happens if I don’t collect a rent receipt?